Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 2pt per question. Show your work clearly to eam partial credit! Read the questions carefully! Suppose you invest $100, $200, & $300

please answer all

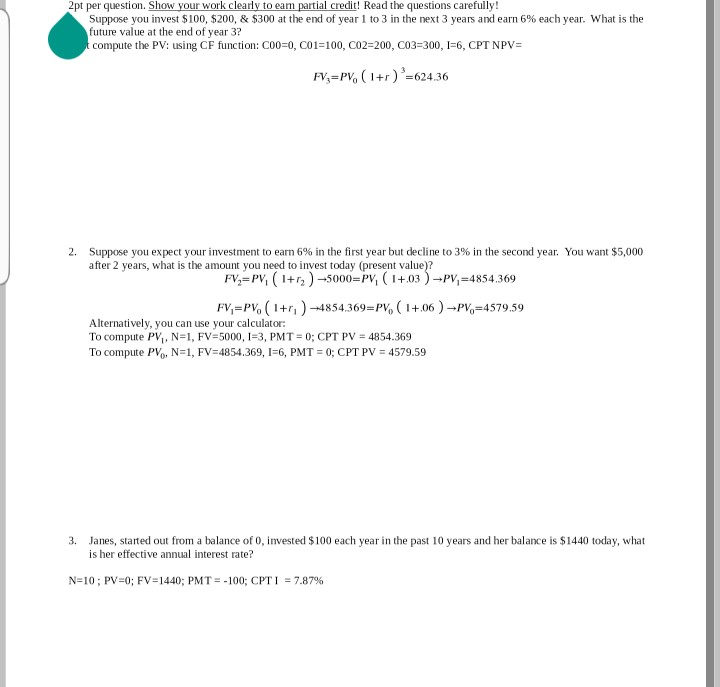

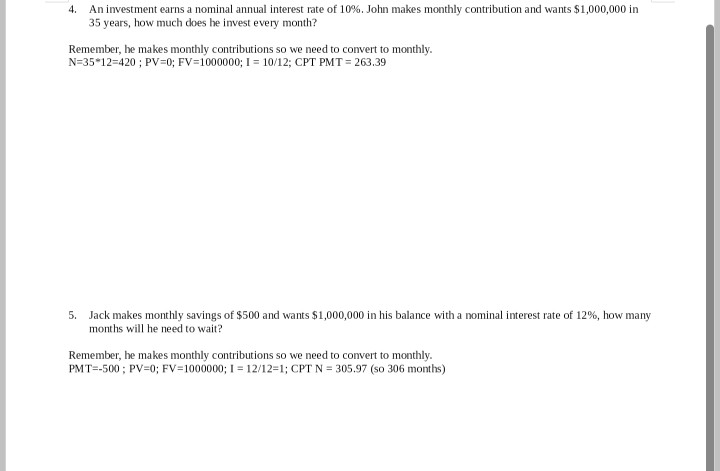

2pt per question. Show your work clearly to eam partial credit! Read the questions carefully! Suppose you invest $100, $200, & $300 at the end of year 1 to 3 in the next 3 years and earn 6% each year. What is the future value at the end of year 3? tcompute the PV: using CF function: CO0-0, CO1- 100, C02=200 , C03-300, I-6, CPT NPV= FV,=PV (1r)624.36 Suppose you expect your investment to earn 6 % in the first year but decline to 3% in the second year. You want $5,000 after 2 years, what is the amount you need to invest today (present value)? 2. FV=PV (+)-5000-PV, 1+03)-PV, 4854.369 FV,=PV (1+)-4854.369= PV, ( 1+06)-PV4579.59 Alternatively, you can use your calculator To compute PV, N=1, FV -5000, I-3, PMT 0; CPT PV 4854.369 To compute PV, N-1, FV - 4854.369, I-6, PMT 0; CPT PV =4579.59 Janes, started out from a balance of 0, invested $100 each year in the past 10 years and her balance is $1440 today, what 3. is her effective annual interest rate? N-10; PV-0; FV= 1440; PMT 7.87 % -100; CPTI An investment earns a nominal annual interest rate of 10 %. John makes monthly contribution and wants $1,000,000 in 35 years, how much does he invest every month? 4. Remember, he makes monthly contributions so we need to convert to monthly. N-35 12-420; PV=0; FV= 1000000; I 10/12; CPT PMT 263.39 Jack makes monthly savings of $500 and wants $1,000,000 in his balance with a nominal interest rate of 12%, how many 5. months will he need to wait? Remember, he makes monthly contributions so we need to convert to monthly. PMT-500; PV-0; FV=1000000; I 12/12=1; CPT N 305.97 (so 306 months)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started