Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all! A business reports $125,000 for Equipment and $93,000 for Accumulated DepreciationEquipment on its Balance Sheet. What is the book value of the

Please answer all!

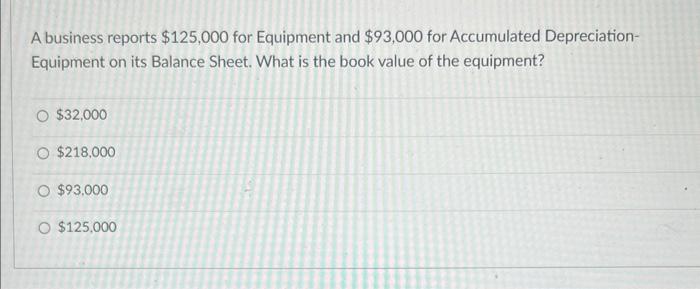

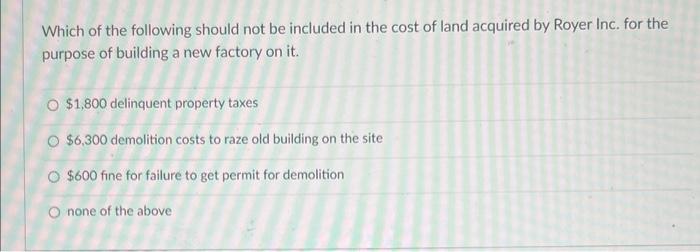

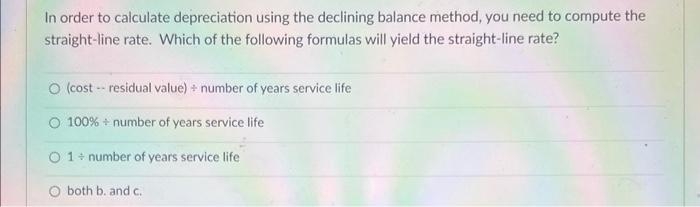

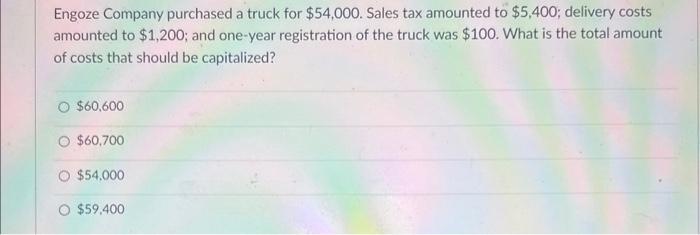

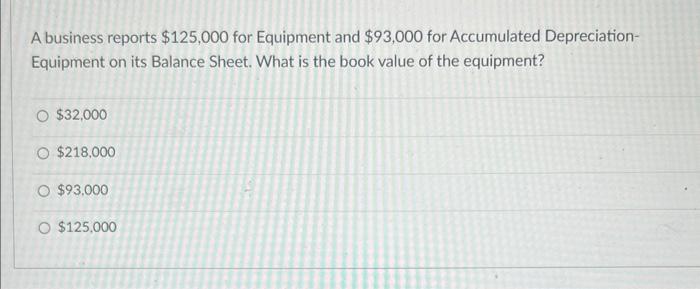

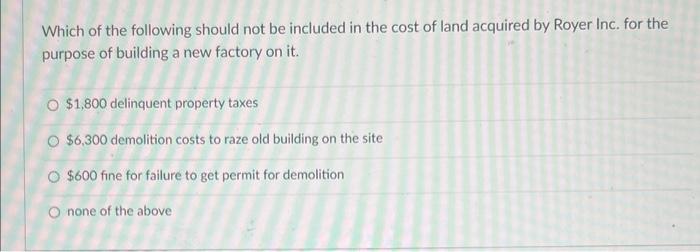

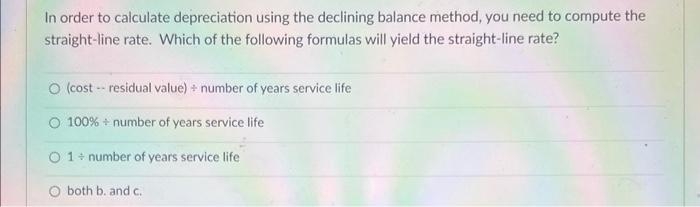

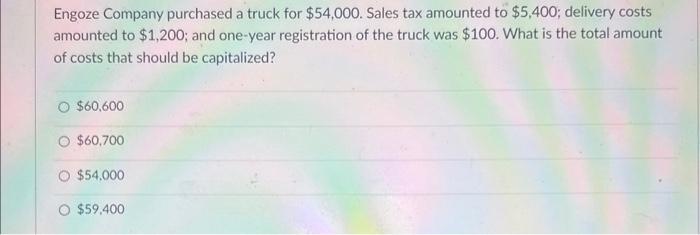

A business reports $125,000 for Equipment and $93,000 for Accumulated DepreciationEquipment on its Balance Sheet. What is the book value of the equipment? $32,000 $218,000 $93.000 $125,000 Which of the following should not be included in the cost of land acquired by Royer Inc. for the purpose of building a new factory on it. $1,800 delinquent property taxes $6,300 demolition costs to raze old building on the site $600 fine for failure to get permit for demolition none of the above In order to calculate depreciation using the declining balance method, you need to compute the straight-line rate. Which of the following formulas will yield the straight-line rate? (cost - residual value) number of years service life 100% number of years service life 1 number of years service life both b. and c. Engoze Company purchased a truck for $54,000. Sales tax amounted to $5,400; delivery costs amounted to $1,200; and one-year registration of the truck was $100. What is the total amount of costs that should be capitalized? $60.600 $60,700 $54.000 $59.400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started