Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all !!!! Answer each of the following questions as completely as possible. You must show your work for partial credit. 1. Waycross Corporation

Please answer all !!!!

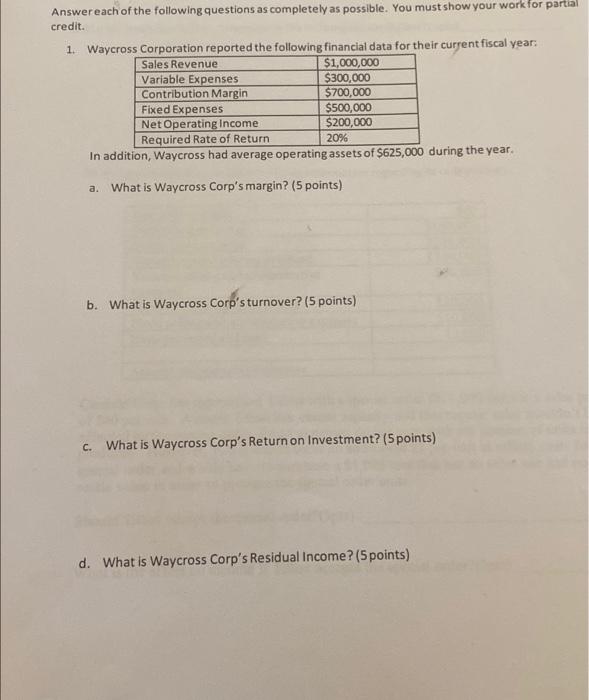

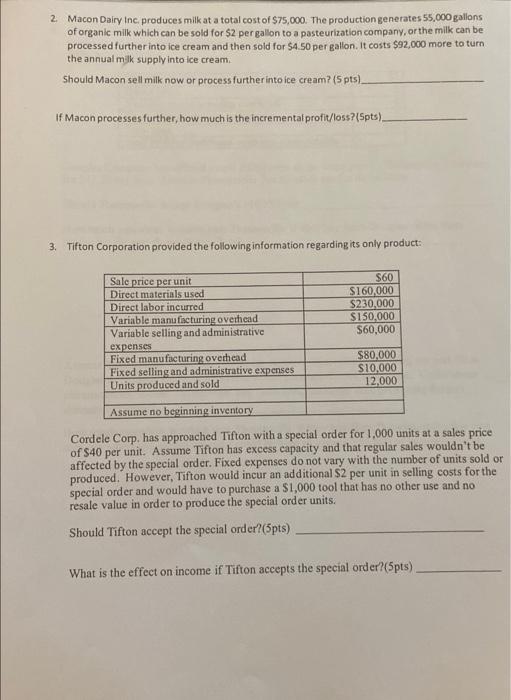

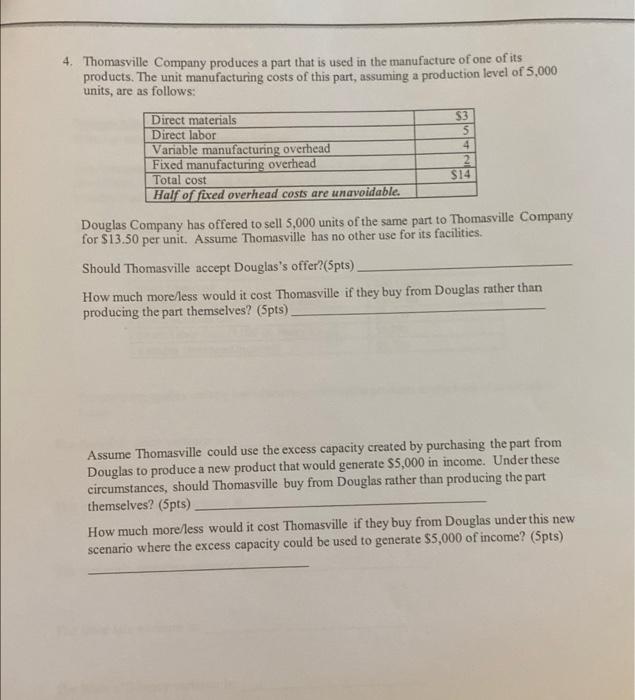

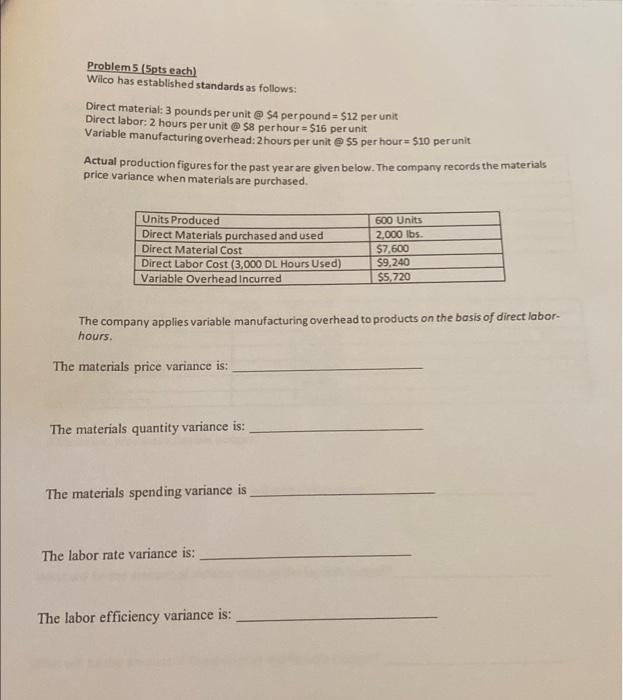

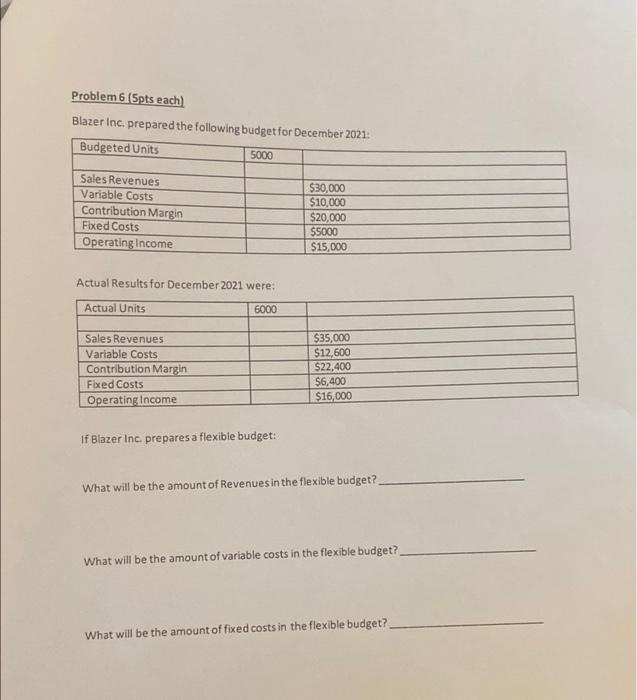

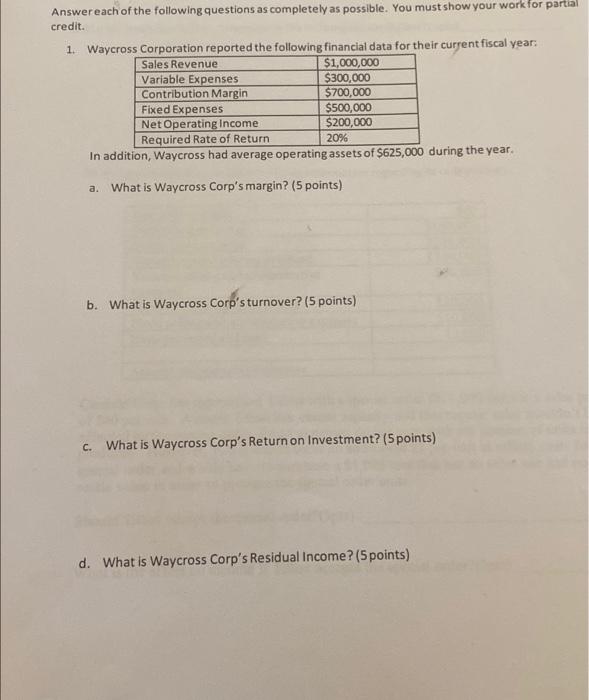

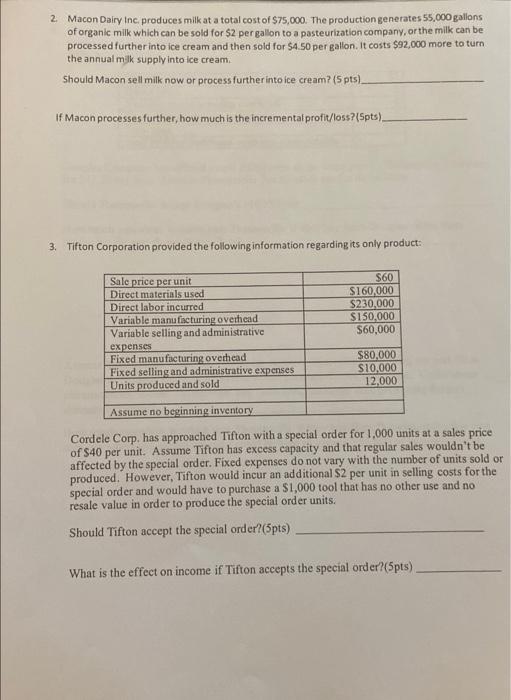

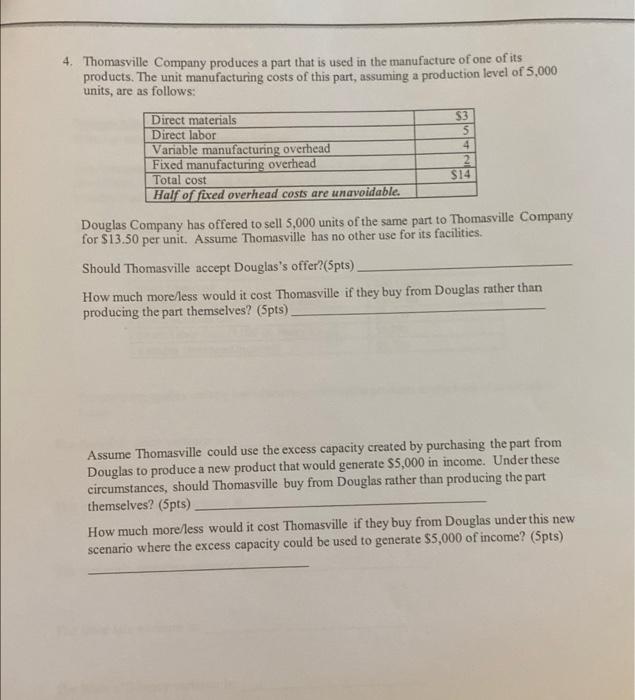

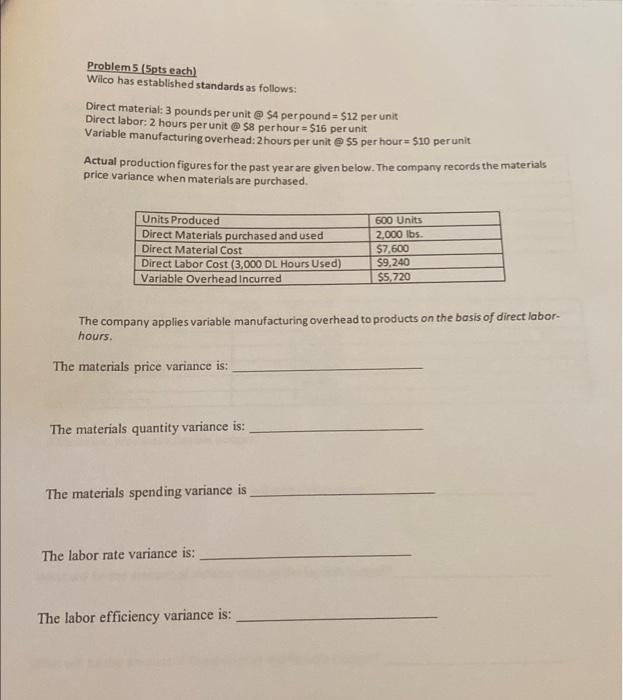

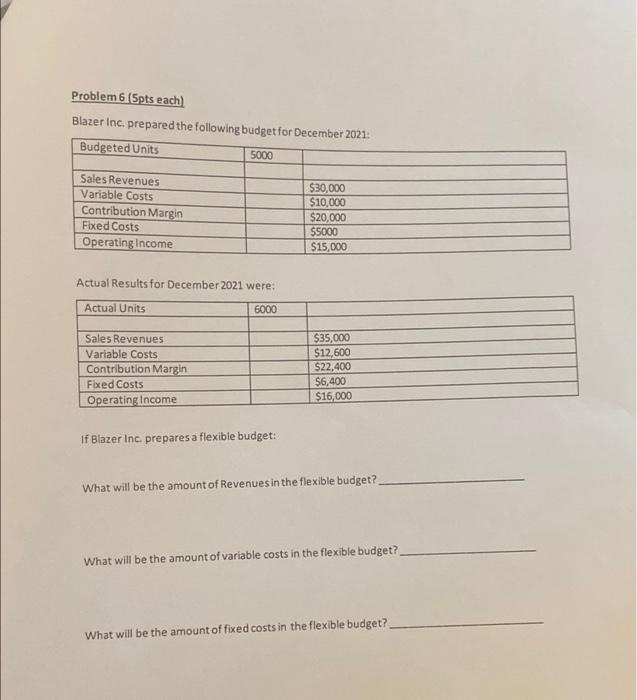

Answer each of the following questions as completely as possible. You must show your work for partial credit. 1. Waycross Corporation reported the following financial data for their current fiscal year: Sales Revenue $1,000,000 Variable Expenses $300,000 Contribution Margin $700,000 Fixed Expenses $500,000 Net Operating Income $200,000 Required Rate of Return 20% In addition, Waycross had average operating assets of $625,000 during the year. a. What is Waycross Corp's margin? (5 points) b. What is Waycross Corp's turnover? (5 points) C. What is Waycross Corp's Return on Investment? (5 points) d. What is Waycross Corp's Residual Income? (5 points) 2. Macon Dairy Inc. produces milk at a total cost