Answered step by step

Verified Expert Solution

Question

1 Approved Answer

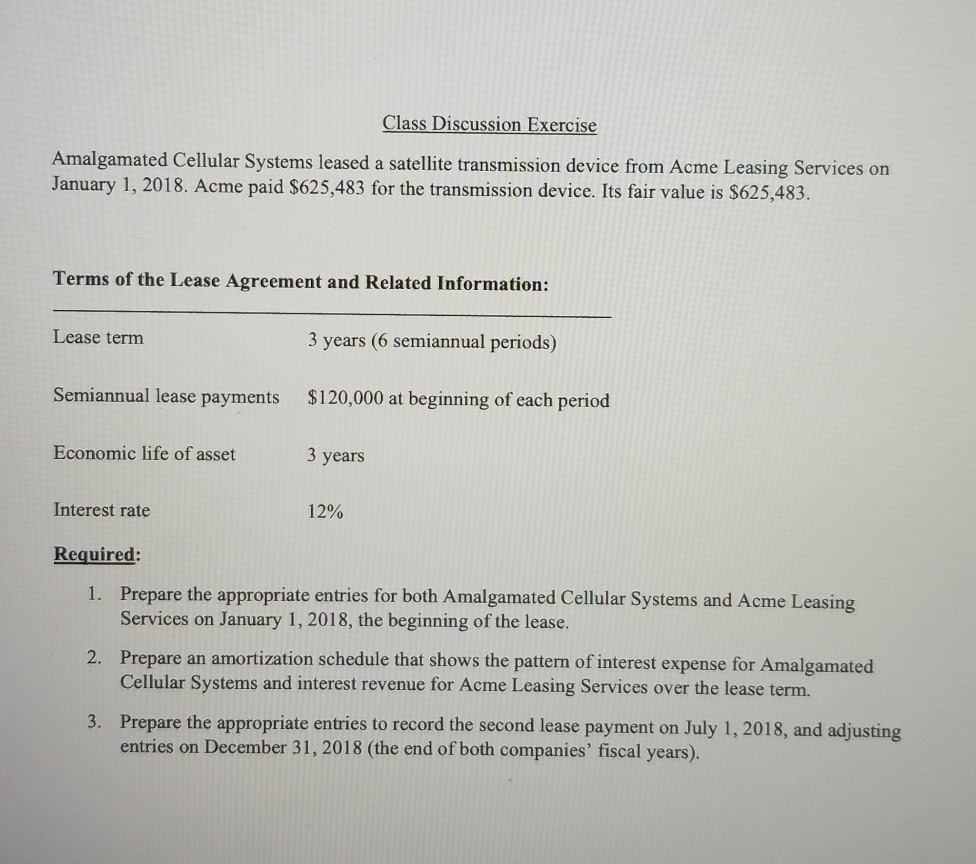

Please answer all 3 questions. Thank you so much. Class Discussion Exercise Amalgamated Cellular Systems leased a satellite transmission device from Acme Leasing Services on

Please answer all 3 questions.

Thank you so much.

Class Discussion Exercise Amalgamated Cellular Systems leased a satellite transmission device from Acme Leasing Services on January 1, 2018. Acme paid $625,483 for the transmission device. Its fair value is $625,483. Terms of the Lease Agreement and Related Information: Lease term 3 years (6 semiannual periods) Semiannual lease payments $120,000 at beginning of each period Economic life of asset 3 years Interest rate 12% Required: 1. Prepare the appropriate entries for both Amalgamated Cellular Systems and Acme Leasing Services on January 1, 2018, the beginning of the lease. 2. Prepare an amortization schedule that shows the pattern of interest expense for Amalgamated Cellular Systems and interest revenue for Acme Leasing Services over the lease term. 3. Prepare the appropriate entries to record the second lease payment on July 1, 2018, and adjusting entries on December 31, 2018 (the end of both companies' fiscal years)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started