please answer all

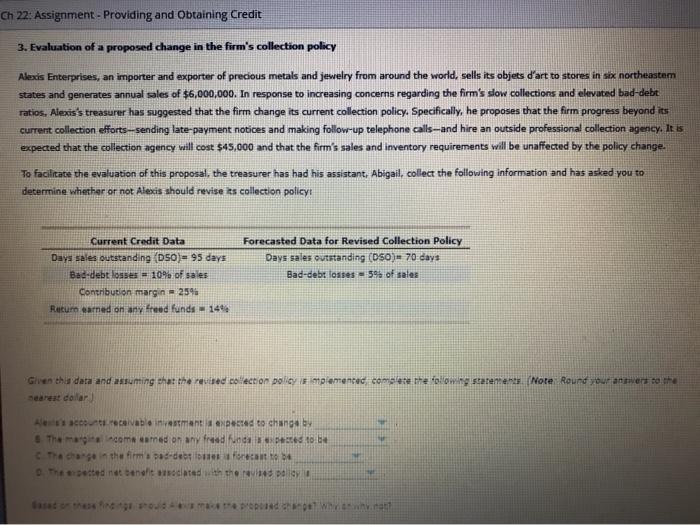

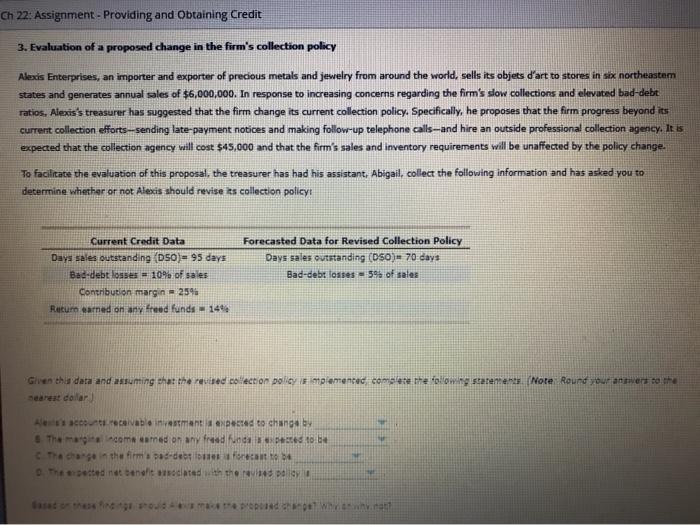

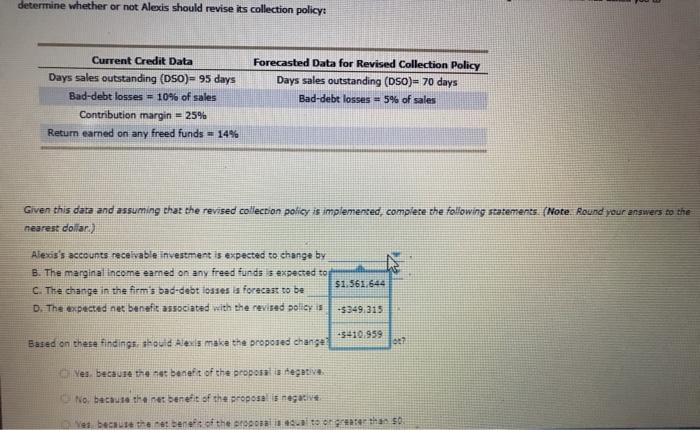

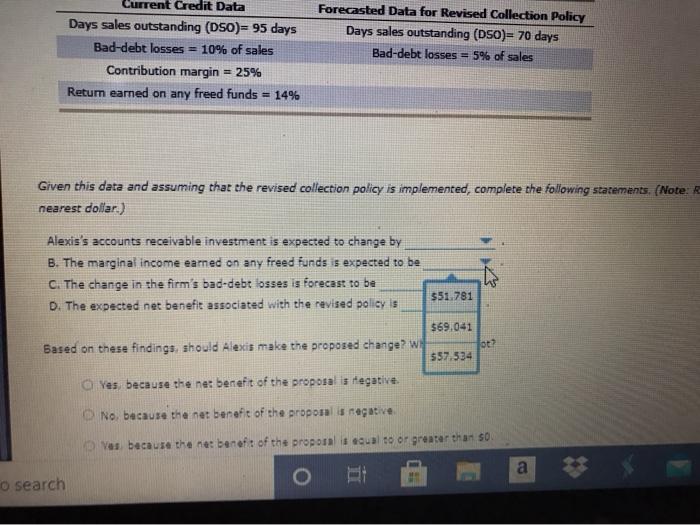

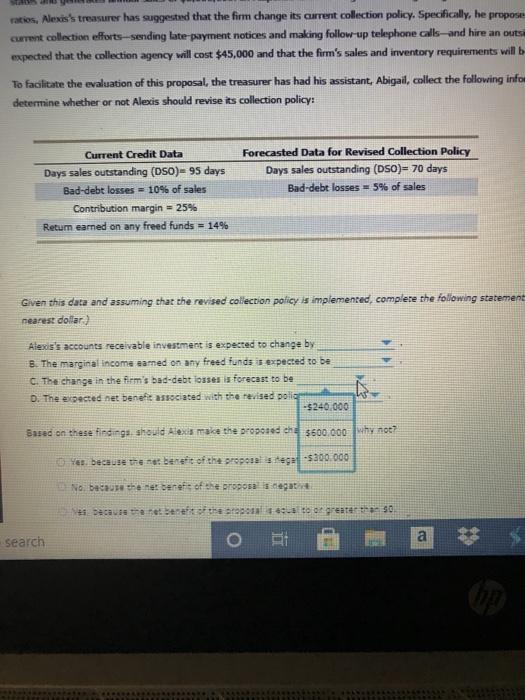

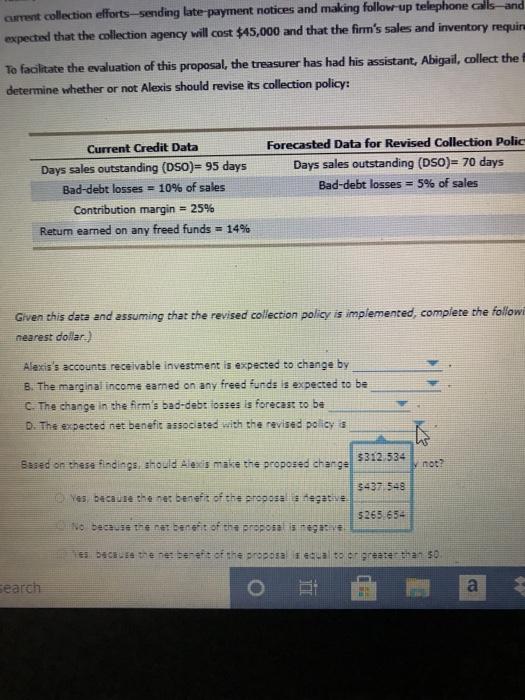

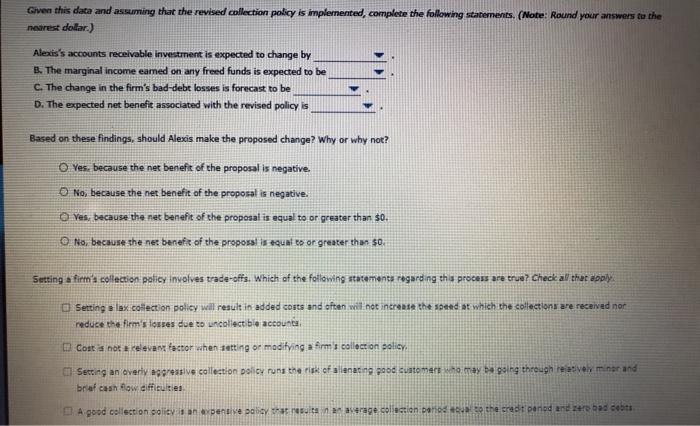

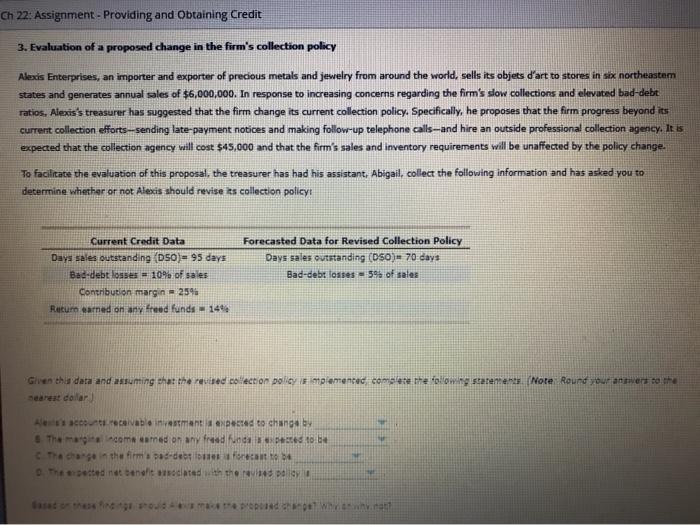

Ch 22: Assignment - Providing and obtaining Credit 3. Evaluation of a proposed change in the firm's collection policy Alexis Enterprises, an importer and exporter of precious metals and jewelry from around the world, sells its objets d'art to stores in sex northeastem states and generates annual sales of $6,000,000. In response to increasing concerns regarding the firm's slow collections and elevated bad-debt ratios, Alexis's treasurer has suggested that the firm change its current collection policy. Specifically, he proposes that the firm progress beyond its current collection efforts-sending late-payment notices and making follow-up telephone calls-and hire an outside professional collection agency. It is expected that the collection agency will cost $45,000 and that the firm's sales and inventory requirements will be unaffected by the policy change. To facilitate the evaluation of this proposal, the treasurer has had his assistant, Abigail, collect the following information and has asked you to determine whether or not Alexis should revise is collection policy Current Credit Data Days sales outstanding (D50)= 95 days Bed debt losses = 10% of sales Contribution margin = 259 Return earned on any freed funds 149 Forecasted Data for Revised Collection Policy Days sales outstanding (050)- 70 days Bad-debt losses - 595 of sales Given the data and assuming that the revised collection policy implemente complete the following statement Note Round your answer to the nearest dollar Actrecevable invatamant put to change by The magicomeamed on any freed funds to the change in the firm's bad debt une forte The peted