Answered step by step

Verified Expert Solution

Question

1 Approved Answer

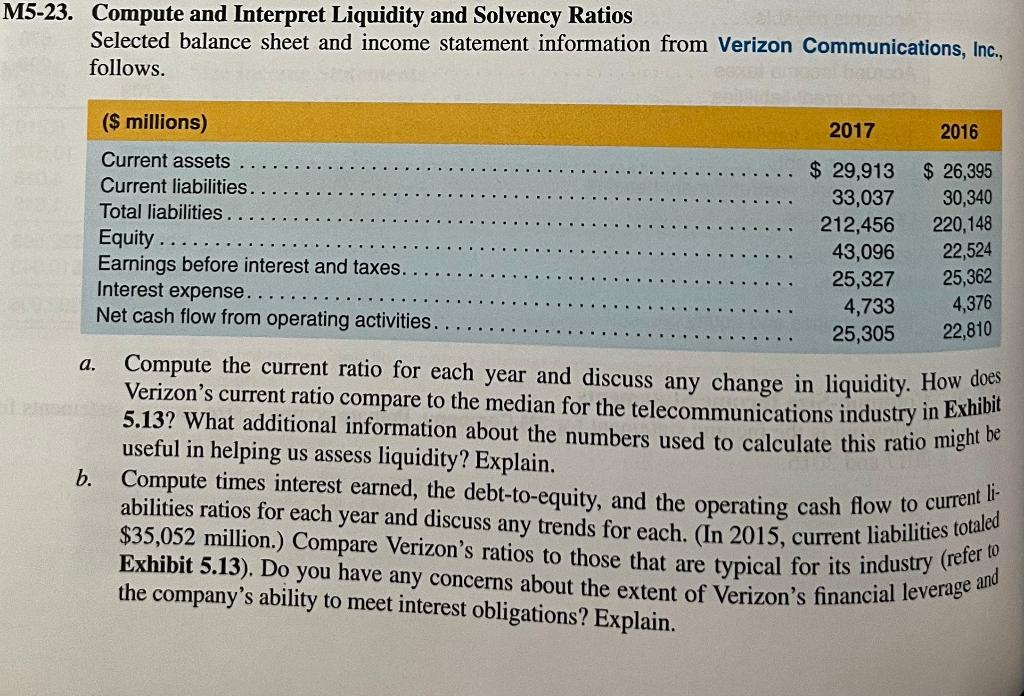

Please answer A,B,C. M5-23. Compute and Interpret Liquidity and Solvency Ratios Selected balance sheet and income statement information from Verizon Communications, Inc., follows. a. ($

Please answer A,B,C.

