Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all as they are straight to the point, i will rate but i need them asap A factory manager is considering the purchase

please answer all as they are straight to the point, i will rate but i need them asap

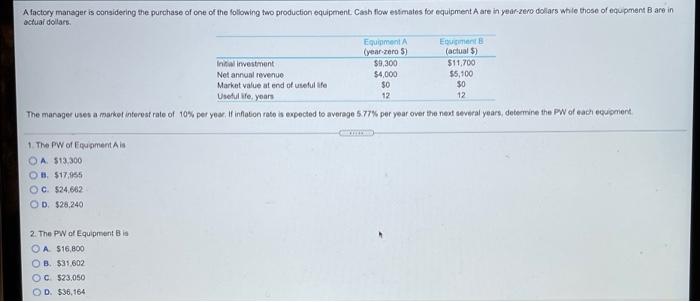

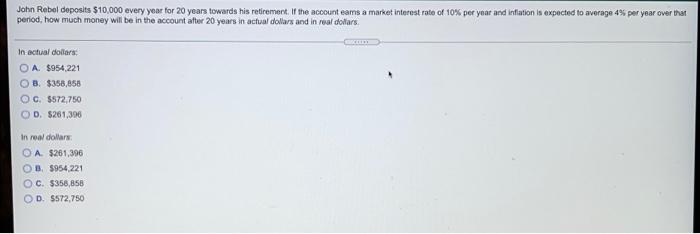

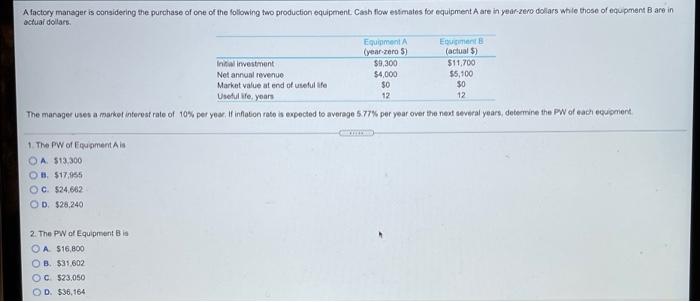

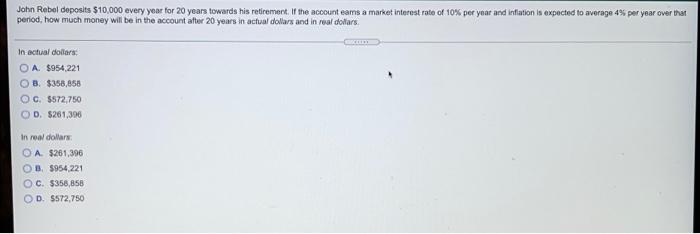

A factory manager is considering the purchase of one of the following two production equipment Cash flow estimates for equipment are in year-zero dollars while those of equipment Bane in actual dollars Equipment Enument Cyear-zero 5) (actual) Inicial Investment $9,300 $11,700 Net annual revenue $4,000 55,100 Market value at end of useful $0 $0 Useful life years 12 12 The manager was a market interest rate of 10% per year. If infoton roto is expected to average 5.77% per year over the next several years, determine the PW of each content 1. The PW of Equipments O A $13.300 O $17,955 OC 524,662 OD $28.240 2. The PW of Equipment Bis A $16,800 OB $31.602 OG 523,050 OD. $36,164 John Rebel deposits $10,000 every year for 20 years towards his retirement. If the account eams a market interest rate of 10% per year and inflation is expected to average 41% per year over that period, how much money will be in the account after 20 years in actual dollars and in real dollars In actual doilers: O A $954 221 B. $358,856 OG $S72,750 OD. $261,390 In real dollar O A $261,396 OB $954.221 OC. $358,858 OD 5572,750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started