Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL 7 questions thank you 1. Suppose an FI wants to evaluate the credit risk of a $10 million loan with a duration

PLEASE ANSWER ALL 7 questions thank you

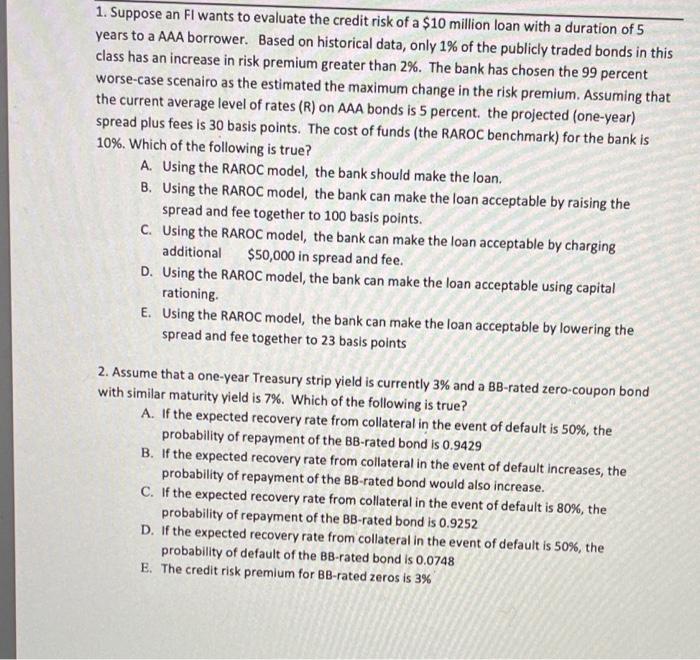

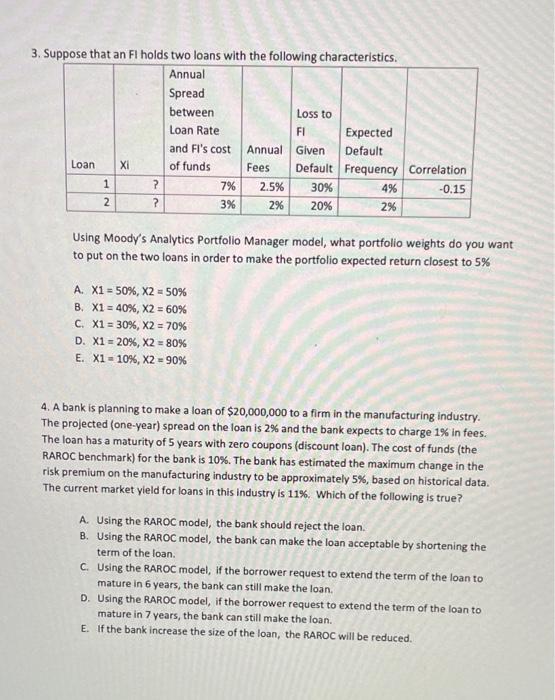

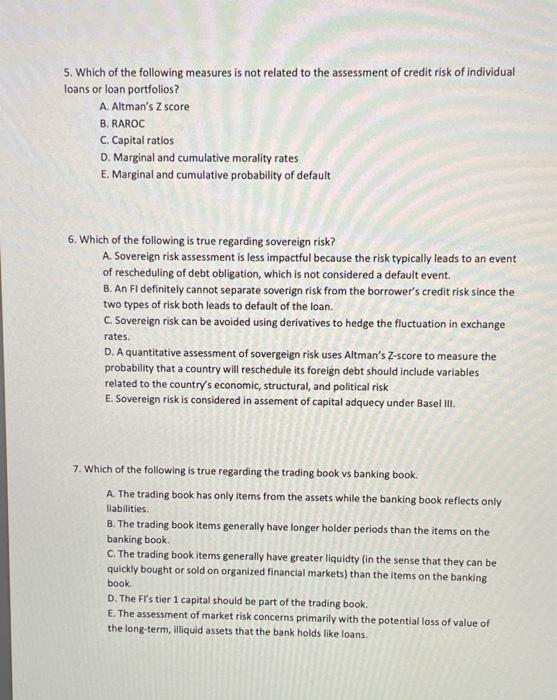

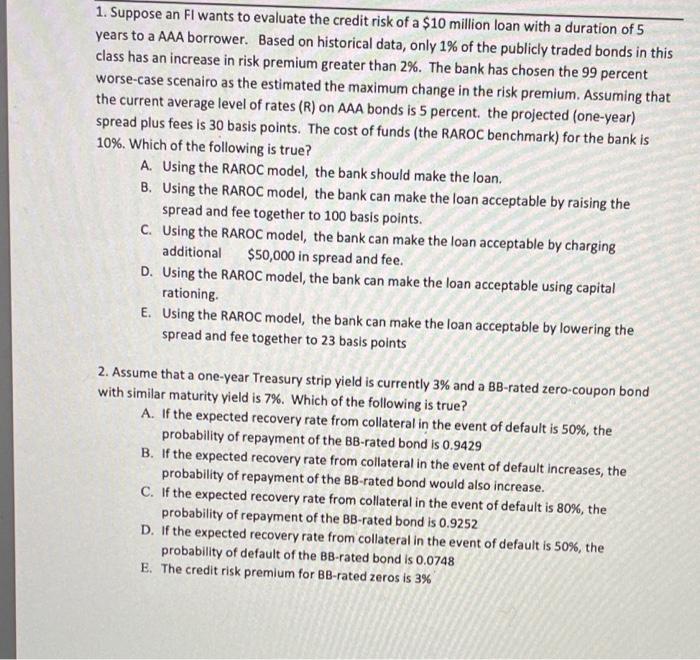

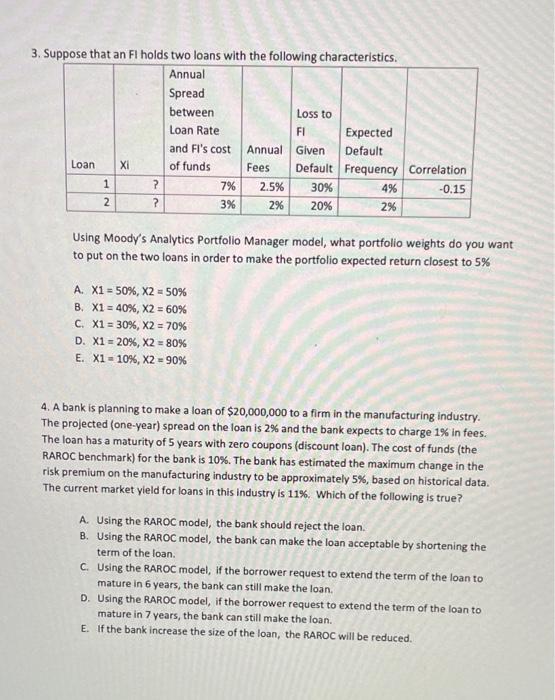

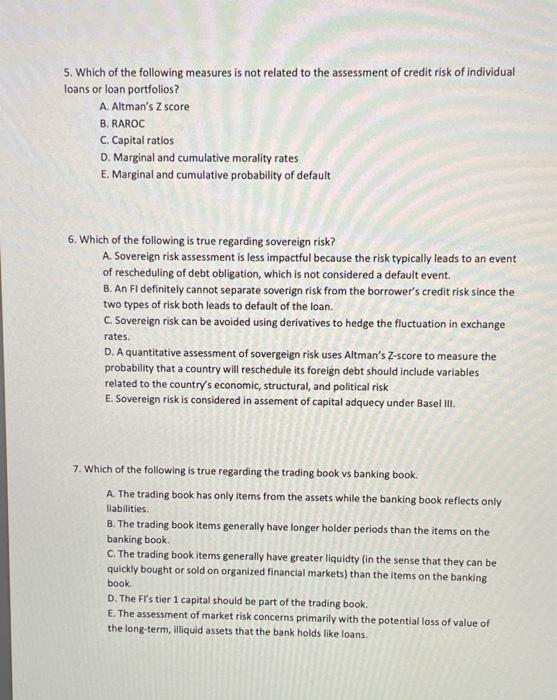

1. Suppose an FI wants to evaluate the credit risk of a $10 million loan with a duration of 5 a years to a AAA borrower. Based on historical data, only 1% of the publicly traded bonds in this class has an increase in risk premium greater than 2%. The bank has chosen the 99 percent worse-case scenairo as the estimated the maximum change in the risk premium. Assuming that the current average level of rates (R) on AAA bonds is 5 percent. the projected (one-year) spread plus fees is 30 basis points. The cost of funds (the RAROC benchmark) for the bank is 10%. Which of the following is true? A. Using the RAROC model, the bank should make the loan. B. Using the RAROC model, the bank can make the loan acceptable by raising the spread and fee together to 100 basis points. C. Using the RAROC model, the bank can make the loan acceptable by charging additional $50,000 in spread and fee. D. Using the RAROC model, the bank can make the loan acceptable using capital rationing. E. Using the RAROC model, the bank can make the loan acceptable by lowering the spread and fee together to 23 basis points 2. Assume that a one-year Treasury strip yield is currently 3% and a BB-rated zero-coupon bond with similar maturity yield is 7%. Which of the following is true? A. If the expected recovery rate from collateral in the event of default is 50%, the probability of repayment of the BB-rated bond is 0.9429 B. If the expected recovery rate from collateral in the event of default increases, the probability of repayment of the BB-rated bond would also increase. C. If the expected recovery rate from collateral in the event of default is 80%, the probability of repayment of the BB-rated bond is 0.9252 D. If the expected recovery rate from collateral in the event of default is 50%, the probability of default of the BB-rated bond is 0.0748 E. The credit risk premium for BB-rated zeros is 3% 3. Suppose that an Fl holds two loans with the following characteristics. Annual Spread between Loss to Loan Rate FI Expected and Fi's cost Annual Given Default Loan Xi of funds Fees Default Frequency Correlation 1 2 7% 2.5% 30% 4% -0.15 2 ? 