of $75,000. The production generates 55,000 gallons of organic milk which can be sold for S2 per gallon to a pasteurization company, or the milk can be processed further into ice cream and then sold for $4.50 per gallon. It costs $92,000 more to turn the annual milk supply into ice cream Should Macon sell milk now or process further into ice cream? (5 pts). If Macon processes further, how much is the incremental profit/loss? (Spts) 3. Tifton Corporation provided the following information regarding its only product: Sale price per unit Direct materials used Direct labor incurred Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses Units produced and sold $60 $160,000 S230,000 $150,000 $60,000 $80,000 S10,000 12,000 Assume no beginning inventory Cordele Corp. has approached Tifton with a special order for 1,000 units at a sales price of $40 per unit. Assume Tifton has excess capacity and that regular sales wouldn't be affected by the special order. Fixed expenses do not vary with the number of units sold or produced. However, Tifton would incur an additional $2 per unit in selling costs for the special order and would have to purchase a $1,000 tool that has no other use and no resale value in order to produce the special order units. Should Tifton accept the special order?(5pts) What is the effect on income if Tifton accepts the special order?(5pts) 4. Thomasville Company produces a part that is used in the manufacture of one of its products. The unit manufacturing costs of this part, assuming a production level of 5.000 units, are as follows: Direct materials S3 Direct labor 5 Variable manufacturing overhead 4 Fixed manufacturing overhead 2. Total cost $14 Half of fixed overhead costs are unavoidable. Douglas Company has offered to sell 5,000 units of the same part to Thomasville Company for $13.50 per unit. Assume Thomasville has no other use for its facilities. Should Thomasville nccept Douglas's offer?(Spts) How much more/less would it cost Thomasville if they buy from Douglas rather than producing the part themselves? (5pts) Assume Thomasville could use the excess capacity created by purchasing the part from Douglas to produce a new product that would generate $5,000 in income. Under these circumstances, should Thomasville buy from Douglas rather than producing the part themselves? (5pts) How much more/less would it cost Thomasville if they buy from Douglas under this new scenario where the excess capacity could be used to generate $5,000 of income? (5pts) Problem 5 (5pts each) Wico has established standards as follows: Direct material: 3 pounds per unit @ SA per pound = $12 per unit Direct labor: 2 hours per unit @ S8 per hour = $15 perunit Variable manufacturing overhead: 2 hours per unit @ $5 per hour = $10 per unit Actual production figures for the past year are given below. The company records the materials price variance when materials are purchased Units Produced Direct Materials purchased and used Direct Material Cost Direct Labor Cost (3,000 DL Hours Used) Variable Overhead Incurred 600 Units 2,000 lbs. $7,600 $9,240 $5,720 The company applies variable manufacturing overhead to products on the basis of direct labor hours The materials price variance is: The materials quantity variance is: The materials spending variance is The labor rate variance is: The labor efficiency variance is: Problem 6 (5pts each) Blazer Inc. prepared the following budget for December 2021 Budgeted Units 5000 Sales Revenues Variable Costs Contribution Margin Fixed Costs Operating Income $30,000 $10,000 $20,000 $5000 $15,000 Actual Results for December 2021 were: Actual Units 6000 Sales Revenues Variable Costs Contribution Margin Fixed Costs Operating Income $35,000 $12,600 $22,400 $6,400 $16,000 If Blazer Inc. prepares a flexible budget: What will be the amount of Revenues in the flexible budget? What will be the amount of variable costs in the flexible budget? What will be the amount of fixed costs in the flexible budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started