Please Answer All 4 Questions

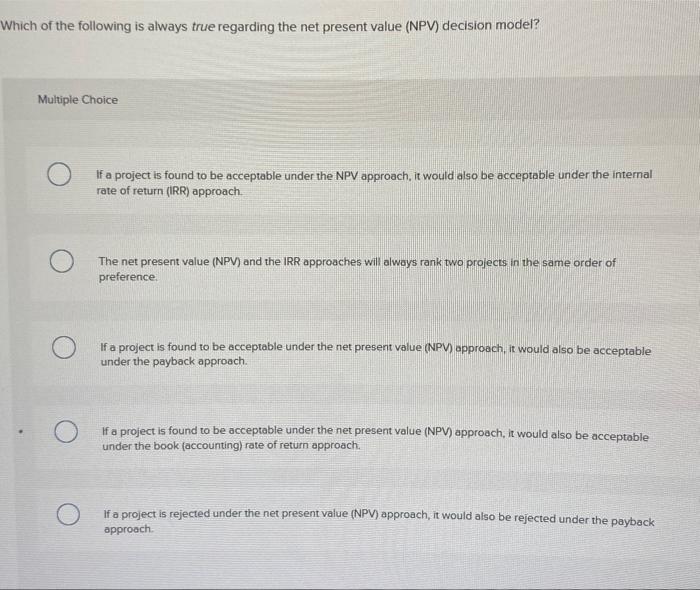

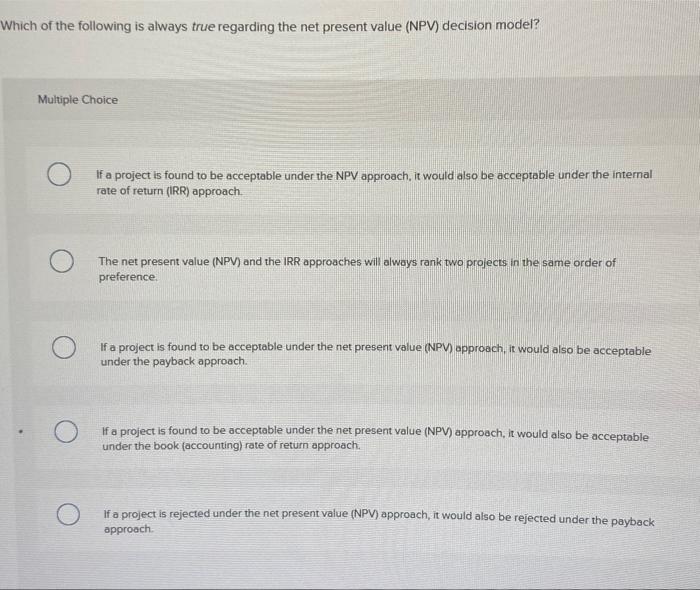

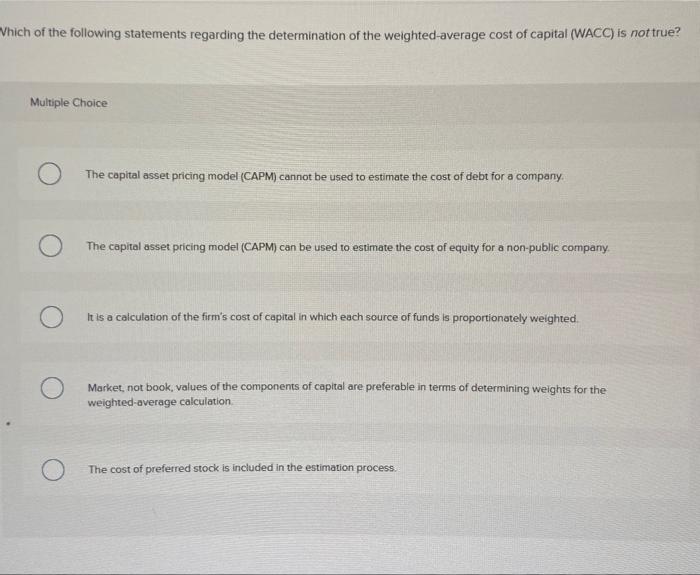

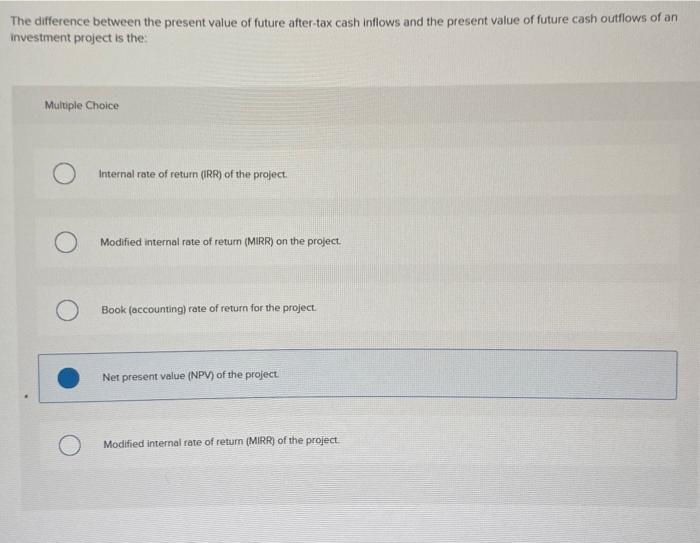

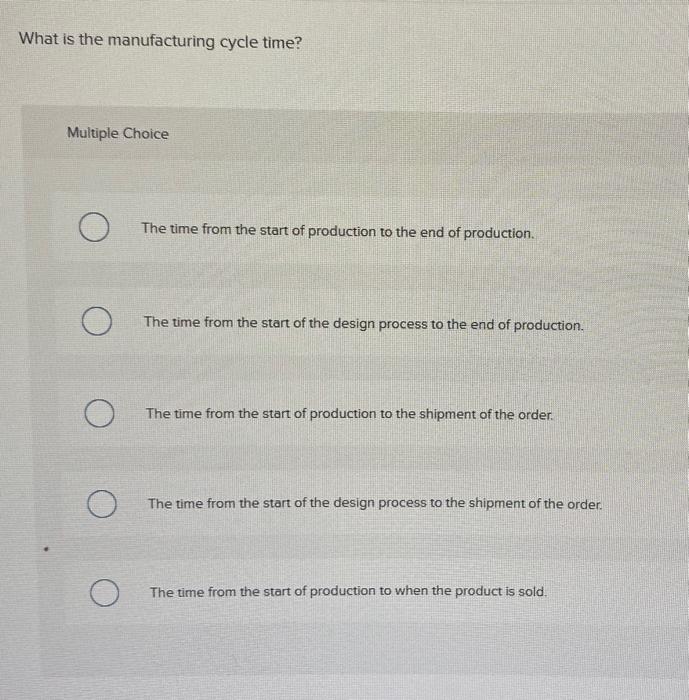

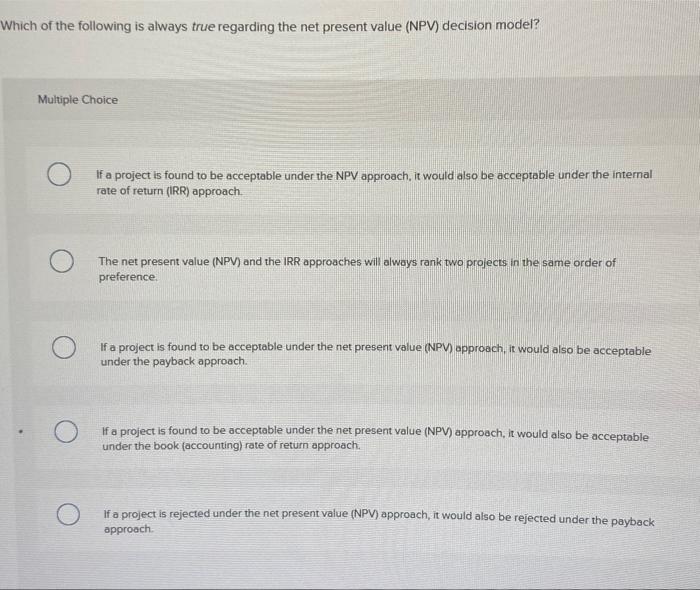

Which of the following is always true regarding the net present value (NPV) decision model? Multiple Choice If a project is found to be acceptable under the NPV approach, it would also be acceptable under the internal rate of return (IRR) approach. The net present value (NPV) and the IRR approaches will alwoys rank two projects in the same order of preference. If a project is found to be acceptable under the net present value (NPV) approach, it would also be acceptable under the payback approach. If a project is found to be acceptable under the net present value (NPV) approach, it would also be acceptable under the book (accounting) rate of retum approach. If a project is rejected under the net present value (NPV) approach, it would also be rejected under the payback approach. Thich of the following statements regarding the determination of the weighted-average cost of capital (WACC) is not true? Multiple Choice The capital asset pricing model (CAPM) cannot be used to estimate the cost of debt for a company. The capital asset pricing model (CAPM) can be used to estimate the cost of equity for a non-public company It is a calculation of the firm's cost of capital in which each source of funds is proportionately weighted Market, not book, values of the components of capital are preferable in terms of determining weights for the weighted-average calculation The cost of preferred stock is included in the estimation process. The difference between the present value of future after-tax cash inflows and the present value of future cash outflows of an investment project is the: Multiple Choice Internal rate of retum (IRR) of the project. Modified internal rate of retum (MIRR) on the project. Book (occounting) rate of return for the project. Net present value (NPV) of the project. Modified internal tate of retum (MIRR) of the project What is the manufacturing cycle time? Multiple Choice The time from the start of production to the end of production. The time from the start of the design process to the end of production. The time from the start of production to the shipment of the order. The time from the start of the design process to the shipment of the order. The time from the start of production to when the product is sold