Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer a, b, c, d, and e. Thank you! 37. LO.4 In 2016, Adrianna contributed land with a basis of $16,000 and a fair

Please answer a, b, c, d, and e. Thank you!

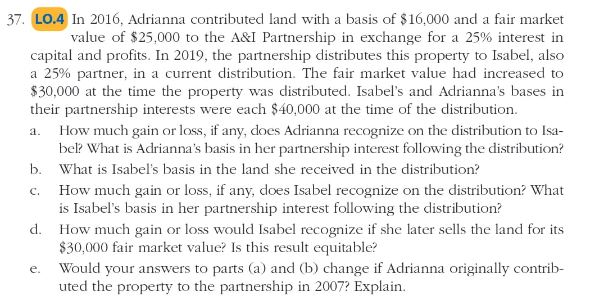

37. LO.4 In 2016, Adrianna contributed land with a basis of $16,000 and a fair market value of $25,000 to the A&I Partnership in exchange for a 25% interest in capital and profits. In 2019, the partnership distributes this property to Isabel, also a 25% partner, in a current distribution. The fair market value had increased to $30,000 at the time the property was distributed. Isabel's and Adrianna's bases in their partnership interests were each $40,000 at the time of the distribution. a. How much gain or loss, if any, does Adrianna recognize on the distribution to Isa- bel? What is Adrianna's basis in her partnership interest following the distribution? b. What is Isabel's basis in the land she received in the distribution? How much gain or loss, if any, does Isabel recognize on the distribution? What is Isabel's basis in her partnership interest following the distribution? d. How much gain or loss would Isabel recognize if she later sells the land for its $30,000 fair market value? Is this result equitable? e. Would your answers to parts (a) and (b) change if Adrianna originally contrib- uted the property to the partnership in 2007? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started