Answered step by step

Verified Expert Solution

Question

1 Approved Answer

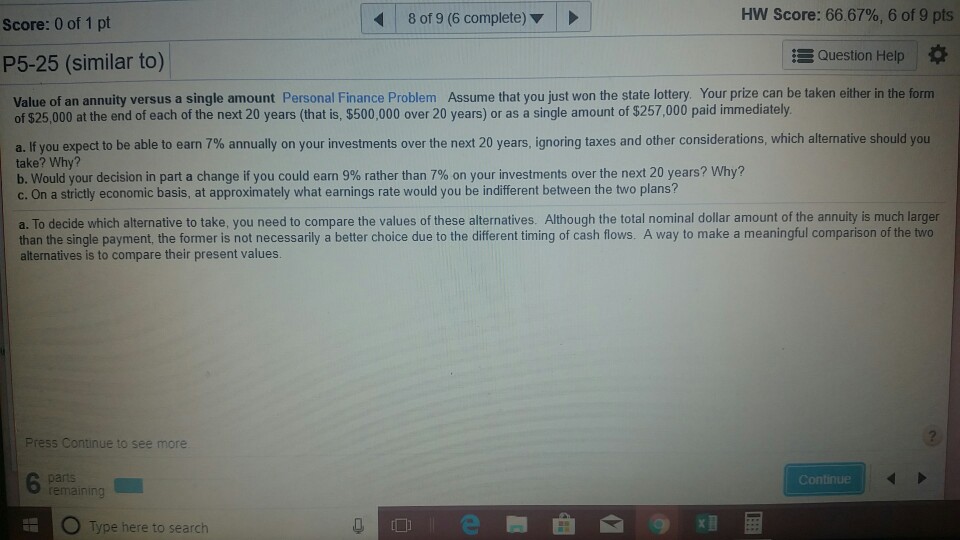

please answer a,b, c as well 8 of 9 (6 complete) HW Score: 66 67%, 6 of 9 pts Score: 0 of 1 pt P5-25

please answer a,b, c as well

8 of 9 (6 complete) HW Score: 66 67%, 6 of 9 pts Score: 0 of 1 pt P5-25 (similar to) Question Help * Value of an annuity versus a single amount Personal Finance Problem Assume that you just won the state lottery. Your prize can be taken either in the form of $25,000 at the end of each of the next 20 years (that is, $500,000 over 20 years) or as a single amount of $257,000 paid immediately a f you expect to be able to earn 7% annually on your investments over the next 20 years, gnoring taxes and other considerations, which alternative should you take? Why? b, would your decision in part a change if you could earn 9% rather than 7% on your investments over the next 20 years? Why? c. On a strictly economic basis, at approximately what earnings rate would you be indifferent between the two plans? a. To decide which alternative to take, you need to compare the values of these alternatives. Although the total nominal dollar amount of the annuity is much larger than the single payment the former is not necessarily a better choice due to the different timing of cash flows, A way to make a meaningful comparison of the two alternatives is to compare their present values Press Continue to see more rernarnng Continue O Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started