Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all as soon as possible . Question Shamrock Ltd. issued $697,400 of 15-year, 7.5% bonds on January 1, 2018, when the market interest

please answer all as soon as possible .

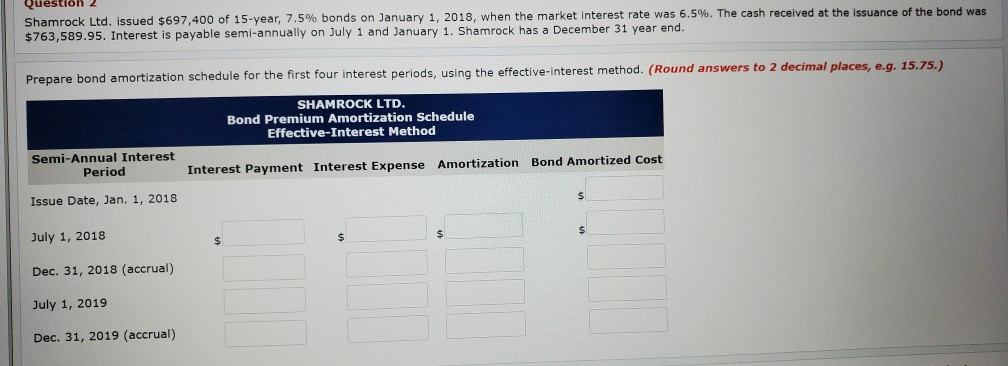

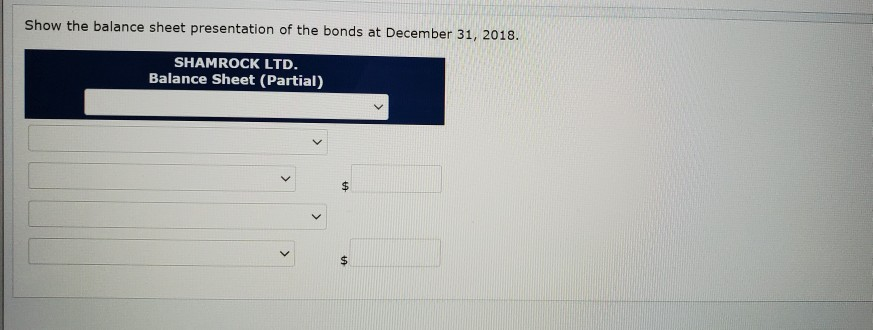

Question Shamrock Ltd. issued $697,400 of 15-year, 7.5% bonds on January 1, 2018, when the market interest rate was 6.5%. The cash received at the issuance of the bond was $763,589.95. Interest is payable semi-annually on July 1 and January 1. Shamrock has a December 31 year end. Prepare bond amortization schedule for the first four interest periods, using the effective interest method. (Round answers to 2 decimal places, e.g. 15.75.) SHAMROCK LTD. Bond Premium Amortization Schedule Effective-Interest Method Semi-Annual Interest Period Interest Payment Interest Expense Amortization Bond Amortized Cost Issue Date, Jan. 1, 2018 $ $ July 1, 2018 $ Dec. 31, 2018 (accrual) July 1, 2019 Dec. 31, 2019 (accrual) Show the balance sheet presentation of the bonds at December 31, 2018. SHAMROCK LTD. Balance Sheet (Partial) $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started