please answer all and show all the work.

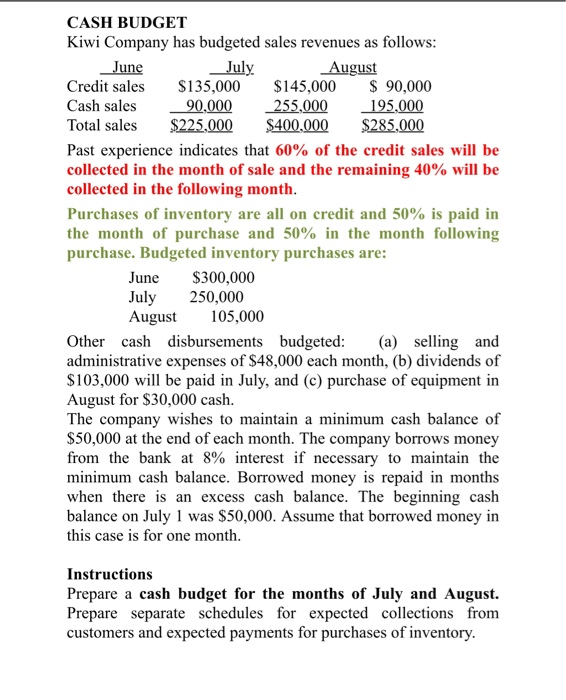

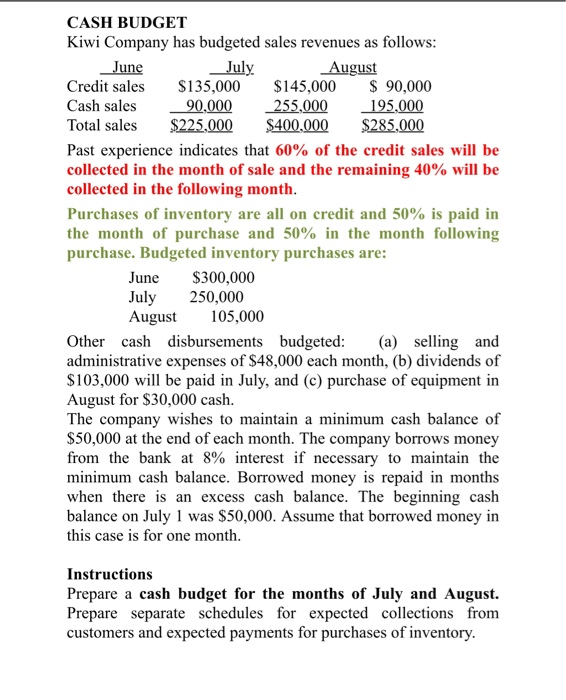

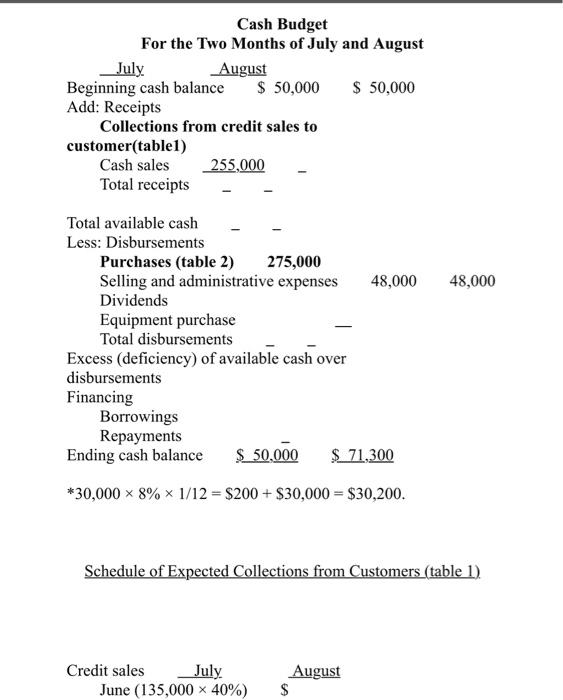

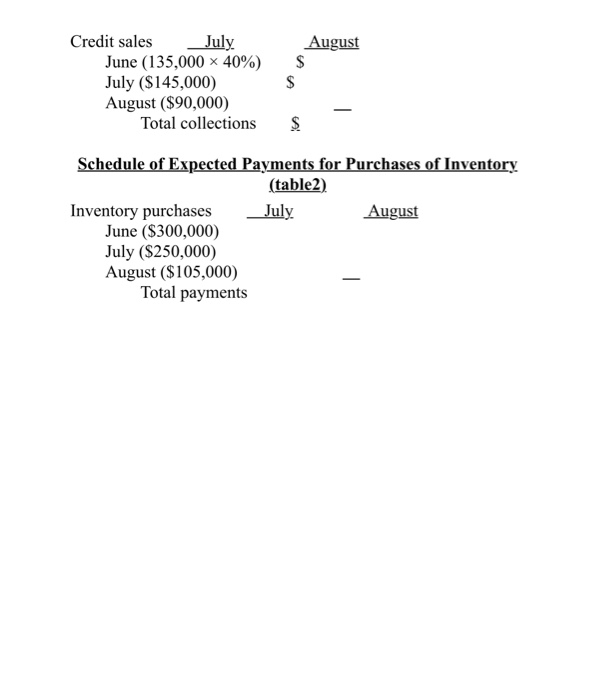

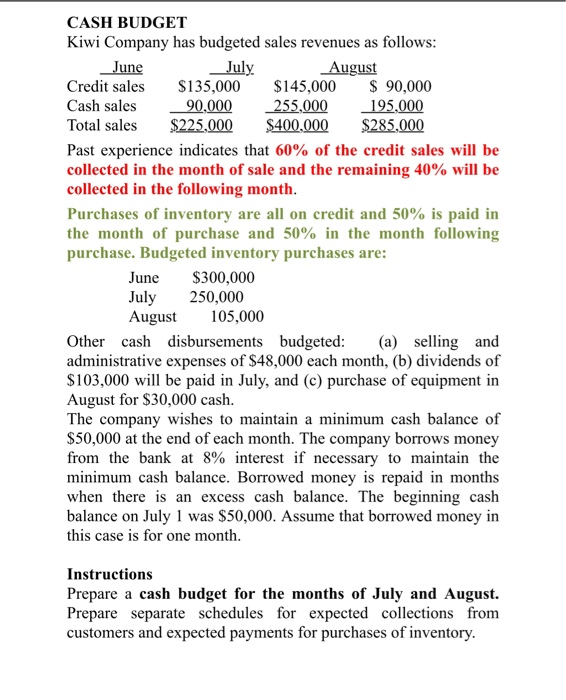

CASH BUDGET Kiwi Company has budgeted sales revenues as follows: June July August Credit sales $135,000 $145,000 $ 90,000 Cash sales 90,000 255.000 195,000 Total sales $225,000 $400,000 $285,000 Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are: June $300,000 July 250,000 August 105,000 Other cash disbursements budgeted: (a) selling and administrative expenses of $48,000 each month, (b) dividends of $103,000 will be paid in July, and (c) purchase of equipment in August for $30,000 cash. The company wishes to maintain a minimum cash balance of $50,000 at the end of each month. The company borrows money from the bank at 8% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $50,000. Assume that borrowed money in this case is for one month. Instructions Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory. Cash Budget For the Two Months of July and August July August Beginning cash balance $ 50,000 $ 50,000 Add: Receipts Collections from credit sales to customer(table1) Cash sales 255,000 Total receipts 48,000 Total available cash Less: Disbursements Purchases (table 2) 275,000 Selling and administrative expenses 48,000 Dividends Equipment purchase Total disbursements Excess (deficiency) of available cash over disbursements Financing Borrowings Repayments Ending cash balance $ 50,000 $ 71,300 *30,000 8% 1/12 = $200 + $30,000 = $30,200. Schedule of Expected Collections from Customers (table 1). Credit sales July June (135,000 x 40%) August $ August Credit sales _July June (135,000 x 40%) July ($145,000) August ($90,000) Total collections $ $ $ Schedule of Expected Payments for Purchases of Inventory (table2) Inventory purchases July August June ($300,000) July ($250,000) August ($105,000) Total payments