Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 2.) Choose from the following the correct answer. When determining weights of capital sources to determine WACC, one should use: (5 points)

please answer all

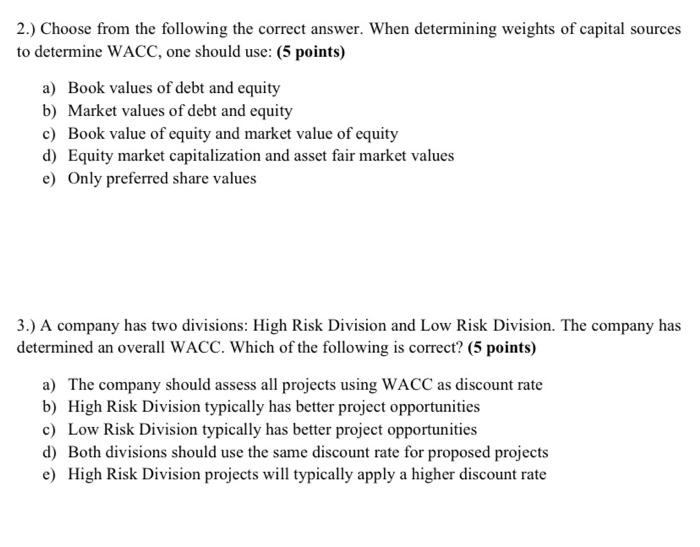

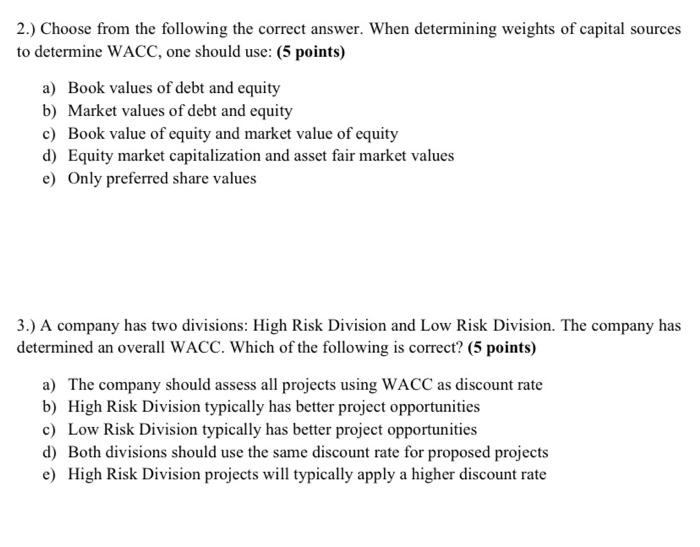

2.) Choose from the following the correct answer. When determining weights of capital sources to determine WACC, one should use: (5 points) a) Book values of debt and equity b) Market values of debt and equity c) Book value of equity and market value of equity d) Equity market capitalization and asset fair market values e) Only preferred share values 3.) A company has two divisions: High Risk Division and Low Risk Division. The company has determined an overall WACC. Which of the following is correct? (5 points) a) The company should assess all projects using WACC as discount rate b) High Risk Division typically has better project opportunities c) Low Risk Division typically has better project opportunities d) Both divisions should use the same discount rate for proposed projects e) High Risk Division projects will typically apply a higher discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started