Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all :( At times firms will need to decide if they want to continue to use their current equipment or replace the equipment

please answer all

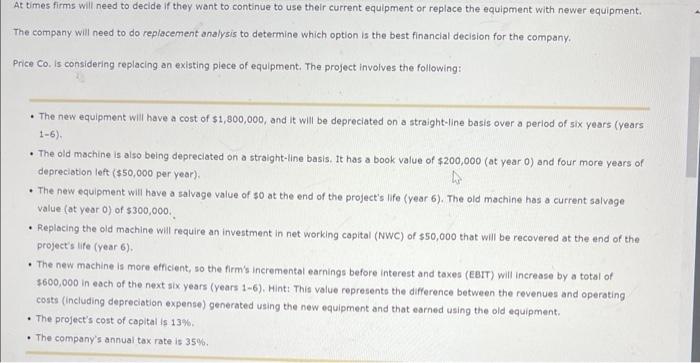

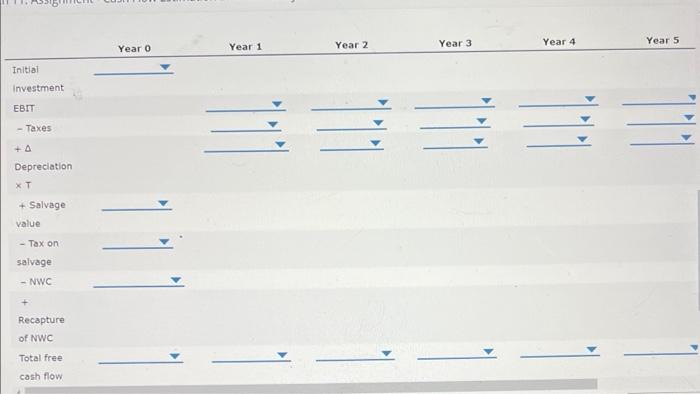

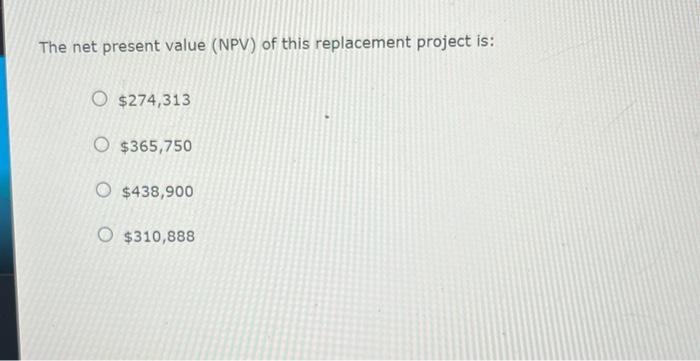

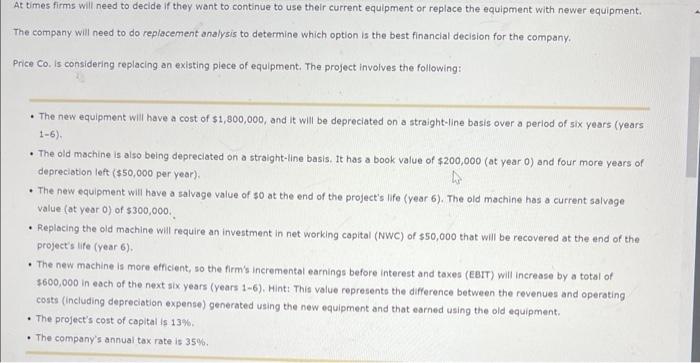

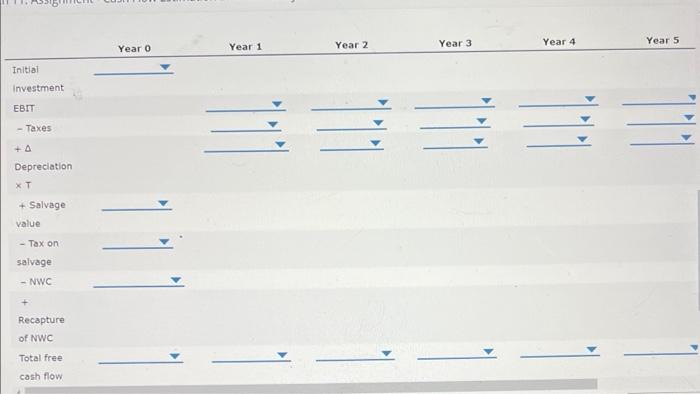

At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. Is considering replacing an existing plece of equipment. The project involves the following: - The new equipment will have a cost of $1,300,000, and it will be depreciated on a straight-line basis over a period of six years (years 16) - The old machine is also being depreciated on a straight-line basis, tt has a book value of $200,000 (at year 0 ) and four more years of depreciation left ( $50,000 per year). - The new equipment will have a salvage value of 50 at the end of the project's life (year 6 ). The old machine has a current salvage value (at year 0 ) of $300,000. - Replacing the old machine will require an investment in net working copital (NWC) of $50,000 that will be recovered at the end of the project's ufe (year 6 ). - The new machine is more efficient, so the firm's incremental earnings before interest and taxes (EBIT) will increase by a total of 3600,000 in each of the next six years (years 1-6). Hint: This value represente the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that earned using the old equipment. - The project's cost of copital is 13%. - The company's annual tax rate is 35%. The net present value (NPV) of this replacement project is: $274,313 $365,750 $438,900 $310,888 :(

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started