Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer (a) to (e), Please show me step by step with the formula, thank you. You have information on several possible investments as laid

Please answer (a) to (e), Please show me step by step with the formula, thank you.

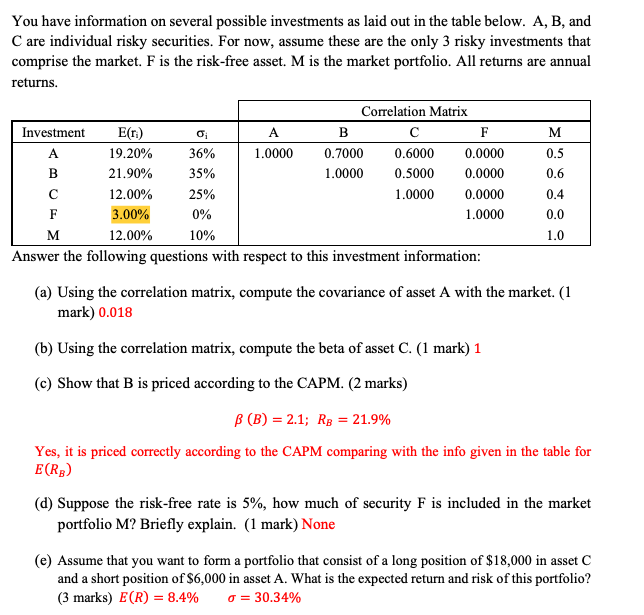

You have information on several possible investments as laid out in the table below. A, B, and C are individual risky securities. For now, assume these are the only 3 risky investments that comprise the market. F is the risk-free asset. M is the market portfolio. All returns are annual returns. Correlation Matrix Investment E() 0 A B F M A 19.20% 36% 1.0000 0.7000 0.6000 0.0000 0.5 B 21.90% 35% 1.0000 0.5000 0.0000 0.6 12.00% 25% 1.0000 0.0000 0.4 F 3.00% 0% 1.0000 0.0 M 12.00% 10% 1.0 Answer the following questions with respect to this investment information: (a) Using the correlation matrix, compute the covariance of asset A with the market. (1 mark) 0.018 (b) Using the correlation matrix, compute the beta of asset C. (1 mark) 1 (c) Show that B is priced according to the CAPM. (2 marks) B (B) = 2.1; Rg = 21.9% Yes, it is priced correctly according to the CAPM comparing with the info given in the table for E(R) (d) Suppose the risk-free rate is 5%, how much of security F is included in the market portfolio M? Briefly explain. (1 mark) None (e) Assume that you want to form a portfolio that consist of a long position of $18,000 in asset C and a short position of $6,000 in asset A. What is the expected return and risk of this portfolio? (3 marks) E(R) = 8.4% o = 30.34%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started