please answer all

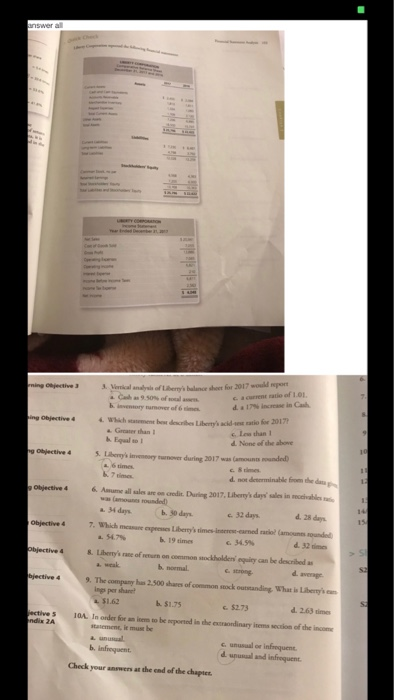

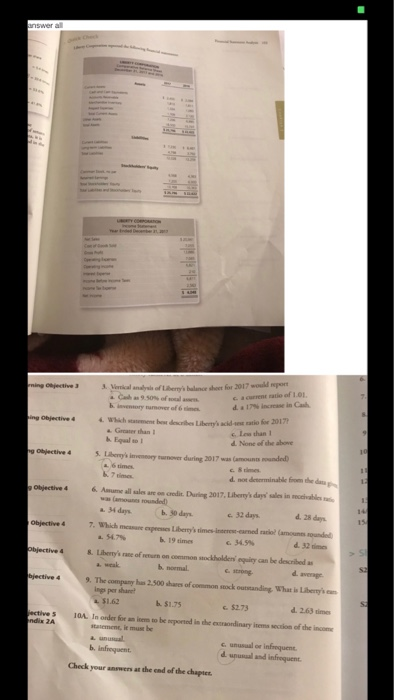

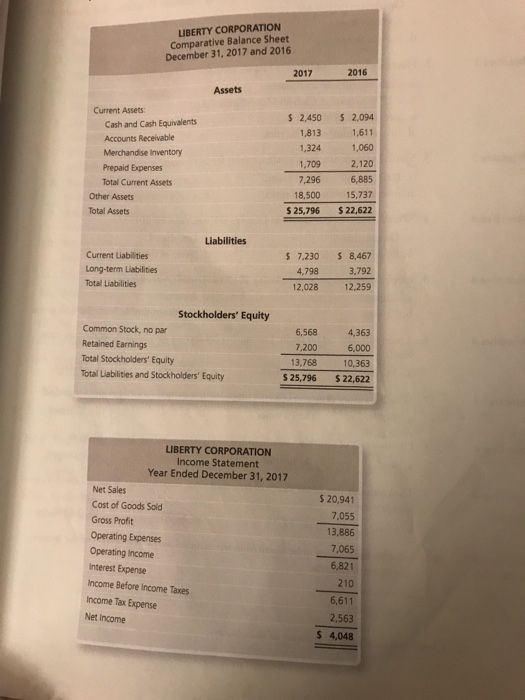

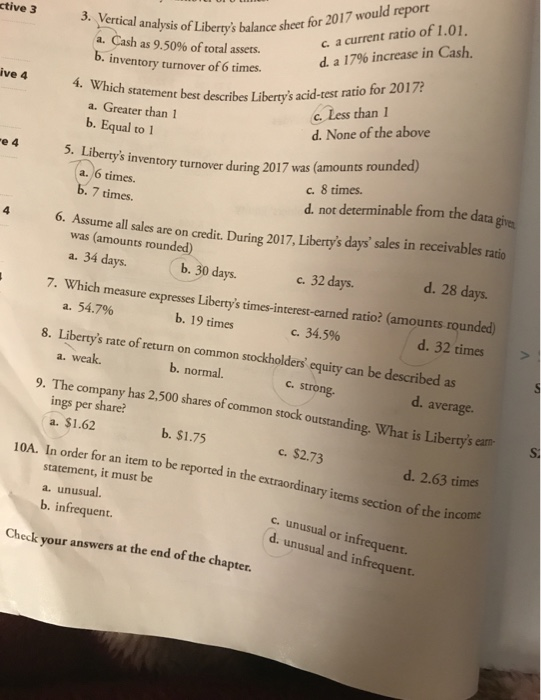

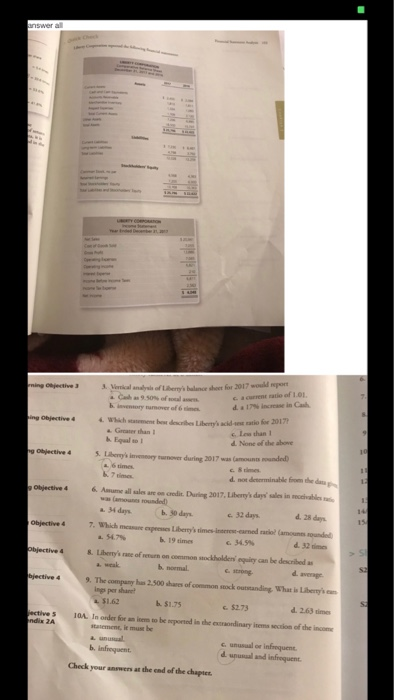

answer all bded Der 3. Vical andlysis of Lem bulenor hoet for 2017 would eport c1current ratio of 1.01 ds 17 % incease in Cah wming Ojective 31 a Ceb an 9 50% of oal ae b invensory namover of 6 tm 4 Which staemen bes describes Libem's acid-e ratio for 2017 Greater than & Equal so 1 ing Objective 4 len than 1 d. None of the above g Objective 4 5. Lbey's ivensory tunover during 2017 was (amounts ounded) a6 times 7 simes 11 times 4 sot deneminable from the dap 12 gObjective 4 6. Amume all sales are on credit. During 2017, Liberry's days sales in mcivables was (amounes rounded) 15 14 a 34 das b. 50 days d. 28 day c. 32 days 15 Objective 4 7. Which measre epeesses Lbem's times-inen-earned raciel (amouns unded 547% 19 times d. 32 me s 34.5% > S Objective 4 8. Liberty's rane of remurn on common sockholden equiy can be descibed a a, weak b normal 4weng Ctrong bjective 4 9. The company has 2.500 hares of common sock ountanding What i Libem's ings per sharet b $1.75 S1.62 $2.73 4. 263 dme jective s ndix 2A 10A In onder for an ism so be epoted in the exmoninary isems secion of the incom statemene, ie muse be a. unusual b infiequent c unusal or infequent d wual and infiquen Check your answers at the end of the chapter, UBERTY CORPORATION Comparative Balance Sheet December 31, 2017 and 2016 2016 2017 Assets Current Assets S 2.094 $ 2,450 Cash and Cash Equivalents 1,813 1,611 Accounts Receivable 1,324 1,060 Merchandise Inventory 1,709 2,120 Prepaid Expenses 6,885 7,296 Total Current Assets 15,737 18,500 Other Assets $ 22,622 Total Assets $ 25,796 Liabilities Current