net benefit onclated with the play determine whether or not Alexis should revise its collection policy: Current Credit Data Days sales outstanding (DSO)- 95 days Bad-debt losses = 10% of sales Contribution margin = 25% Return earned on any freed funds 14% Forecasted Data for Revised Collection Policy Days sales outstanding (DSO)= 70 days Bad-debt losses = 5% of sales Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note. Round your answers to the nearest dollar) Alexis's accounts receivable investment is expected to change by B. The marginal income earned on any freed funds : expected to C. The change in the firm's bad-debt losses is forecast to be D. The expected net benefit associated with the revised policy $1.561 644 +5349 315 *3410959 Based on these findings should Alex's make the proposed changes 1 Yes, because the net benefit of the proposa negative No because the net benefit of the proposal negative Ve because the benefit of the proposal to neater than 50 Current Credit Data Days sales outstanding (DSO)= 95 days Bad-debt losses = 10% of sales Contribution margin = 25% Return earned on any freed funds = 14% Forecasted Data for Revised Collection Policy Days sales outstanding (DSO)= 70 days Bad-debt losses = 5% of sales Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note: nearest dollar) Alexis's accounts receivable investment is expected to change by B. The marginal income earned on any freed funds is expected to be C. The change in the firm's bad-debt losses is forecast to be $51.781 D. The expected net benefit associated with the revised policy is 569.041 Based on these findings, should Alexis make the proposed change? W $57.534 Yes because the ne: benefit of the proposal is negative. lot? No, because the net benefit of the proposal is negative Yes because the ne: benefit of the proposal cual to or greater than 50 a o search ratios, Alexis's treasurer has suggested that the firm change its current collection policy. Specifically, he propose