Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 4 questions. thank you A company has $4,000 in its allowance for doubtful accounts before making any adjusting entries of a company

please answer all 4 questions. thank you

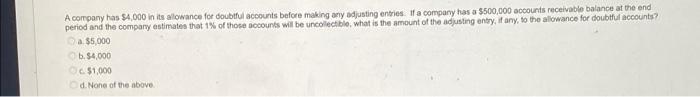

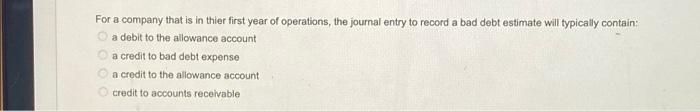

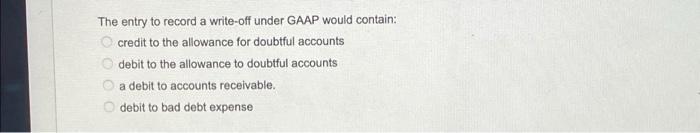

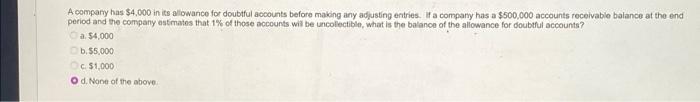

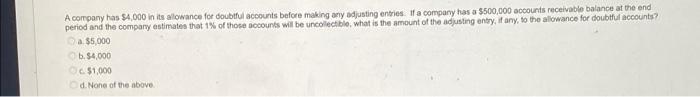

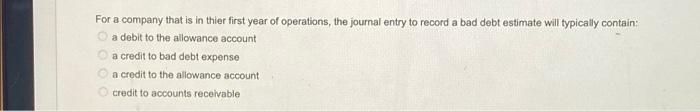

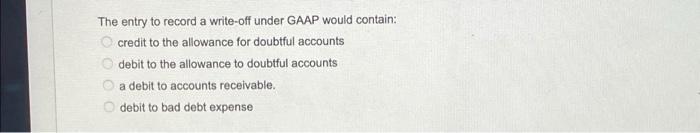

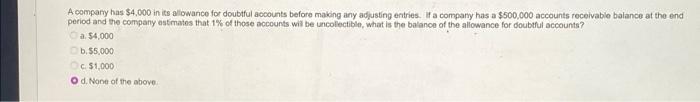

A company has $4,000 in its allowance for doubtful accounts before making any adjusting entries of a company has a $500,000 accounts receivable balance at the end period and the company estimates that 1% of those accounts will be uncollectible, what is the amount of the adjusting entry, if any, to the allowance for doubtful accounts? a $5,000 b. $4,000 SC 51,000 d. None of the above For a company that is in thier first year of operations, the journal entry to record a bad debt estimate will typically contain: a debit to the allowance account a credit to bad debt expense a credit to the allowance account credit to accounts receivable The entry to record a write-off under GAAP would contain: credit to the allowance for doubtful accounts debit to the allowance to doubtful accounts a debit to accounts receivable. debit to bad debt expense A company has $4.000 in its allowance for doubtful accounts before making any adjusting entries. If a company has a $500,000 accounts receivable balance at the end period and the company estimates that 1% of those accounts will be uncollectible, what is the balance of the allowance for doubtful accounts a $4,000 b.$5,000 $1,000 O d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started