Answered step by step

Verified Expert Solution

Question

1 Approved Answer

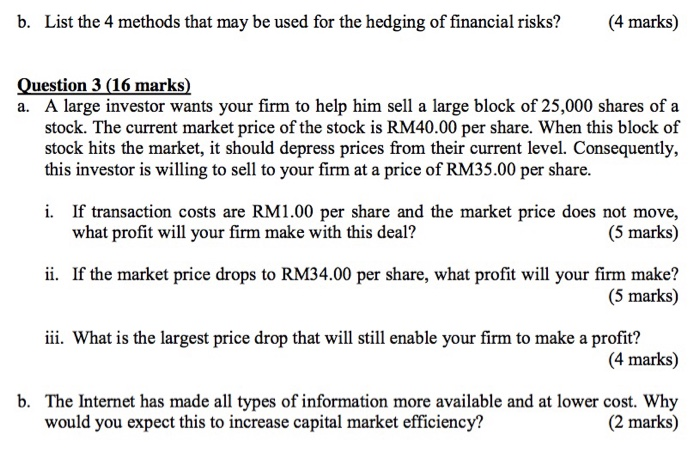

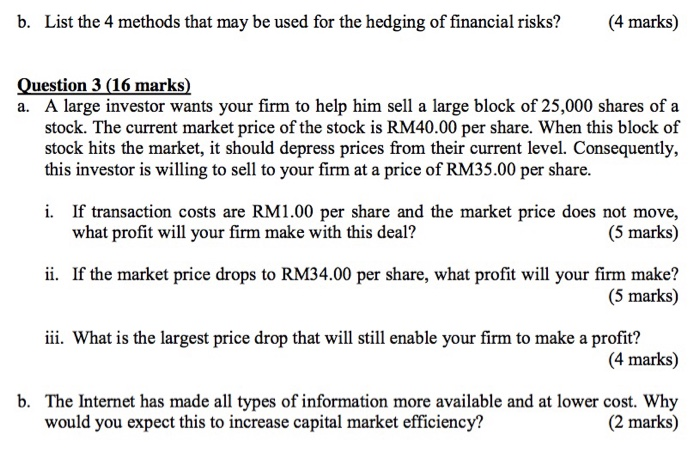

please answer all... b. List the 4 methods that may be used for the hedging of financial risks? (4 marks) Question 3 (16 marks) a.

please answer all...

b. List the 4 methods that may be used for the hedging of financial risks? (4 marks) Question 3 (16 marks) a. A large investor wants your firm to help him sell a large block of 25,000 shares of a stock. The current market price of the stock is RM40.00 per share. When this block of stock hits the market, it should depress prices from their current level. Consequently, this investor is willing to sell to your firm at a price of RM35.00 per share. i. If transaction costs are RM1.00 per share and the market price does not move, what profit will your firm make with this deal? (5 marks) ii. If the market price drops to RM34.00 per share, what profit will your firm make? (5 marks) iii. What is the largest price drop that will still enable your firm to make a profit? (4 marks) b. The Internet has made all types of information more available and at lower cost. Why would you expect this to increase capital market efficiency? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started