Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 3 asap, will upvote!!! Westchester Corp. is considering Projects S and L, whose cash flows are shown below. These projects are mutually

please answer all 3 asap, will upvote!!!

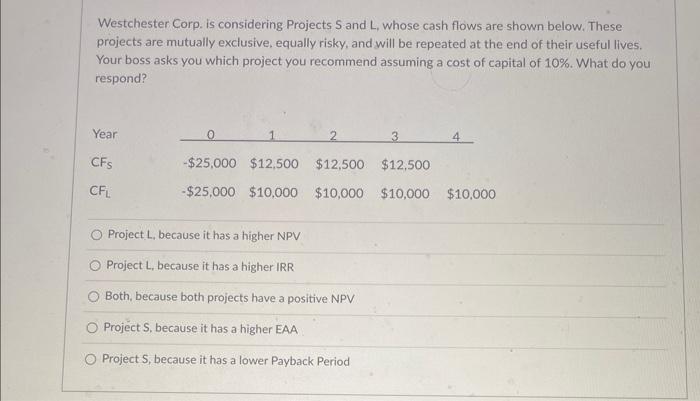

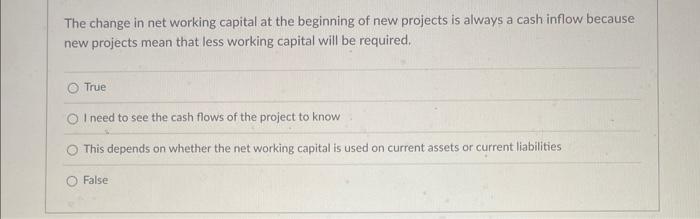

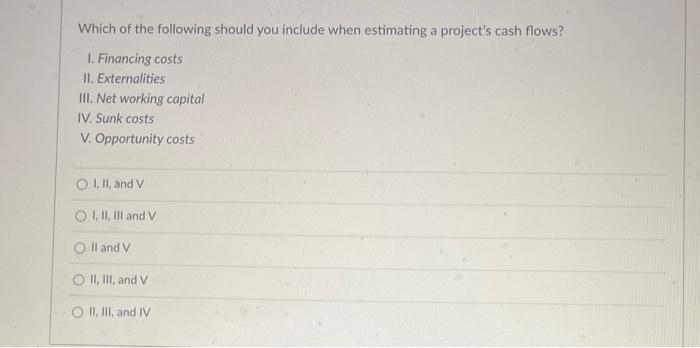

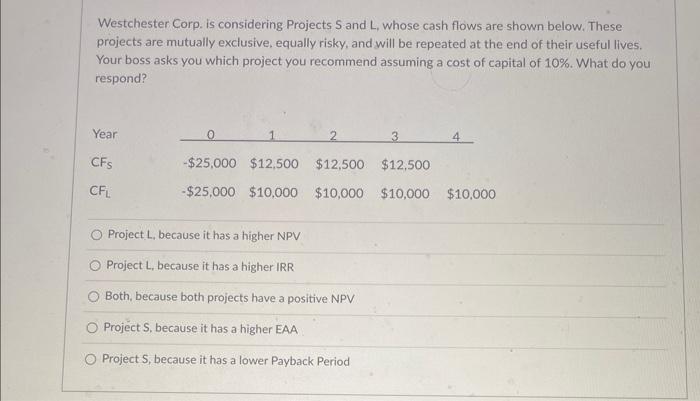

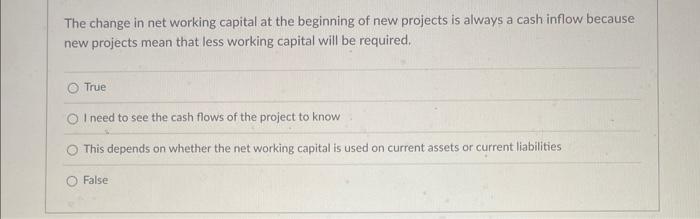

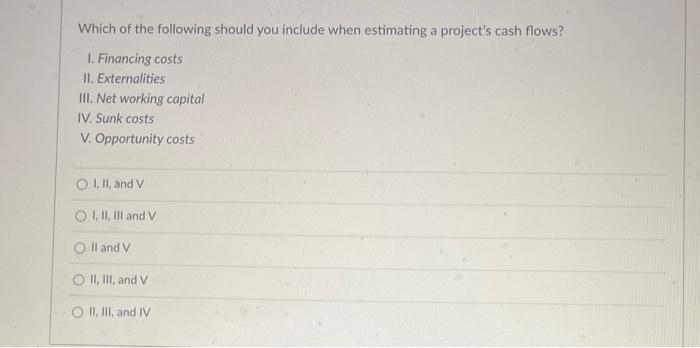

Westchester Corp. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and will be repeated at the end of their useful lives. Your boss asks you which project you recommend assuming a cost of capital of 10%. What do you respond? Project L, because it has a higher NPV Project L, because it has a higher IRR Both, because both projects have a positive NPV Project S, because it has a higher EAA Project S, because it has a lower Payback Period The change in net working capital at the beginning of new projects is always a cash inflow because new projects mean that less working capital will be required. True I need to see the cash flows of the project to know This depends on whether the net working capital is used on current assets or current liabilities False Which of the following should you include when estimating a project's cash flows? 1. Financing costs II. Externalities III. Net working capital IV. Sunk costs V. Opportunity costs I, II, and V I. II, III and V 1 and V II, III, and V II, III, and IV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started