Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 3 for a like and good rating Your client turned 22 years old today and expects to start working today. Your client

please answer all 3 for a like and good rating

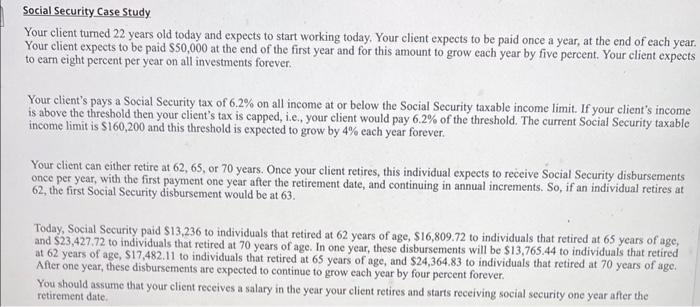

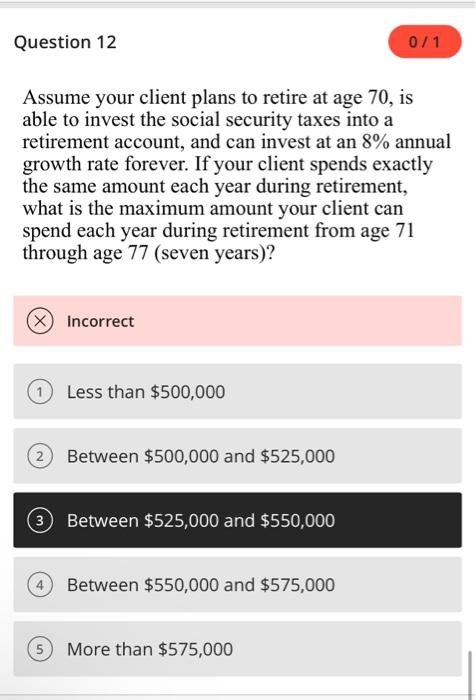

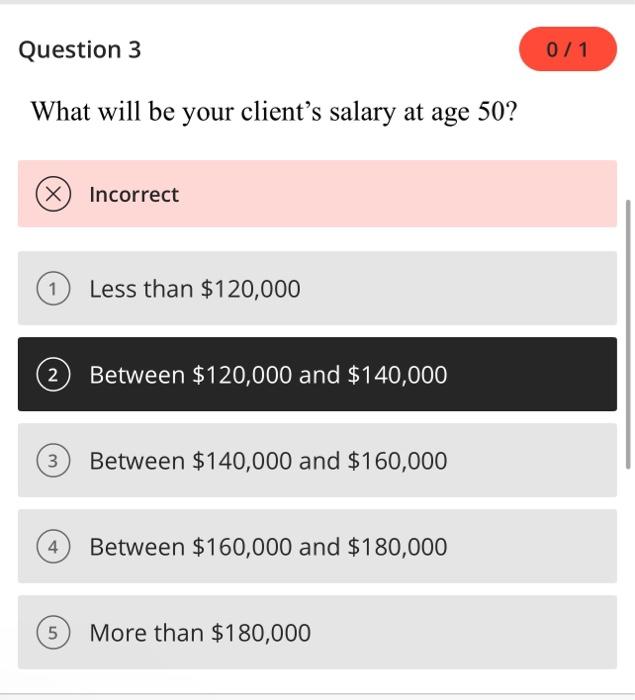

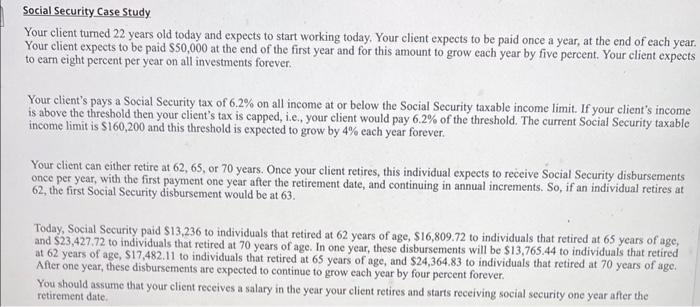

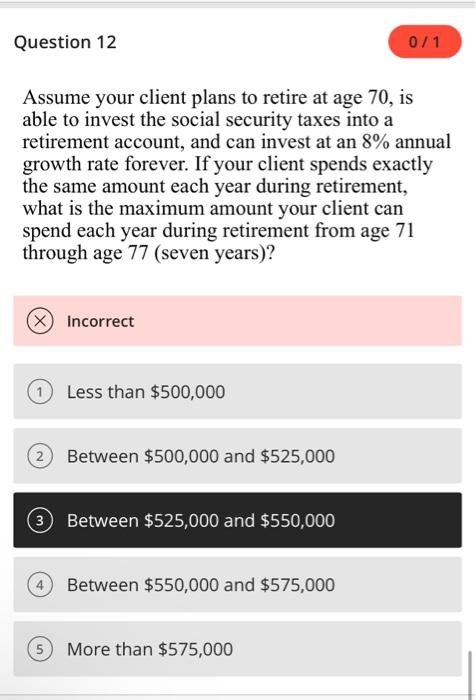

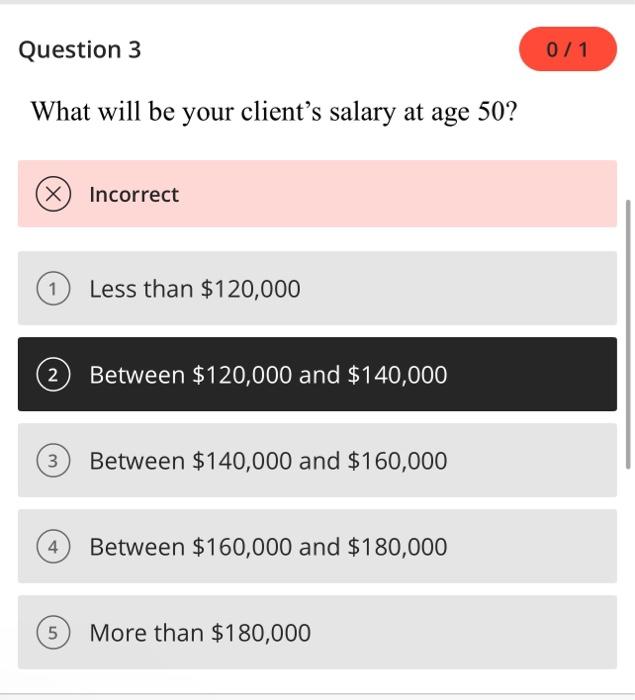

Your client turned 22 years old today and expects to start working today. Your client expects to be paid once a year, at the end of each year. Your client expects to be paid $50,000 at the end of the first year and for this amount to grow each year by five percent. Your client expects to earn eight percent per year on all investments forever. Your client's pays a Social Security tax of 6.2% on all income at or below the Social Security taxable income limit. If your client's income is above the threshold then your client's tax is capped, i.e., your client would pay 6.2% of the threshold. The current Social Security taxable income limit is $160,200 and this threshold is expected to grow by 4% each year forever. Your client can either retire at 62,65 , or 70 years. Once your client retires, this individual expects to receive Social Security disbursements once per year, with the first payment one year after the retirement date, and continuing in annual increments. So, if an individual retires at 62 , the first Social Security disbursement would be at 63 . Today, Social Security paid $13,236 to individuals that retired at 62 years of age, $16,809.72 to individuals that retired at 65 years of age, and $23,427,72 to individuals that retired at 70 years of age. In one year, these disbursements will be $13,765.44 to individuals that retired at 62 years of age, $17,482.11 to individuals that retired at 65 years of age, and $24,364.83 to individuals that retired at 70 years of age. After one year, these disbursements are expected to continue to grow each year by four percent forever. You should assume that your client receives a salary in the year your client retires and starts receiving social security one year after the retirement date. Assume your client plans to retire at age 70 , is able to invest the social security taxes into a retirement account, and can invest at an 8% annual growth rate forever. If your client spends exactly the same amount each year during retirement, what is the maximum amount your client can spend each year during retirement from age 71 through age 77 (seven years)? Incorrect Less than $500,000 More than $575,000 What will be your client's salary at age 50 ? Incorrect Less than $120,000 Between $120,000 and $140,000 Between $140,000 and $160,000 Between $160,000 and $180,000 More than $180,000 If your client retires at age 65 , what social security disbursement will your client receive at age 66? Between $40,000 and $60,000 Between $60,000 and $80,000 Between $80,000 and $100,000 More than $100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started