please answer a-e

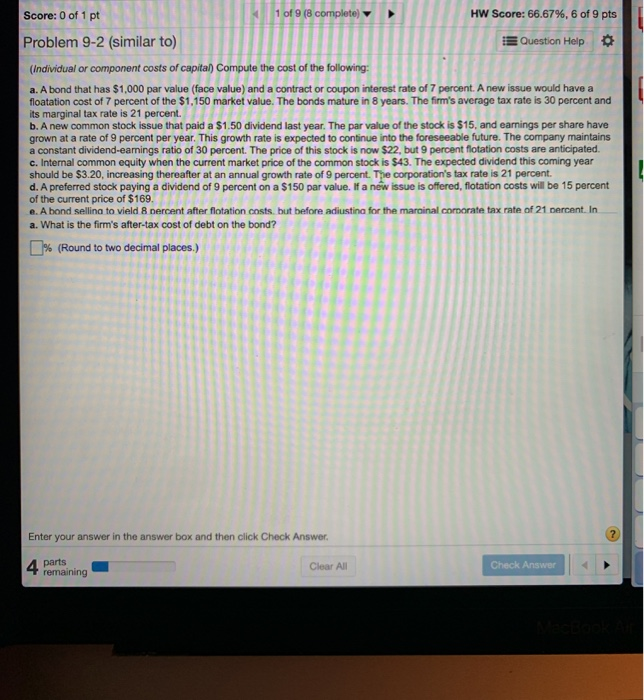

Son of Problem 9-2 (similar to) Question individual or componen ts of capital Compute the cost of the following A bond that $1.000 per value fluce value and a contract of c on t rate of percent. Ar percent and its marginal tax rate is 21 percent A common stockissat pada 51 50 ddy The parte and e would have a fatto cost of part of the 51.150 market value. The band mature in years. The firm's eagerlis 30 whe n this sected to the forestier The c omo out whe r e the one the Aprenedors detonat or .. A bond song to yield percent or fotation before sting for the marginal corporate e song yo u percent of currence of 10 of 21 percent in the words percentiserate that growth of percent. The composta per is the proceeds from the bond with the present value of the future cash What is the firm'saber com o c onhe bon Mound to two decades) Enter your wer in the answer box and ench Che Answer 4. Score: 0 of 1 pt 1 of 9 (8 complete) HW Score: 66.67%, 6 of 9 pts Problem 9-2 (similar to) Question Help (Individual or component costs of capital Compute the cost of the following: a. A bond that has $1,000 par value (face value) and a contract or coupon interest rate of 7 percent. A new issue would have a floatation cost of 7 percent of the $1.150 market value. The bonds mature in 8 years. The firm's average tax rate is 30 percent and its marginal tax rate is 21 percent. b. A new common stock issue that paid a $1.50 dividend last year. The par value of the stock is $15, and earnings per share have grown at a rate of 9 percent per year. This growth rate is expected to continue into the foreseeable future. The company maintains a constant dividend-earings ratio of 30 percent. The price of this s $22, but 9 percent flotation costs are anticipated. c. Internal common equity when the current market price of the common stock $43. The expected dividend this coming year should be $3.20, increasing thereafter at an annual growth rate of 9 percent. T corporation's tax rate is 21 percent. d. A preferred stock paying a dividend of 9 percent on a $150 par value. If offered, flotation costs will be 15 percent of the current price of $169, . A hond sellina to vield 8 percent after flotation costs, but before corporate tax rate of 21 percent. In a. What is the firm's after-tax cost of debt on the bond? ck is now alue. If a new wo c omerate to E S % (Round to two decimal Enter your answer in the answer box and then click Check Answer. A parts 4 remaining Chec Answe