Please answer all 4!!! Will give thumbs up

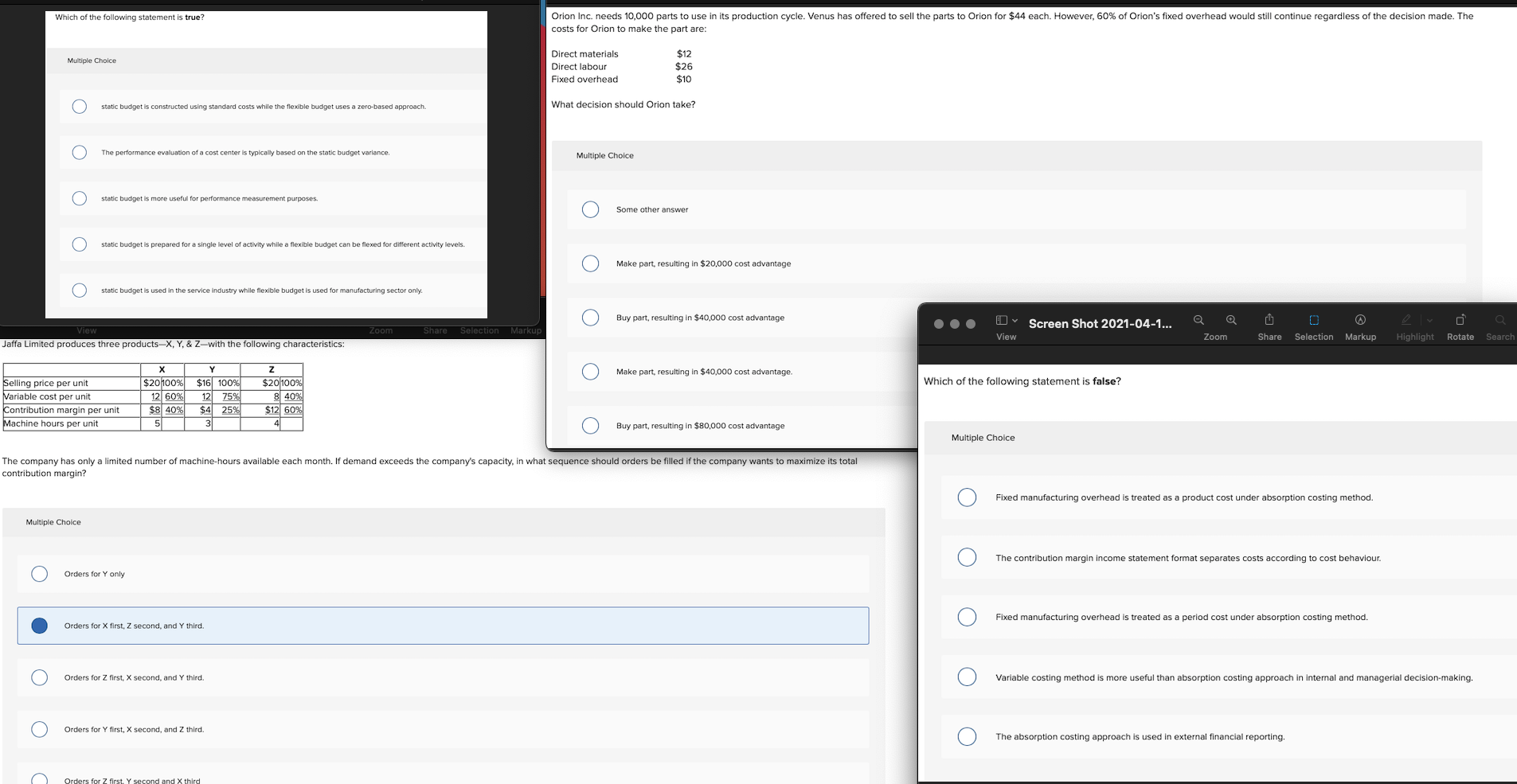

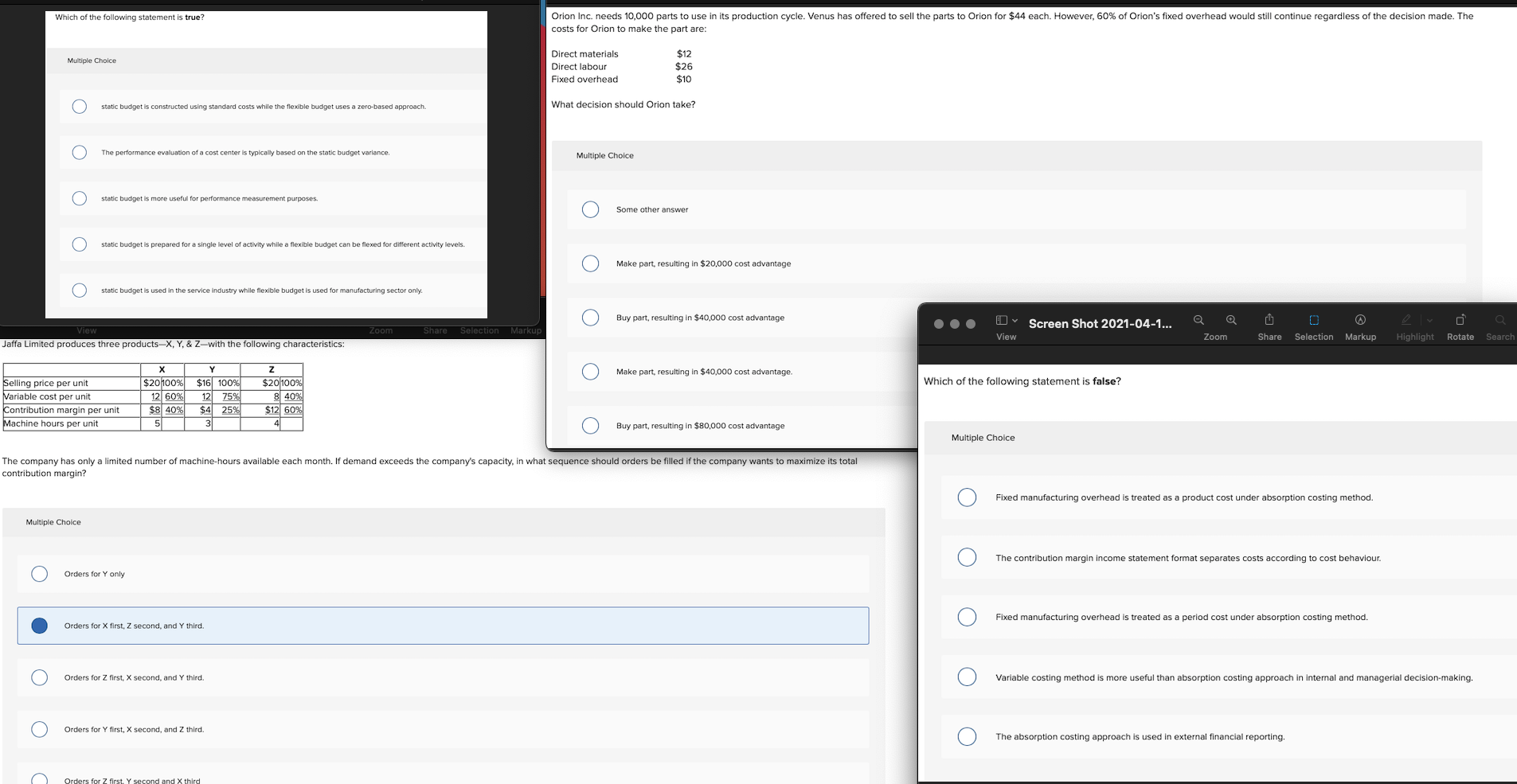

Which of the following statement is true? Orion Inc. needs 10,000 parts to use in its production cycle. Venus has offered to sell the parts to Orion for $44 each. However, 60% of Orion's fixed overhead would still continue regardless of the decision made. The costs for Orion to make the part are: Multiple Choice Direct materials Direct labour Fixed overhead $12 $26 $10 static budget is constructed using standard costs while the flexible budget uses a zero-based approach What decision should Orion take? The performance evaluation of a cost center is typically based on the static budget variance Multiple Choice static budget is more useful for performance measurement purposes. Some other answer O O static budget is prepared for a single level of activity while a flexible budget can be flexed for different activity levels. Make part, resulting in $20,000 cost advantage static budget is used in the service industry while flexible budget is used for manufacturing sector only. o o Buy part, resulting in $40,000 cost advantage Zoom Share Selection Markup D Screen Shot 2021-04-1... View O Selection Markup Zoom Share Highlight Rotate Search Jaffa Limited produces three products-X, Y,& Z-with the following characteristics: Make part, resulting in $40,000 cost advantage. Which of the following statement is false? Selling price per unit Variable cost per unit Contribution margin per unit Machine hours per unit $20 100% 12 60% $8 40% 5 Y $16 100% 12 75% $4 25% 3 z $20 100% 8 40% $12 60% 4 O O Buy part, resulting in $80,000 cost advantage Multiple Choice The company has only a limited number of machine-hours available each month. If demand exceeds the company's capacity, in what sequence should orders be filled if the company wants to maximize its total contribution margin? Fixed manufacturing overhead treated as a product cost under absorption costing method. Multiple Choice The contribution margin income statement format separates costs according to cost behaviour. Orders for Y only Fixed manufacturing overhead is treated as a period cost under absorption costing method. Orders for X first, Z second, and Y third Orders for Z first, X second, and Y third Variable costing method is more useful than absorption costing approach in internal and managerial decision-making. Orders for Y first, X second, and third The absorption costing approach is used in external financial reporting, Orders for Z first. Y second and X third