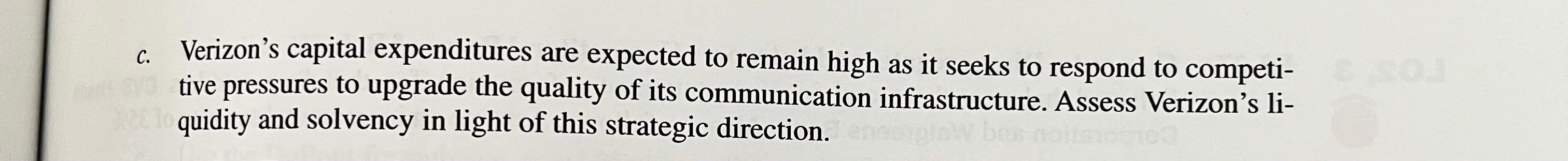

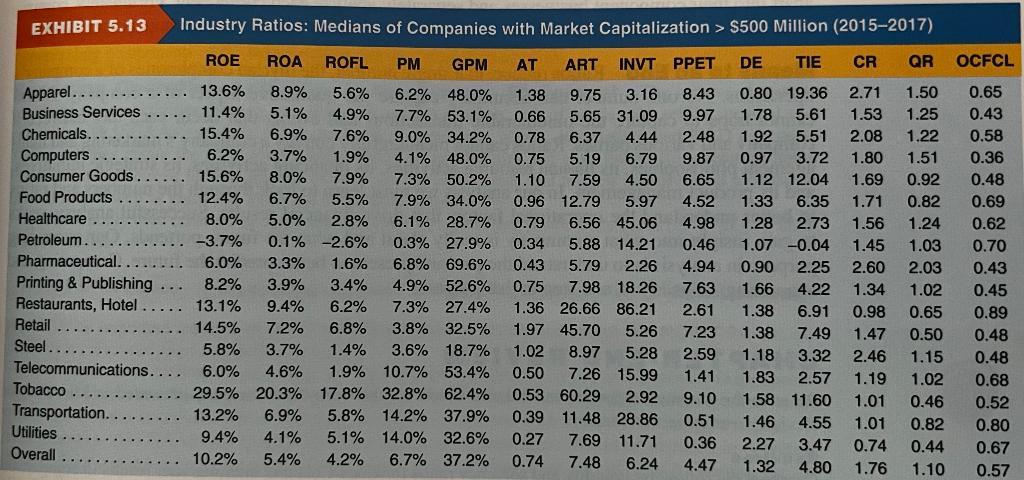

M5-23. Compute and Interpret Liquidity and Solvency Ratios Selected balance sheet and income statement information from Verizon Communications, Inc., follows. a. ($ millions) 2017 2016 Current assets $ 29,913 $ 26,395 Current liabilities.. 33,037 30,340 Total liabilities 212,456 220,148 Equity 43,096 22,524 Earnings before interest and taxes. 25,327 25,362 Interest expense. 4,733 4,376 Net cash flow from operating activities.. 25,305 22,810 Compute the current ratio for each year and discuss any change in liquidity. How does Verizon's current ratio compare to the median for the telecommunications industry in Exhibit 5.13? What additional information about the numbers used to calculate this ratio might be useful in helping us assess liquidity? Explain. b. Compute times interest earned, the debt-to-equity, and the operating cash flow to current li- abilities ratios for each year and discuss any trends for each. (In 2015, current liabilities totaled Exhibit 5.13). Do you have any concerns about the extent of Verizon's financial leverage a $35,052 million.) Compare Verizon's ratios to those that are typical for its industry (refer to the company's ability to meet interest obligations? Explain. and C. Verizon's capital expenditures are expected to remain high as it seeks to respond to competi- tive pressures to upgrade the quality of its communication infrastructure. Assess Verizon's li- quidity and solvency in light of this strategic direction. EXHIBIT 5.13 Industry Ratios: Medians of Companies with Market Capitalization > S500 Million (2015-2017) ROFL AT ART INVT PPET DE TIE CR QR OCFCL 8.43 9.97 7.6% 2.48 ROE ROA PM GPM 13.6% 8.9% 5.6% 6.2% 48.0% 11.4% 5.1% 4.9% 7.7% 53.1% 15.4% 6.9% 9.0% 34.2% 6.2% 3.7% 1.9% 4.1% 48.0% 15.6% 8.0% 7.9% 7.3% 50.2% 12.4% 6.7% 5.5% 7.9% 34.0% 8.0% 5.0% 2.8% 6.1% 28.7% -3.7% 0.1% -2.6% 0.3% 27.9% 6.0% 3.3% 1.6% 6.8% 69.6% 8.2% 3.9% 3.4% 4.9% 52.6% 13.1% 9.4% 6.2% 7.3% 27.4% 14.5% 7.2% 6.8% 3.8% 32.5% 5.8% 3.7% 1.4% 3.6% 18.7% 6.0% 4.6% 1.9% 10.7% 53.4% 29.5% 20.3% 17.8% 32.8% 62.4% 13.2% 6.9% 5.8% 14.2% 37.9% 9.4% 4.1% 5.1% 14.0% 32.6% 10.2% 5.4% 4.2% 6.7% 37.2% Apparel Business Services Chemicals. Computers Consumer Goods. Food Products Healthcare Petroleum Pharmaceutical. Printing & Publishing Restaurants, Hotel Retail Steel Telecommunications. Tobacco Transportation. Utilities Overall 9.87 6.65 4.52 4.98 0.46 4.94 1.38 9.75 3.16 0.66 5.65 31.09 0.78 6.37 4.44 0.75 5.19 6.79 1.10 7.59 4.50 0.96 12.79 5.97 0.79 6.56 45.06 0.34 5.88 14.21 0.43 5.79 2.26 0.75 7.98 18.26 1.36 26.66 86.21 1.97 45.70 5.26 1.02 8.97 5.28 0.50 7.26 15.99 0.53 60.29 2.92 0.39 11.48 28.86 0.27 7.69 11.71 0.74 7.48 6.24 7.63 0.80 19.36 1.78 5.61 1.92 5.51 0.97 3.72 1.12 12.04 1.33 6.35 1.28 2.73 1.07 -0.04 0.90 2.25 1.66 4.22 1.38 6.91 1.38 7.49 1.18 3.32 1.83 2.57 1.58 11.60 1.46 4.55 2.27 3.47 1.32 4.80 2.71 1.53 2.08 1.80 1.69 1.71 1.56 1.45 2.60 1.34 0.98 1.47 2.46 1.19 1.01 1.01 0.74 1.76 1.50 1.25 1.22 1.51 0.92 0.82 1.24 1.03 2.03 1.02 0.65 0.50 1.15 1.02 0.46 0.82 0.44 1.10 0.65 0.43 0.58 0.36 0.48 0.69 0.62 0.70 0.43 0.45 0.89 0.48 0.48 0.68 0.52 0.80 0.67 0.57 2.61 7.23 2.59 1.41 9.10 0.51 0.36 4.47Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started