Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all and showing working. i will appreciate ii) On January 1, 2018, Mulungushi purchased 10% bonds, having a maturity value (par value) of

please answer all and showing working. i will appreciate

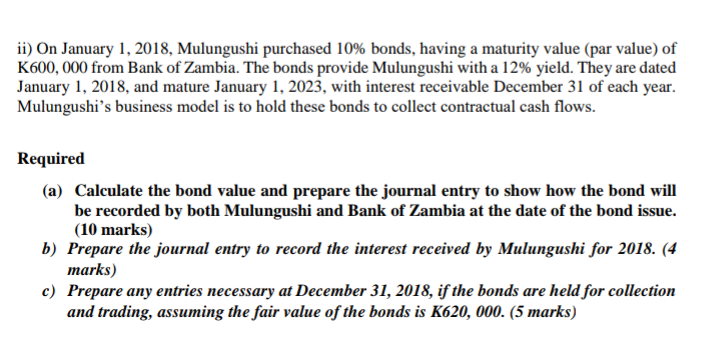

ii) On January 1, 2018, Mulungushi purchased 10% bonds, having a maturity value (par value) of K600,000 from Bank of Zambia. The bonds provide Mulungushi with a 12% yield. They are dated January 1, 2018, and mature January 1, 2023, with interest receivable December 31 of each year. Mulungushi's business model is to hold these bonds to collect contractual cash flows. Required (a) Calculate the bond value and prepare the journal entry to show how the bond will be recorded by both Mulungushi and Bank of Zambia at the date of the bond issue. (10 marks) b) Prepare the journal entry to record the interest received by Mulungushi for 2018. (4 marks) c) Prepare any entries necessary at December 31, 2018, if the bonds are held for collection and trading, assuming the fair value of the bonds is K620, 000. (5 marks) ii) On January 1, 2018, Mulungushi purchased 10% bonds, having a maturity value (par value) of K600,000 from Bank of Zambia. The bonds provide Mulungushi with a 12% yield. They are dated January 1, 2018, and mature January 1, 2023, with interest receivable December 31 of each year. Mulungushi's business model is to hold these bonds to collect contractual cash flows. Required (a) Calculate the bond value and prepare the journal entry to show how the bond will be recorded by both Mulungushi and Bank of Zambia at the date of the bond issue. (10 marks) b) Prepare the journal entry to record the interest received by Mulungushi for 2018. (4 marks) c) Prepare any entries necessary at December 31, 2018, if the bonds are held for collection and trading, assuming the fair value of the bonds is K620, 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started