current collection efforts-sending late payment notices and making follow-up telephone calls and hire an outs expected that the collection agency will cost $45,000 and that the firm's sales and inventory requirements will b To facilitate the evaluation of this proposal, the treasurer has had his assistant, Abigail, collect the following info determine whether or not Alexis should revise its collection policy: Current Credit Data Days sales outstanding (DSO)= 95 days Bad-debt losses = 10% of sales Contribution margin = 25% Retur earned on any freed funds = 14% Forecasted Data for Revised Collection Policy Days sales outstanding (DSO)= 70 days Bad-debt losses 5% of sales Given this data and assuming that the revised collection policy is implemented, complere the following statement nearest dollar) Alexis's accounts receivable investment is expected to change by 8. The marginal income eamed on any freed funds is expected to be C. The change in the firm's bad-debt losses is forecast to be D. The expected net benefit associated with the revised polig -$240.000 Based on these findings should Alexis make the proposed the $600,000 why not? Yes, because these benefit of the proposals negal -$300.000 No because the heroene of the proposegat because there benefit of the toto or greater SO Search carent collection efforts-sending late payment notices and making follow-up telephone calls and expected that the collection agency will cost $45,000 and that the firm's sales and inventory require To facilitate the evaluation of this proposal, the treasurer has had his assistant, Abigail, collect the determine whether or not Alexis should revise its collection policy: Current Credit Data Days sales outstanding (DSO)= 95 days Bad-debt losses = 10% of sales Contribution margin = 25% Return earned on any freed funds = 14% Forecasted Data for Revised Collection Polic Days sales outstanding (DSO)= 70 days Bad-debt losses = 5% of sales Given this data and assuming that the