2% 20% 296 3% Using Moody's Analytics Portfolio Manager model, what portfolio weights do you want to put on the two loans in order to make the portfolio expected return closest to 5% A. X1 = 50%, X2 - 50% B. X1 = 40%, X2 = 60% C. X1 = 30%, X2 = 70% D. X1 = 20%, X2 = 80% E. X1 = 10%, X2 = 90% 4. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yleld for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan, D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced. 5. Which of the following measures is not related to the assessment of credit risk of individual loans or loan portfolios? A. Altman's Z score B. RAROC C. Capital ratios D. Marginal and cumulative morality rates E. Marginal and cumulative probability of default 6. Which of the following is true regarding sovereign risk? A. Sovereign risk assessment is less impactful because the risk typically leads to an event of rescheduling of debt obligation, which is not considered a default event. B. An FI definitely cannot separate soverign risk from the borrower's credit risk since the two types of risk both leads to default of the loan. C. Sovereign risk can be avoided using derivatives to hedge the fluctuation in exchange D. A quantitative assessment of sovergeign risk uses Altman's Z-score to measure the probability that a country will reschedule its foreign debt should include variables related to the country's economic, structural, and political risk E. Sovereign risk is considered in assement of capital adquecy under Basel III. rates. 7. Which of the following is true regarding the trading book vs banking book. A The trading book has only items from the assets while the banking book reflects only liabilities. B. The trading book items generally have longer holder periods than the items on the banking book C. The trading book items generally have greater liquidty (in the sense that they can be quickly bought or sold on organized financial markets) than the items on the banking D. The Ft's tier 1 