Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL 3 !!!! 0 300 30 Ida Company produces a handcrafted musical Instrument called a gamelan that is similar to a xylophone. The

PLEASE ANSWER ALL 3 !!!!

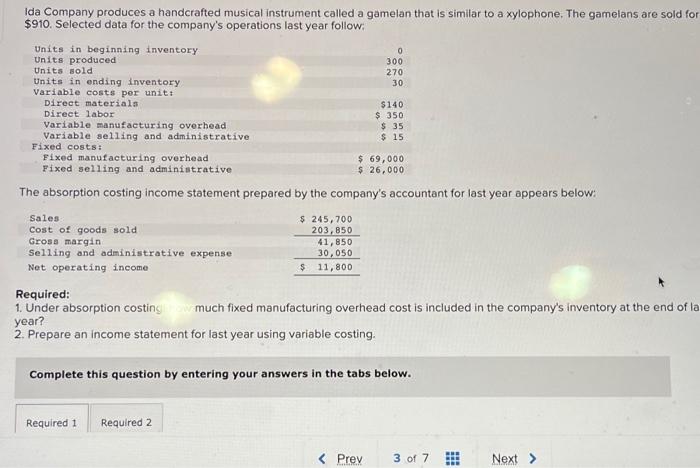

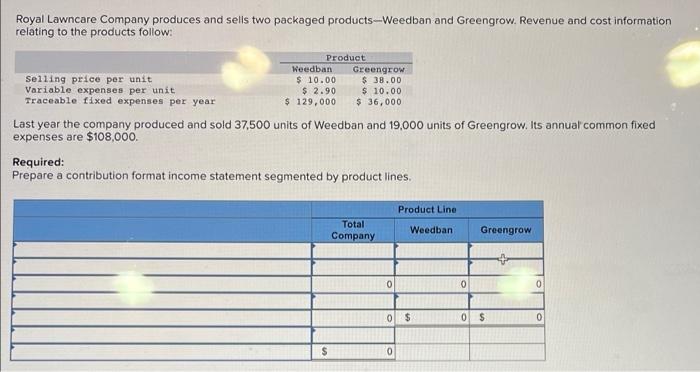

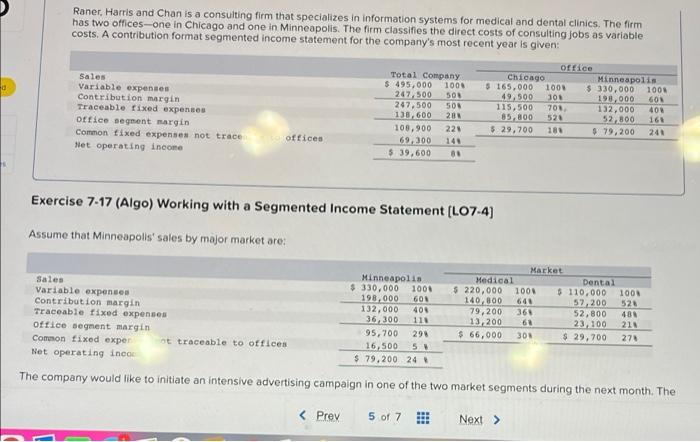

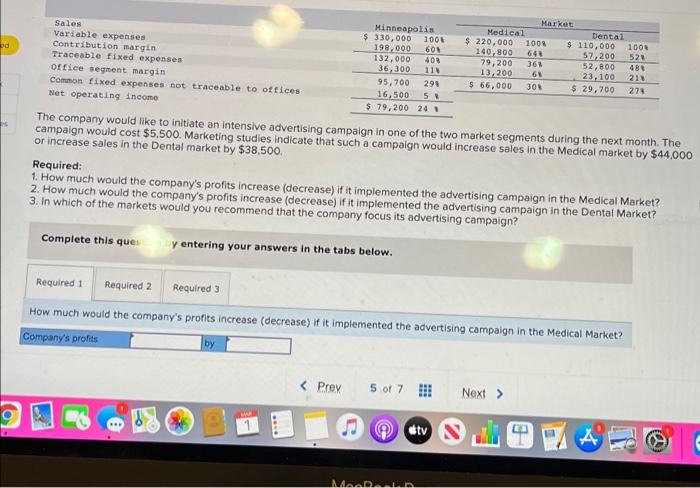

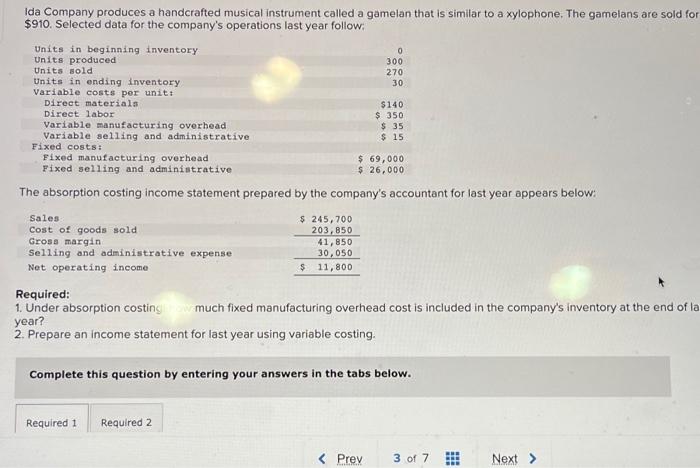

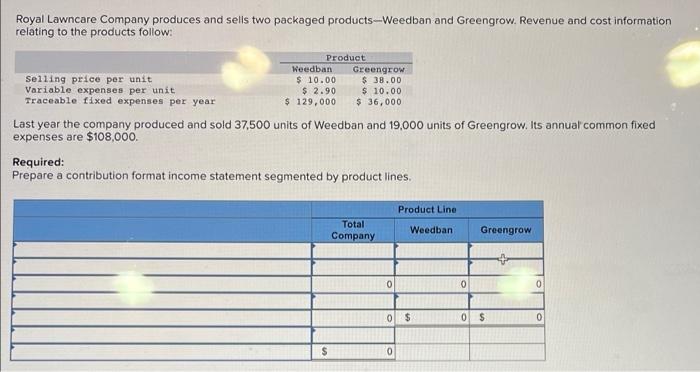

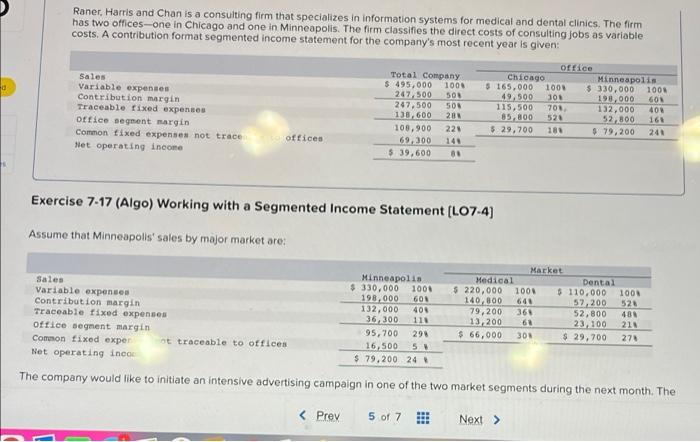

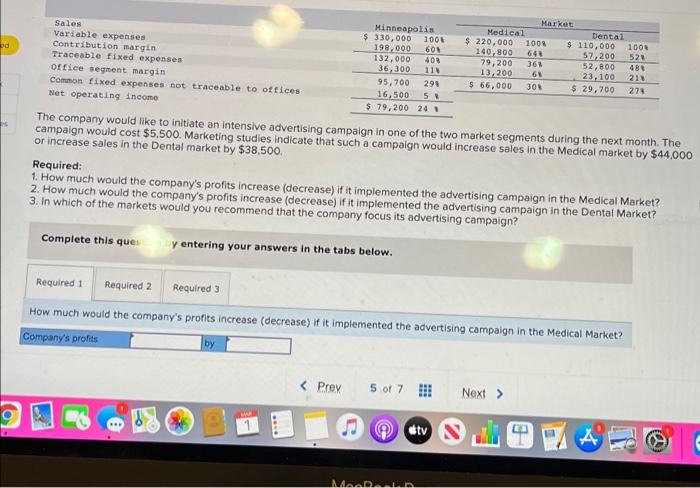

0 300 30 Ida Company produces a handcrafted musical Instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $910. Selected data for the company's operations last year follow; Units in beginning inventory Units produced Units sold 270 Units in ending inventory Variable costs per unit Direct materiala $140 Direct labor $ 350 Variable manufacturing overhead $ 35 Variable selling and administrative $ 15 Fixed costs: Fixed manufacturing overhead $ 69,000 Fixed selling and administrative $ 26,000 The absorption costing income statement prepared by the company's accountant for last year appears below: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income $ 245, 700 203,850 41,850 30,050 $ 11,800 Required: 1. Under absorption costing much fixed manufacturing overhead cost is included in the company's inventory at the end of la year? 2. Prepare an income statement for last year using variable costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 10.00 $ 38.00 Variable expenses per unit $ 2.90 $ 10.00 Traceable fixed expenses per year $ 129,000 $ 36,000 Last year the company produced and sold 37,500 units of Weedban and 19,000 units of Greengrow. Its annual common fixed expenses are $108,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrow 0 0 0 0 $ 0 $ 0 $ 0 Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given d Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not trace Het operating income Total Company $ 495,000 1008 247.500 508 247,500 500 138,600 281 108,900 224 69,200 $ 39,600 80 office Chicago Minneapolis $ 165,000 1001 $ 330,000 100$ 49,500 305 198,000 GON 115,500 701 132,000 409 85,800 520 52,800 $ 29,700 180 $ 79,200 241 offices Exercise 7-17 (Algo) Working with a Segmented Income Statement (L07-4) Assume that Minneapolis' sales by major market are: 1000 Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed exper at traceable to offices Net operating incoe Minneapolis $ 330,000 1008 198,000 601 132,000 405 36,300 111 95,700 296 16,500 5 $ 79,200 24 Market Medical Dental $ 220,000 $ 110,000 100N 140/800 640 52,200 52 79,200 361 52,800 480 13,200 68 23,100 211 $ 66,000 301 $ 29,700 278 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The pd Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income 400 Minneapolis $ 330,000 1001 198,000 601 132,000 36,300 111 95,700 298 16,500 50 $ 79,200 24. Market Medical Dental $ 220,000 1000 $ 110,000 1001 140,800 640 57,200 520 79,200 361 52,800 13,200 65 23.100 211 $ 66,000 30$ $ 29,700 273 480 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,500. Marketing studies indicate that such a campaign would increase sales in the Medical market by $44,000 or increase sales in the Dental market by $38,500 Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this ques y entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits dtv A MADUN

0 300 30 Ida Company produces a handcrafted musical Instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $910. Selected data for the company's operations last year follow; Units in beginning inventory Units produced Units sold 270 Units in ending inventory Variable costs per unit Direct materiala $140 Direct labor $ 350 Variable manufacturing overhead $ 35 Variable selling and administrative $ 15 Fixed costs: Fixed manufacturing overhead $ 69,000 Fixed selling and administrative $ 26,000 The absorption costing income statement prepared by the company's accountant for last year appears below: Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income $ 245, 700 203,850 41,850 30,050 $ 11,800 Required: 1. Under absorption costing much fixed manufacturing overhead cost is included in the company's inventory