Answered step by step

Verified Expert Solution

Question

1 Approved Answer

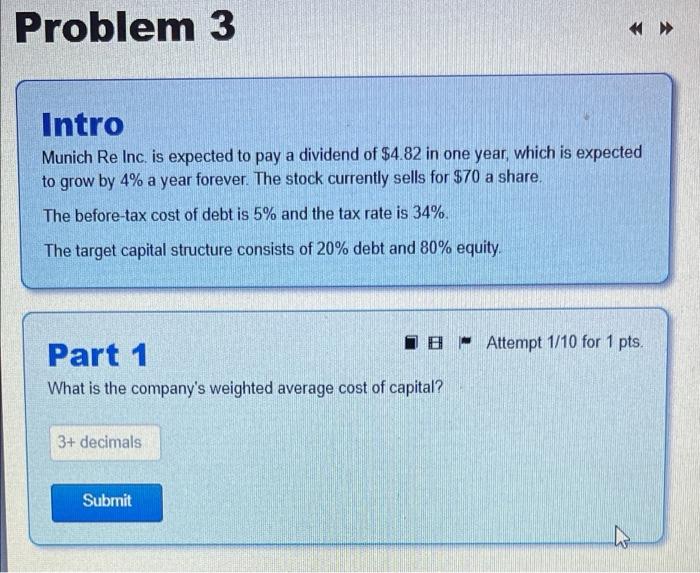

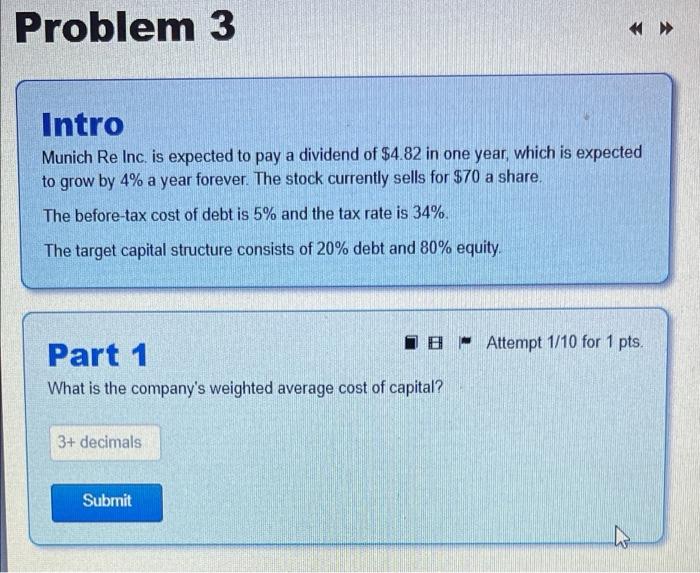

please answer all 4. i will give you a thumbs up Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82