capital should be part of the trading book, E. The assessment of market risk concerns primarily with the potential loss of value of the long-term, illiquid assets that the bank holds like loans. book 1. Suppose an FI wants to evaluate the credit risk of a $10 million loan with a duration of 5 a years to a AAA borrower. Based on historical data, only 1% of the publicly traded bonds in this class has an increase in risk premium greater than 2%. The bank has chosen the 99 percent worse-case scenairo as the estimated the maximum change in the risk premium. Assuming that the current average level of rates (R) on AAA bonds is 5 percent. the projected (one-year) spread plus fees is 30 basis points. The cost of funds (the RAROC benchmark) for the bank is 10%. Which of the following is true? A. Using the RAROC model, the bank should make the loan. B. Using the RAROC model, the bank can make the loan acceptable by raising the spread and fee together to 100 basis points. C. Using the RAROC model, the bank can make the loan acceptable by charging additional $50,000 in spread and fee. D. Using the RAROC model, the bank can make the loan acceptable using capital rationing. E. Using the RAROC model, the bank can make the loan acceptable by lowering the spread and fee together to 23 basis points 2. Assume that a one-year Treasury strip yield is currently 3% and a BB-rated zero-coupon bond with similar maturity yield is 7%. Which of the following is true? A. If the expected recovery rate from collateral in the event of default is 50%, the probability of repayment of the BB-rated bond is 0.9429 B. If the expected recovery rate from collateral in the event of default increases, the probability of repayment of the BB-rated bond would also increase. C. If the expected recovery rate from collateral in the event of default is 80%, the probability of repayment of the BB-rated bond is 0.9252 D. If the expected recovery rate from collateral in the event of default is 50%, the probability of default of the BB-rated bond is 0.0748 E. The credit risk premium for BB-rated zeros is 3% 3. Suppose that an Fl holds two loans with the following characteristics. Annual Spread between Loss to Loan Rate FI Expected and Fi's cost Annual Given Default Loan Xi of funds Fees Default Frequency Correlation 1 2 7% 2.5% 30% 4% -0.15 2 ? 