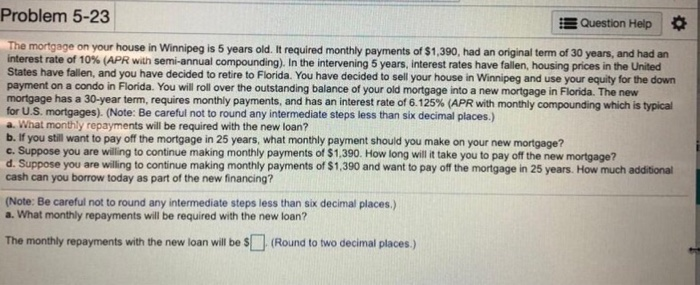

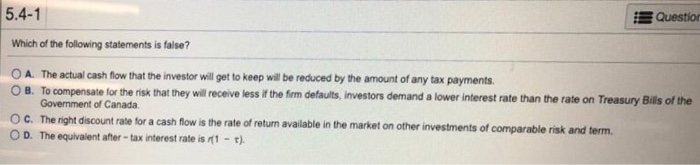

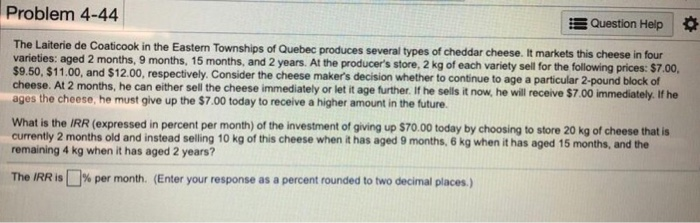

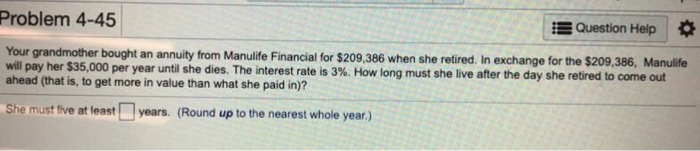

Problem 5-23 E Question Help The mortgage on your house in Winnipeg is 5 years old. It required monthly payments of $1,390, had an original term of 30 years, and had an interest rate of 10% ( R wan se annual compounding Inthe intervening 5years interest rates have fallen, housing pnces the United States have fallen, and you have decided to retire to Florida. You have decided to sell your house in Winnipeg and use your equity for the down payment on a condo in Florida. You will roll over the outstanding balance of your old mortgage into a new mortgage in Florida. The new mortgage has a 30-year term requires monthly payments, and has an interest rate of 6.125% APR with monthly compounding which is typical for U.S. mortgages). (Note: Be careful not to round any intermediate steps less than six decimal places.) a. What monthly repayments will be required with the new loan? b. If you still want to pay off the mortgage in 25 years, what monthly payment should you make on your new mortgage? c. Suppose you are willing to continue making monthly payments of $1,390. How long will it take you to pay off the new mortgage? d. Suppose you are willing to continue making monthly payments of $1,390 and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the new financing? Note: Be careful not to round any intermediate steps less than six decimal places.) a. What monthly repayments will be required with the new loan? The monthly repayments with the new loan will be s(Round to two decimal places.) 5.4-1 Which of the following statements is false? OA. The actual cash flow that the investor will get to keep will be reduced by the amount of any tax payments Questio O B. To compensate for the risk that they wil receive less if the frm defaultsinvestors demand a lower interest rate than the rate on Treasury Bills of the Government of Canada. The nght discount rate for a cash flow is the rate of return available C. in the market on other investments of comparable risk and term. OD. The equivalent after -tax interest rate is r ) Problem 4-44 Question Heip several types of cheddar cheese. It markets this cheese in four The Laiterie de Coaticook in the Eastern Townships of Quebec produces varieties: aged 2 months, 9 months, 15 months, and 2 years. At the producer's store, 2 kg of each variety sell for the following prices: $7 $9.50, $11.00, and $12.00, respectively. Consider the cheese makers decision whether to continue to age a particular 2-pound block of cheese. At 2 months, he can either sell the cheese immediately or let it age further. If he sells it now, he will receive $7.00 immediately. If he ages the cheese, he must give up the $7.00 today to receive a higher amount in the future. What is the IRR (expressed in percent per month) of the investment of giving up $70.00 today by choosing to store 20 kg of cheese that is currently 2 months old and instead selling 10 kg of this cheese when it has aged 9 months, 6 kg when it has aged 15 months, and the remaining 4 kg when it has aged 2 years? The IRR is % per month. (Enter your response as a percent rounded to two decimal places.) Problem 4-45 EQuestion Help bought an annuity from Manulife Financial for $209.386 when she retired. In exchange for the $209,386, Manulife will pay her $35,000 per year until she dies. The interest ra ahead (that is, to get more in value than what she paid in)? te is 3%. How long must she live after the day she retired to come out She must tive at least years. (Round up to the nearest whole year)