at the end of la year? 2. Prepare an income statement for last year using variable costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 10.00 $ 38.00 Variable expenses per unit $ 2.90 $ 10.00 Traceable fixed expenses per year $ 129,000 $ 36,000 Last year the company produced and sold 37,500 units of Weedban and 19,000 units of Greengrow. Its annual common fixed expenses are $108,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrow 0 0 0 0 $ 0 $ 0 $ 0 Raner, Harris and Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given d Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not trace Het operating income Total Company $ 495,000 1008 247.500 508 247,500 500 138,600 281 108,900 224 69,200 $ 39,600 80 office Chicago Minneapolis $ 165,000 1001 $ 330,000 100$ 49,500 305 198,000 GON 115,500 701 132,000 409 85,800 520 52,800 $ 29,700 180 $ 79,200 241 offices Exercise 7-17 (Algo) Working with a Segmented Income Statement (L07-4) Assume that Minneapolis' sales by major market are: 1000 Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed exper at traceable to offices Net operating incoe Minneapolis $ 330,000 1008 198,000 601 132,000 405 36,300 111 95,700 296 16,500 5 $ 79,200 24 Market Medical Dental $ 220,000 $ 110,000 100N 140/800 640 52,200 52 79,200 361 52,800 480 13,200 68 23,100 211 $ 66,000 301 $ 29,700 278 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The pd Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income 400 Minneapolis $ 330,000 1001 198,000 601 132,000 36,300 111 95,700 298 16,500 50 $ 79,200 24. Market Medical Dental $ 220,000 1000 $ 110,000 1001 140,800 640 57,200 520 79,200 361 52,800 13,200 65 23.100 211 $ 66,000 30$ $ 29,700 273 480 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,500. Marketing studies indicate that such a campaign would increase sales in the Medical market by $44,000 or increase sales in the Dental market by $38,500 Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this ques y entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits dtv A MADUN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started