Answered step by step

Verified Expert Solution

Question

1 Approved Answer

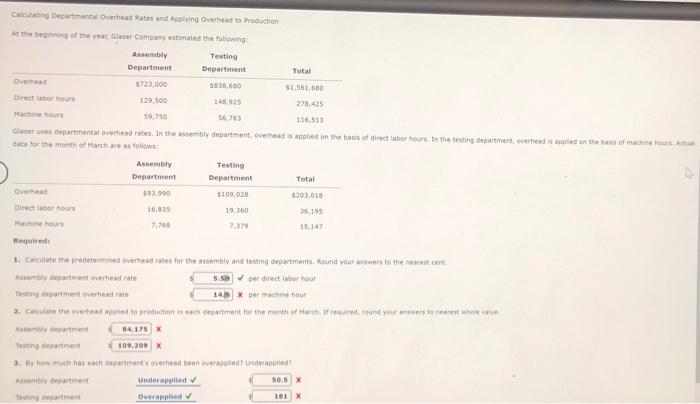

please answer all and show work thank you will like if correct Calcio Departmental Overhead Rates and Applying Overhead to Production At the beginning of

please answer all and show work thank you will like if correct

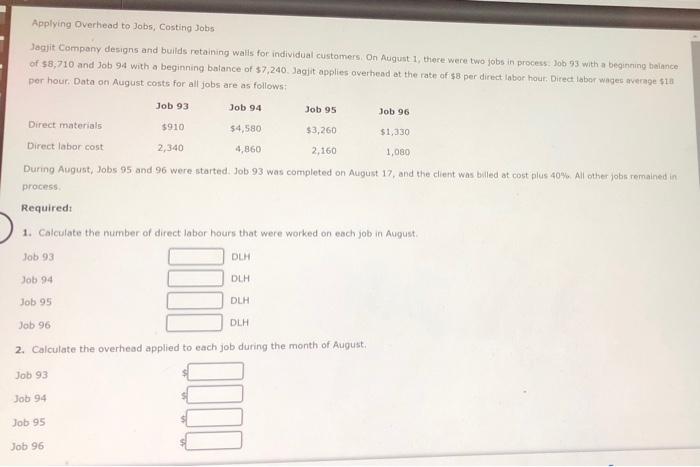

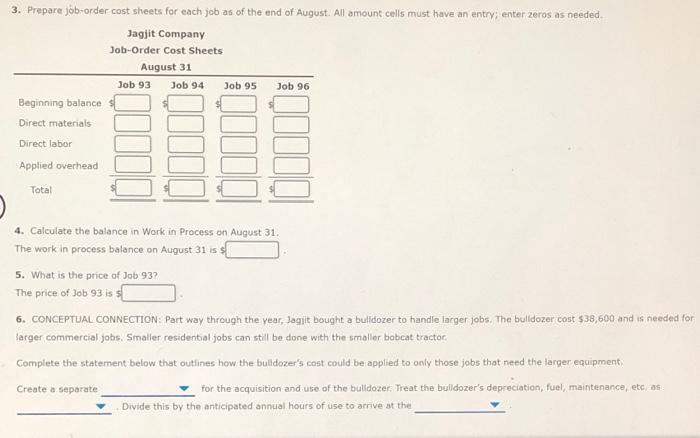

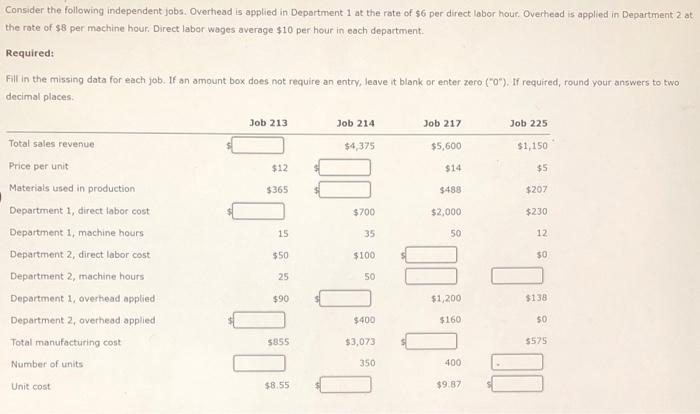

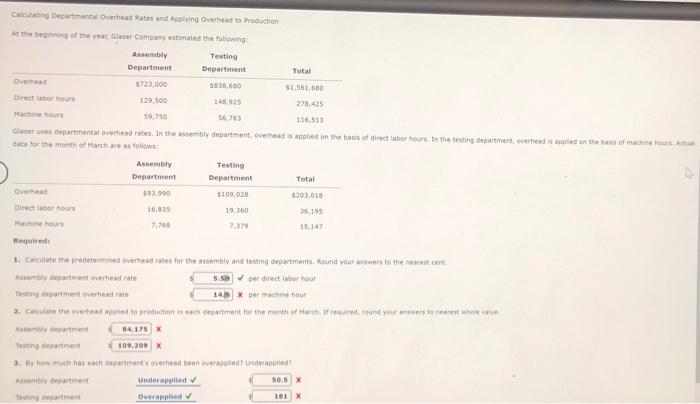

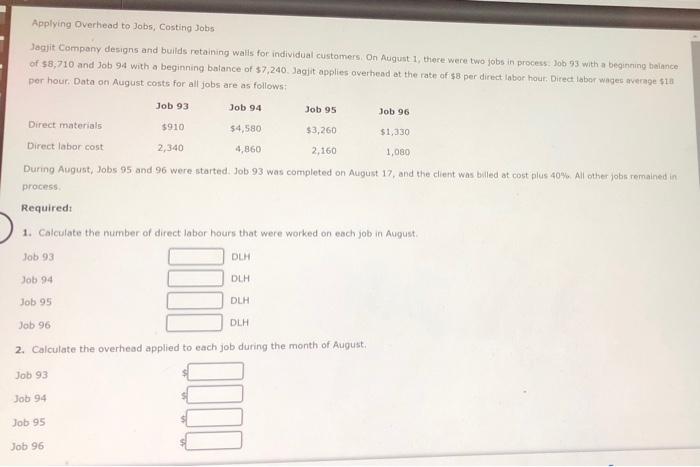

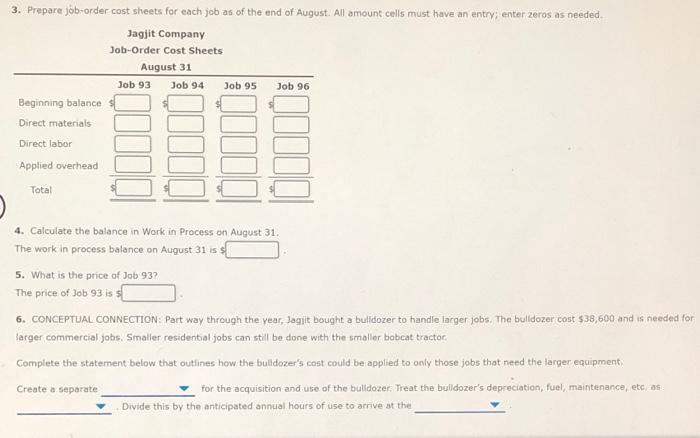

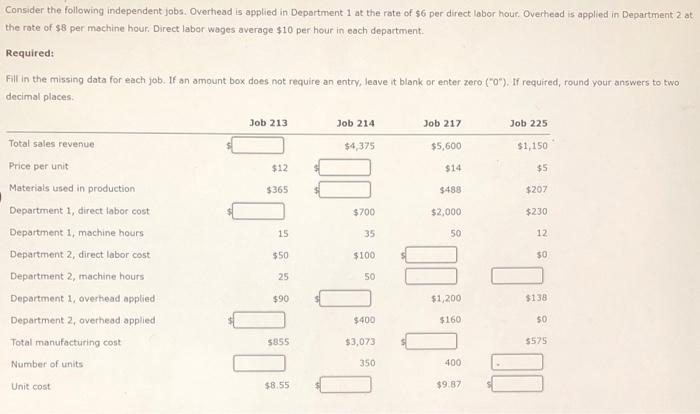

Calcio Departmental Overhead Rates and Applying Overhead to Production At the beginning of the year Glaser Company estimated the following Assembly Testing Department Department Total Dead 8723,000 5838,660 51.561.600 Direct labor hon 129,500 143.925 278.425 Machine hours 59,750 56.76) 116,513 se departmental overhead rates in the assembly department overheasised on the basis of direct labor hours to the testing department, overhead is applied on the basis of machine hours. Actual data for the month of March are as follows: Assembly Testing Department Department Total Overhead 593,900 3109,028 1203,018 labor hours 15,835 19,160 36,195 Machine Hours 7.760 7,39 15.147 Required 1. Calculate the predetermined veedates for the assembly and testing department Round your answers to the neareston Aby department overhead rate per direct bor hout Testing department overhead rate Xper machine hour 3. Commutate te verbetet to reduction