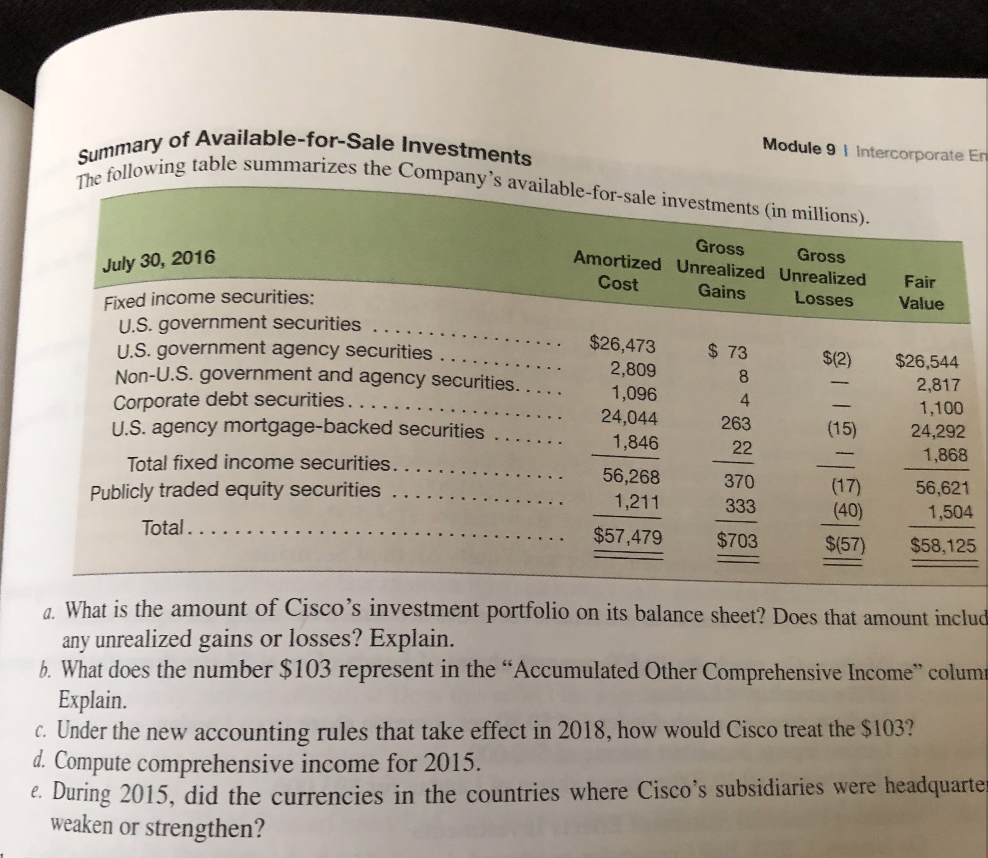

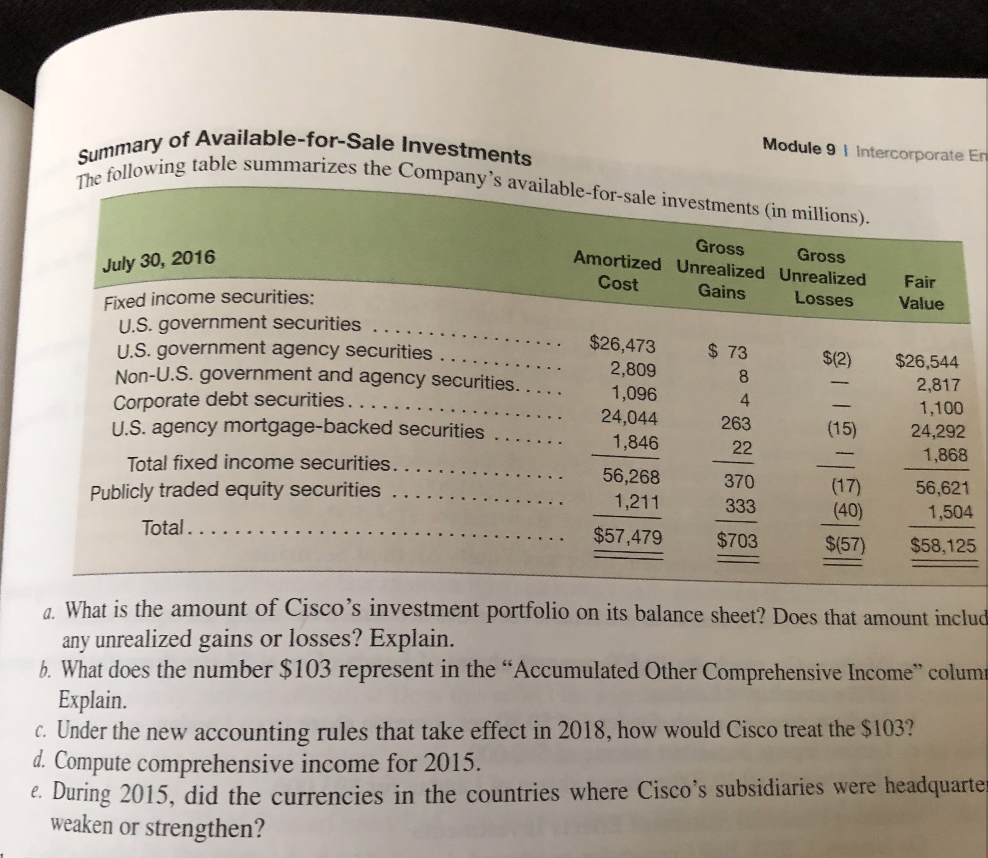

Please answer A, B, C, D, E. The information is on two different pages! Thanks so much