2% 20% 296 3% Using Moody's Analytics Portfolio Manager model, what portfolio weights do you want to put on the two loans in order to make the portfolio expected return closest to 5% A. X1 = 50%, X2 - 50% B. X1 = 40%, X2 = 60% C. X1 = 30%, X2 = 70% D. X1 = 20%, X2 = 80% E. X1 = 10%, X2 = 90% 4. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yleld for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan, D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced. 5. Which of the following measures is not related to the assessment of credit risk of individual loans or loan portfolios? A. Altman's Z score B. RAROC C. Capital ratios D. Marginal and cumulative morality rates E. Marginal and cumulative probability of default 6. Which of the following is true regarding sovereign risk? A. Sovereign risk assessment is less impactful because the risk typically leads to an event of rescheduling of debt obligation, which is not considered a default event. B. An FI definitely cannot separate soverign risk from the borrower's credit risk since the two types of risk both leads to default of the loan. C. Sovereign risk can be avoided using derivatives to hedge the fluctuation in exchange D. A quantitative assessment of sovergeign risk uses Altman's Z-score to measure the probability that a country will reschedule its foreign debt should include variables related to the country's economic, structural, and political risk E. Sovereign risk is considered in assement of capital adquecy under Basel III. rates. 7. Which of the following is true regarding the trading book vs banking book. A The trading book has only items from the assets while the banking book reflects only liabilities. B. The trading book items generally have longer holder periods than the items on the banking book C. The trading book items generally have greater liquidty (in the sense that they can be quickly bought or sold on organized financial markets) than the items on the banking D. The Ft's tier 1 capital should be part of the trading book, E. The assessment of market risk concerns primarily with the potential loss of value of the long-term, illiquid assets that the bank holds like loans. book

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started