please answer all and make sure they are 100% correct. last time some were not correct

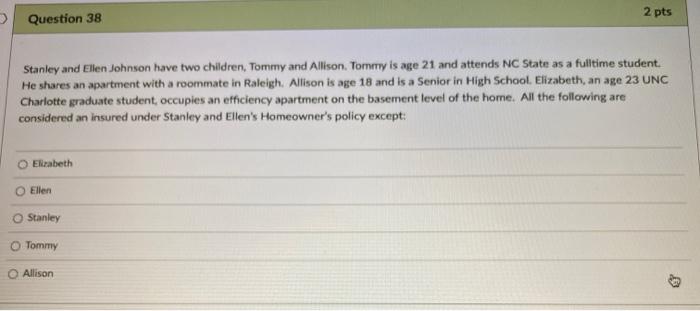

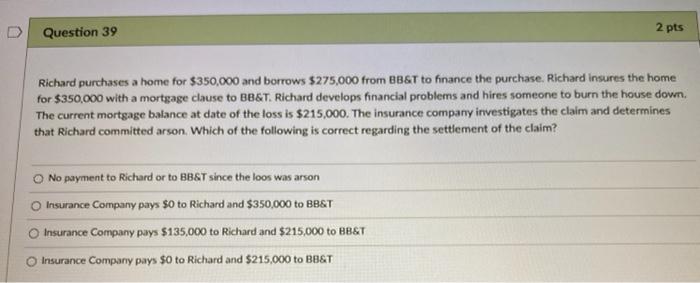

Question 38 2 pts Stanley and Ellen Johnson have two children, Tommy and Allison, Tommy is age 21 and attends NC State as a fulltime student He shares an apartment with a roommate in Raleigh, Allison is age 18 and is a Senior in High School. Elizabeth, an age 23 UNC Charlotte graduate student occupies an efficiency apartment on the basement level of the home. All the following are considered an insured under Stanley and Ellen's Homeowner's policy except Elrabeth Elen Stanley Tommy Allison D Question 39 2 pts Richard purchases a home for $350,000 and borrows $275,000 from 186T to finance the purchase, Richard insures the home for $350,000 with a mortgage cause to BEST. Richard develops financial problems and hires someone to burn the house down. The current mortgage balance at date of the loss is $215,000. The insurance company investigates the claim and determines that Richard committed arson. Which of the following is correct regarding the settlement of the claim? No payment to Richard or to BBGT since the loos was arson Insurance Company pays to Richard and $350.000 to BBST Insurance Company pays $135,000 to Richard and $215,000 to BBST Insurance Company pays $0 to Richard and $215,000 to BB&T Question 38 2 pts Stanley and Ellen Johnson have two children, Tommy and Allison, Tommy is age 21 and attends NC State as a fulltime student He shares an apartment with a roommate in Raleigh Allison is age 18 and is a Senior in High School. Elizabeth, an age 23 UNC Charlotte graduate student, occupies an efficiency apartment on the basement level of the home. All the following are considered an insured under Stanley and Ellen's Homeowner's policy except: Elizabeth Ellen Stanley Tommy Allison Question 39 2 pts Richard purchases a home for $350,000 and borrows $275,000 from BB&T to finance the purchase. Richard insures the home for $350,000 with a mortgage clause to BB&T. Richard develops financial problems and hires someone to burn the house down The current mortgage balance at date of the loss is $215,000. The insurance company investigates the claim and determines that Richard committed arson. Which of the following is correct regarding the settlement of the claim? No payment to Richard or to BB&T since the loos was arson Insurance Company pays $0 to Richard and $350,000 to BB&T Insurance Company pays $135,000 to Richard and $215,000 to BB&T Insurance Company pays $0 to Richard and $215,000 to BB&T