revised collection policy is implemented, complete the follow nearest dollar) Alexis's accounts receivable investment is expected to change by B. The marginal income eamed on any freed funds is expected to be C. The change in the firm's bad-debt tosses is forecast to be D. The expected net benefit associated with the revised policy 3312 534 Based on these findings should leis make the proposed change 3437 548 Yes because the ner benefit of the proposaregate $265.654 No because the nat benefit of the Proposal is negative 13 DESET the neberert of the proposals ecuato er greater than 50 search a Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note: Round your answers to the nearest dolar.) Alexis's accounts receivable investment is expected to change by B. The marginal income eared on any freed funds is expected to be C. The change in the firm's bad-debt losses is forecast to be D. The expected net benefit associated with the revised policy is Based on these findings, should Alexis make the proposed change? Why or why not? Yes, because the net benefit of the proposal is negative. O No, because the net benefit of the proposal is negative. O ves, because the net benefit of the proposal is equal to or greater than $0. No, because she net benefit of the proposal is equal to or greater than $0. Setting a firm's collection policy involves trade-offs. Which of the following statements regarding this process are true? Checic all that apply Serting e lex collection policy will result in added costs and often will not increase the speed at which the collections are received nor reduce the firm's losses due to uncollectible account Costa not relevant factor when setting or modifying a firm collection policy Setting an overly aggressive collection policy runs the risk of alienating pood customer may going through reasveminer and brief cash flow difficulties A good collection policy an pentive policy that resulterage collection panies to the creat pened and are basebe