please answer all 4. i will give you a thumbs up

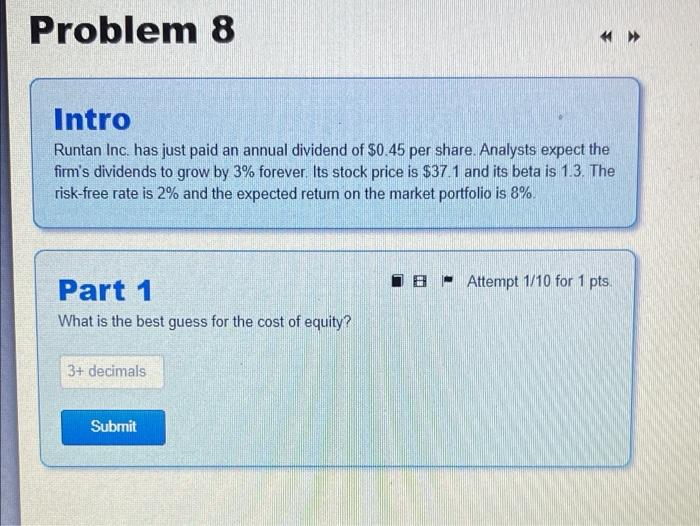

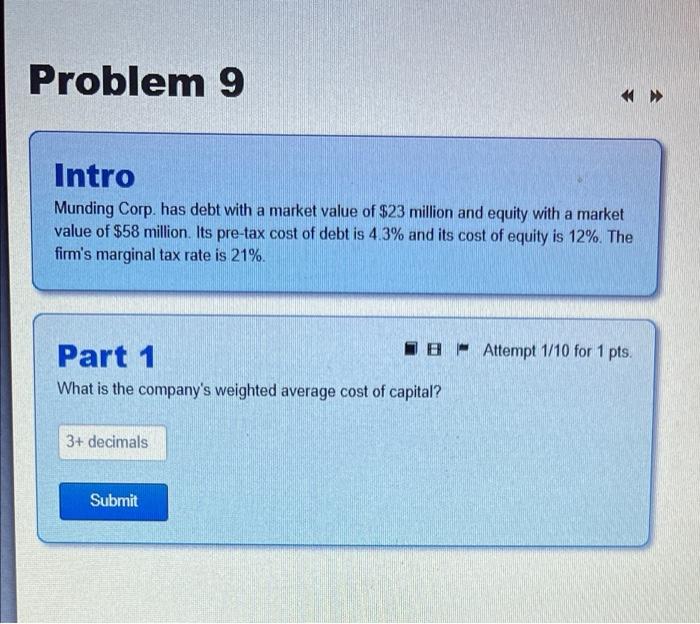

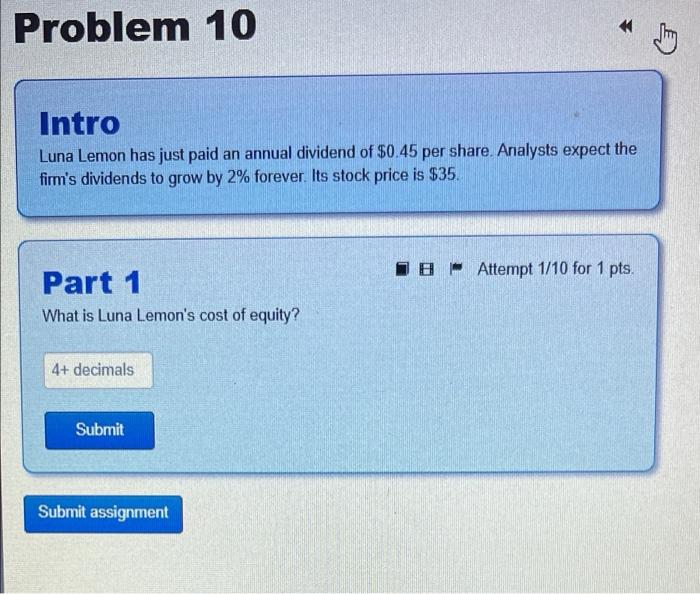

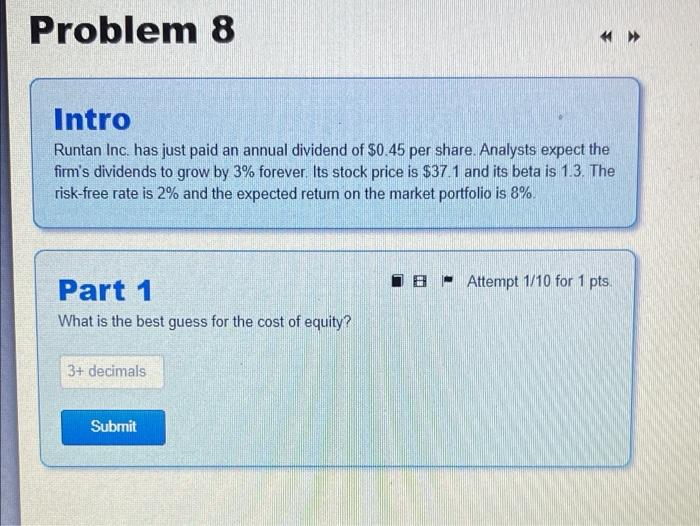

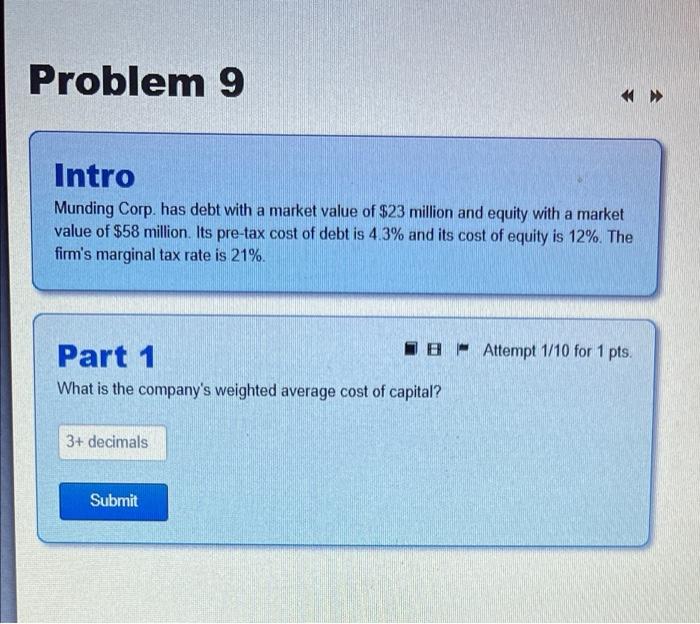

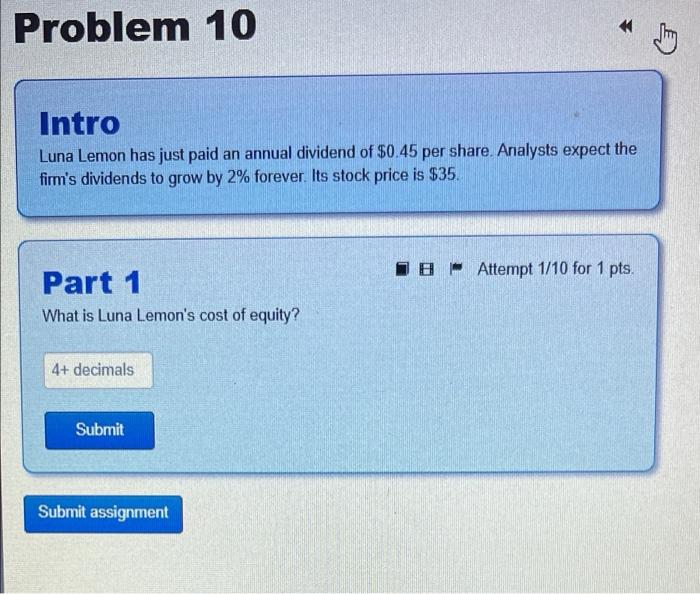

Problem 3 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $70 a share. The before-tax cost of debt is 5% and the tax rate is 34%. The target capital structure consists of 20% debt and 80% equity. Part 1 What is the company's weighted average cost of capital? 3+ decimals Submit Attempt 1/10 for 1 pts. Problem 8 Intro Runtan Inc. has just paid an annual dividend of $0.45 per share. Analysts expect the firm's dividends to grow by 3% forever. Its stock price is $37.1 and its beta is 1.3. The risk-free rate is 2% and the expected return on the market portfolio is 8% Part 1 What is the best guess for the cost of equity? 3+ decimals 41 Submit BAttempt 1/10 for 1 pts. Problem 9 Intro Munding Corp. has debt with a market value of $23 million and equity with a market value of $58 million. Its pre-tax cost of debt is 4.3% and its cost of equity is 12%. The firm's marginal tax rate is 21%. Part 1 What is the company's weighted average cost of capital? 3+ decimals. BAttempt 1/10 for 1 pts. Submit Problem 10 Intro Luna Lemon has just paid an annual dividend of $0.45 per share. Analysts expect the firm's dividends to grow by 2% forever. Its stock price is $35. Part 1 What is Luna Lemon's cost of equity? 4+ decimals Submit 44 Submit assignment Attempt 1/10 for 1 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started