Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all as no monthly questions remain! Thumbs up! Consider a stock that that has just paid a dividend of S1,57. The dividend is

Please answer all as no monthly questions remain! Thumbs up!

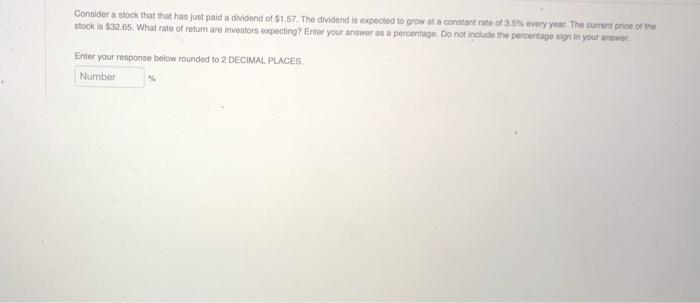

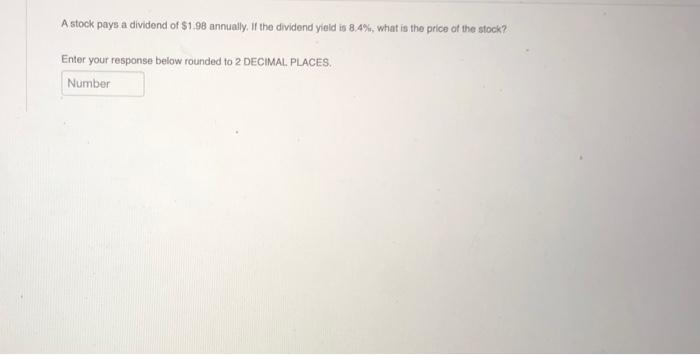

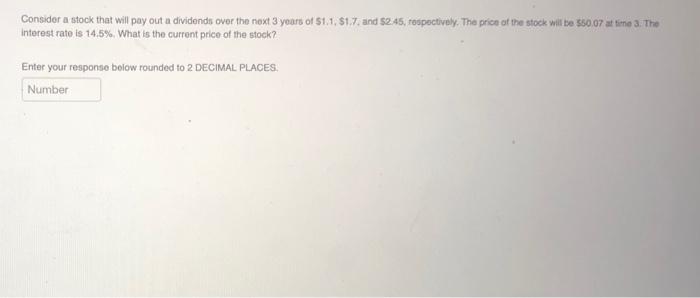

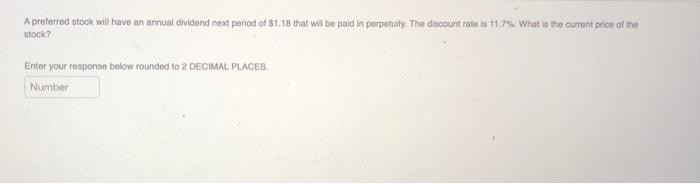

Consider a stock that that has just paid a dividend of S1,57. The dividend is expected to grow at a constant este of 3.5% every ynat. The current price of the stock is $32.86. What rate of return aro investors expecting? Enter your answer as a percentage. Do not include the percentage sign in your answet Enter your response below rounded to 2 DECIMAL PLACES Number A stock pays a dividend of $1.98 annually. If the dividend yield is 8.4%, what is the price of the stock? Enter your response below rounded to 2 DECIMAL PLACES Number Consider a stock that will pay out a dividends over the next 3 years of S1.1,$1.7 and $2.45, respectively. The price of the stock will be $50.07 at times. The Interest rate is 14,5%. What is the current price of the stock? Enter your response below rounded to 2 DECIMAL PLACES Number A preferred stock will have an annual dividend next period of $1.18 that will be paid in perpetuity. The discount rate is 11.7%. What is the current pros of the stock? Enter your response below rounded to 2 DECIMAL PLACES Number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started