Liabilities $ 7.230 $ 8,467 Long-term Liabilities 3,792 4,798 Total Liabilities 12,028 12,259 Stockholders' Equity Common Stock, no par 6,568 4,363 Retained Earnings 7,200 6,000 Total Stockholders' Equity 13,768 10,363 Total Liabilities and Stockholders' Equity $ 25,796 $ 22,622 LIBERTY CORPORATION Income Statement Year Ended December 31, 2017 Net Sales $ 20,941 Cost of Goods Sold 7,055 Gross Profit 13,886 Operating Expenses 7,065 Operating Income Interest Expense 6,821 Income Before Income Taxes 210 Income Tax Expense 6,611 Net Income 2,563 S 4,048 3. Vertical analysis of Liberty's balance sheet for 2017 would report a. Cash as 9.50% of total assets c a current ratio of 1.01. d. a 17% increase in Cash ctive 3 4. Which statement best describes Liberty's acid-test ratio for 2017? C.Less than 1 d. None of the above b. inventory turnover of 6 times ive 4 Greater than 1 a. b. Equal to 1 e 4 5. Liberty's inventory turnover during 2017 was (amounts rounded) c. 8 times a. 6 times. b. 7 times. d. not determinable from the data give 6. Assume all sales are on credit. During 2017, Liberty's days' sales in receivables ratio was (amounts rounded) a. 34 days. d. 28 days b. 30 days 32 days C. 7. Which measure expresses Liberty's times-interest-earned ratio? (amounts rounded a. 54.7% b. 19 times c. 34.5% d. 32 times 8. Liberty's rate of return on common stockholders' equity can be described as a. weak. b. normal. c. strong d. average. 9. The company has 2,500 shares of common stock outstanding. What is Liberty's eat ings per share? earn- a. $1.62 b. $1.75 c. $2.73 d. 2.63 times 10A In order for an item to be reported in the extraordinary items section of the income statement, it must be a. unusual, unusual or infrequent. d. unusual and infrequent. b. infrequent C. Check your ansv the end of the chapter