in each department for the month of March freuired, round your enthalie Depart 114,175 x Testing department 109,209 X 3. By w muchacht department overhead been overapped underapped Underapplied SOS Twing department Overapplied 181 Applying Overhead to Jobs, Costing Jobs Jagjit Company designs and builds retaining walls for individual customers. On August 1, there were two jobs in process. Job 93 with a beginning balance of $8,710 and Job 94 with a beginning balance of $7,240. Jagjit applies overhead at the rate of 58 per direct labor hour. Direct labor wages average 18 per hour. Data on August costs for all jobs are as follows: Job 93 Job 94 Job 95 Job 96 Direct materials $910 $4,580 $3,260 $1,330 Direct labor cost 2,340 4,860 2,160 1,080 During August, Jobs 95 and 96 were started. Job 93 was completed on August 17, and the client was billed at cost plus 40%. All other jobs remained in process Required: 1. Calculate the number of direct labor hours that were worked on each job in August Job 93 DLH Job 94 DLH Job 95 DLH Job 96 DLH 2. Calculate the overhead applied to each job during the month of August, Job 93 Job 94 Job 95 Job 96 3. Prepare job-order cost sheets for each job as of the end of August. All amount cells must have an entry; enter zeros as needed Jagjit Company Job-Order Cost Sheets August 31 Job 93 Job 94 Job 96 Beginning balance Job 95 Direct materials Direct labor Applied overhead Total 4. Calculate the balance in Work in Process on August 31. The work in process balance on August 31 is 5. What is the price of Job 93 The price of