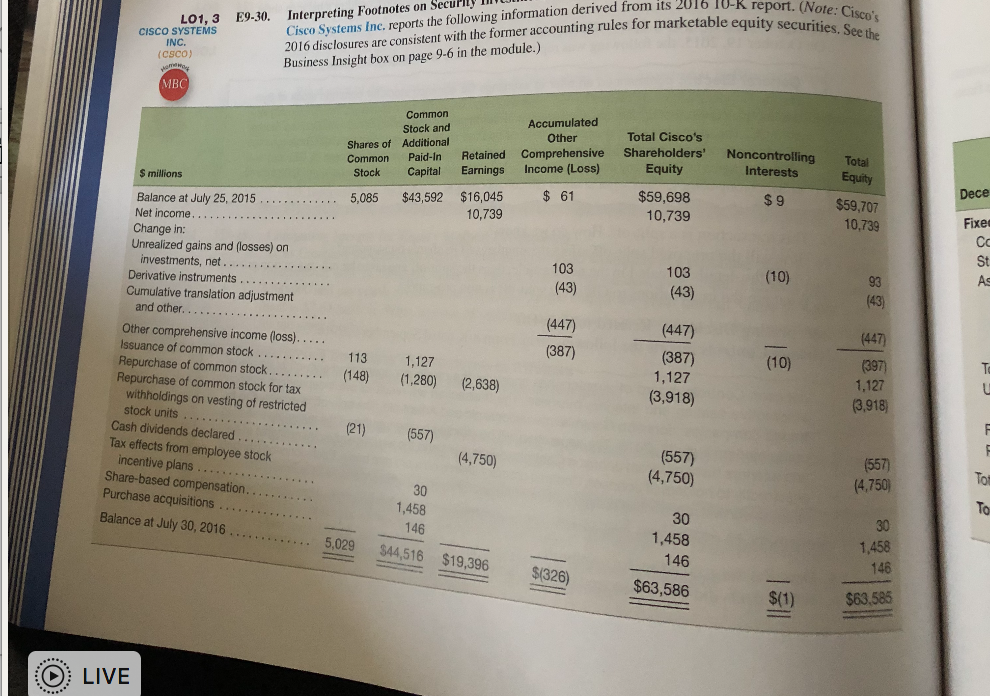

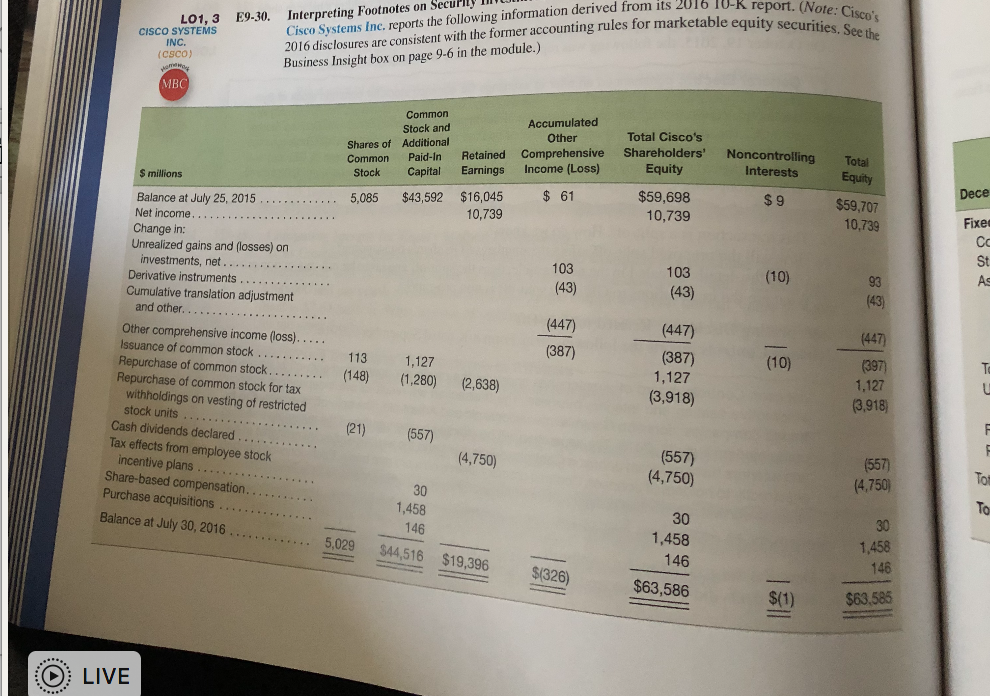

Cisco Systems Inc. reports the following information derived from its 201 2016 disclosures are consistent with the former accounting rules for marketable equity sec T0-K report. (Note securities Seethe urities. See the LO1, 3 E9.30. Interpreting Footnotes on Securlly C?SCO SYSTEMS INC. CBOD) Business Insight box on page 9-6 in the module.) MBC Accumulated Other Stock and Total Cisco's Equity $59,698 Shares of Additional Com Noncontrolling Total mon Paid-In Retained ComprehensiveShareholders' Interests Stock Capital Earnings Income (Loss) Dece $ millions 61 $ 9 5,085 $43,592 $16,045 $59,707 10,739 Balance at July 25, 2015 Net income Change in: Unrealized gains and flosses) on Fixe Co St As 10,739 10,739 103 (43) (447) (387) investments, net Derivative instruments Cumulative translation adjustment 103 (10) 93 and other. (447) (387) 1,127 3,918) (447 Other comprehensive income (loss) Issuance of common stock Repurchase of common stock Repurchase of common stock for tax (10) 113 1,127 (148) (1.280) (2,638) 1,127 3,918) withholdings on vesting of restricted stock units (21) (557) Cash dividends declared Tax effects from employee stock (557) (4,750) 557) (4,750 (4,750) incentive plans Purchase acquisitions Balance at July 30, 2016 30 1,458 146 30 1,458 146 30 1,458 146 5,029 $44,516 $19,396 $(326) 3409 $63 596$0 $(1) $63,585 O LIVE Cisco Systems Inc. reports the following information derived from its 201 2016 disclosures are consistent with the former accounting rules for marketable equity sec T0-K report. (Note securities Seethe urities. See the LO1, 3 E9.30. Interpreting Footnotes on Securlly C?SCO SYSTEMS INC. CBOD) Business Insight box on page 9-6 in the module.) MBC Accumulated Other Stock and Total Cisco's Equity $59,698 Shares of Additional Com Noncontrolling Total mon Paid-In Retained ComprehensiveShareholders' Interests Stock Capital Earnings Income (Loss) Dece $ millions 61 $ 9 5,085 $43,592 $16,045 $59,707 10,739 Balance at July 25, 2015 Net income Change in: Unrealized gains and flosses) on Fixe Co St As 10,739 10,739 103 (43) (447) (387) investments, net Derivative instruments Cumulative translation adjustment 103 (10) 93 and other. (447) (387) 1,127 3,918) (447 Other comprehensive income (loss) Issuance of common stock Repurchase of common stock Repurchase of common stock for tax (10) 113 1,127 (148) (1.280) (2,638) 1,127 3,918) withholdings on vesting of restricted stock units (21) (557) Cash dividends declared Tax effects from employee stock (557) (4,750) 557) (4,750 (4,750) incentive plans Purchase acquisitions Balance at July 30, 2016 30 1,458 146 30 1,458 146 30 1,458 146 5,029 $44,516 $19,396 $(326) 3409 $63 596$0 $(1) $63,585 O LIVE