Answered step by step

Verified Expert Solution

Question

1 Approved Answer

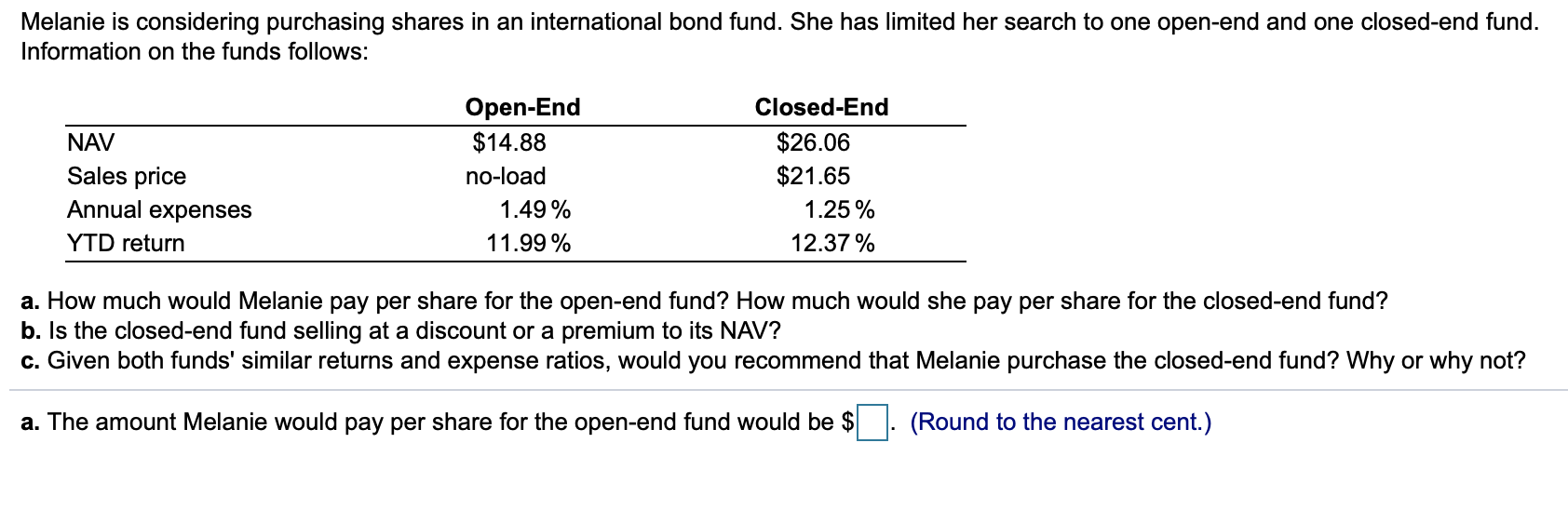

Please answer A-C Melanie is considering purchasing shares in an international bond fund. She has limited her search to one open-end and one closed-end fund.

Please answer A-C

Please answer A-C

Melanie is considering purchasing shares in an international bond fund. She has limited her search to one open-end and one closed-end fund. Information on the funds follows: NAV Sales price Annual expenses YTD return Open-End $14.88 no-load 1.49% 11.99 % Closed-End $26.06 $21.65 1.25% 12.37 % a. How much would Melanie pay per share for the open-end fund? How much would she pay per share for the closed-end fund? b. Is the closed-end fund selling at a discount or a premium to its NAV? c. Given both funds' similar returns and expense ratios, would you recommend that Melanie purchase the closed-end fund? Why or why not? a. The amount Melanie would pay per share for the open-end fund would be $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started