Job 93 is s[ 6. CONCEPTUAL CONNECTION: Part way through the year, Jagjit bought a bulldozer to handle larger jobs. The bulldozer cost $38,600 and is needed for larger commercial jobs. Smaller residential jobs can still be done with the smaller babcat tractor Complete the statement below that outlines how the bulldozer's cost could be applied to only those jobs that need the larger equipment, for the acquisition and use of the bulldozer Treat the bulldozer's depreciation, fuel, maintenance, etc, as Divide this by the anticipated annual hours of use to arrive at the Create a separate Consider the following independent jobs. Overhead is applied in Department 1 at the rate of $6 per direct labor hour. Overhead is applied in Department 2 at the rate of $8 per machine hour. Direct labor wages average $10 per hour in each department Required: Fill in the missing data for each job. If an amount box does not require an entry, leave it blank or enter zero ("0"). If required, round your answers to two decimal places Job 213 Job 214 Job 217 Job 225 $4,375 $5,600 $1,150 Total sales revenue Price per unit Materials used in production $12 $14 $5 $365 $488 $207 Department 1, direct labor cost $700 $2,000 $230 15 35 50 12 $50 $100 50 25 50 Department 1, machine hours Department 2, direct labor cost Department 2, machine hours Department 1. overhead applied Department 2, overhead applied Total manufacturing cost Number of units $90 $1,200 $138 $400 $160 50 11.1 5855 $3,073 350 400 Unit cost $8.55 $9.87

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started