Answered step by step

Verified Expert Solution

Question

1 Approved Answer

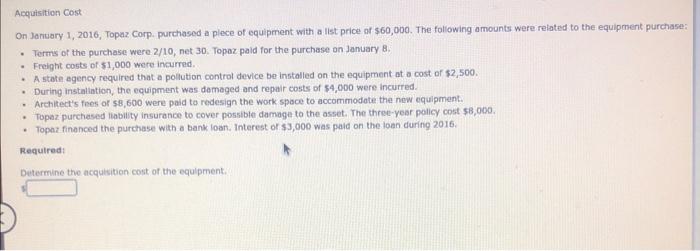

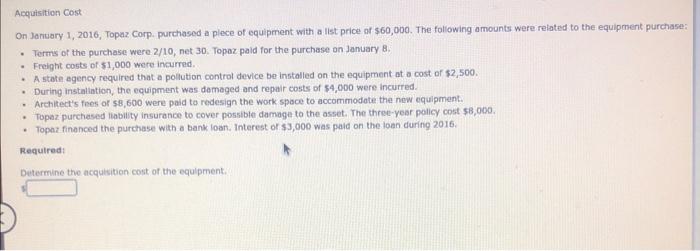

please answer all for like question 1. question 2. question 3. On Jaritary 1, 2016, Topaz Corp. purchased a plece of equipment with a llst

please answer all for like

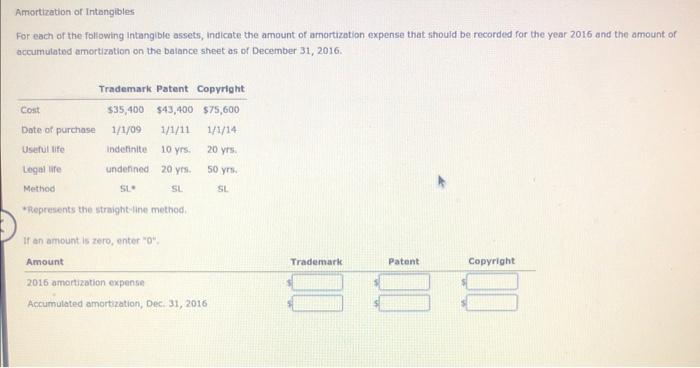

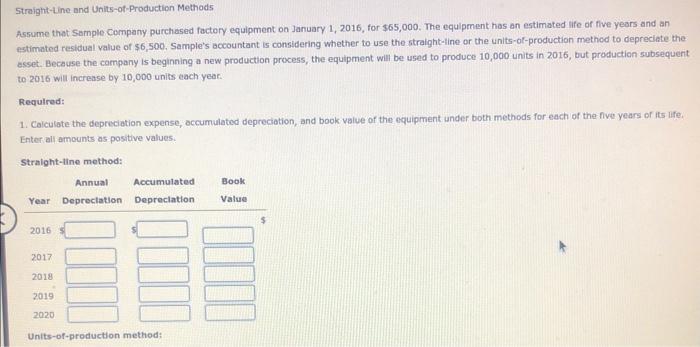

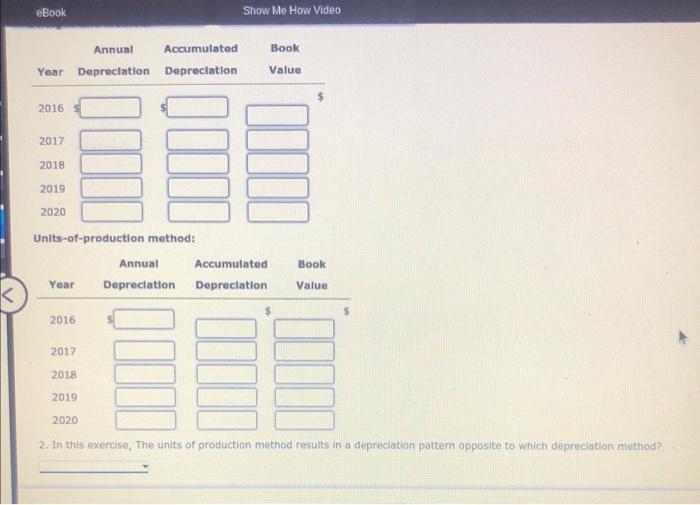

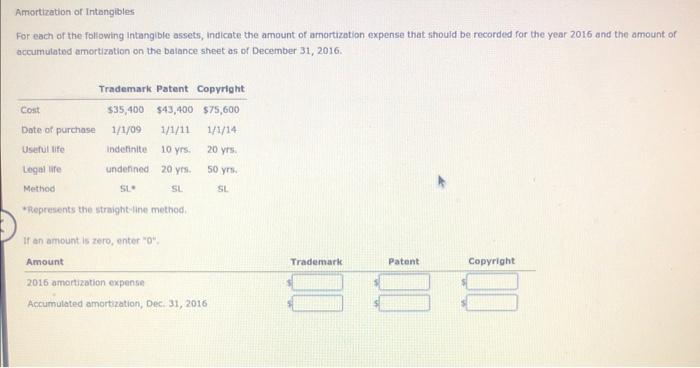

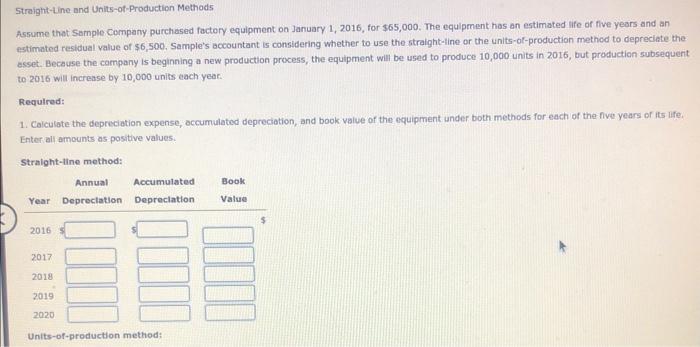

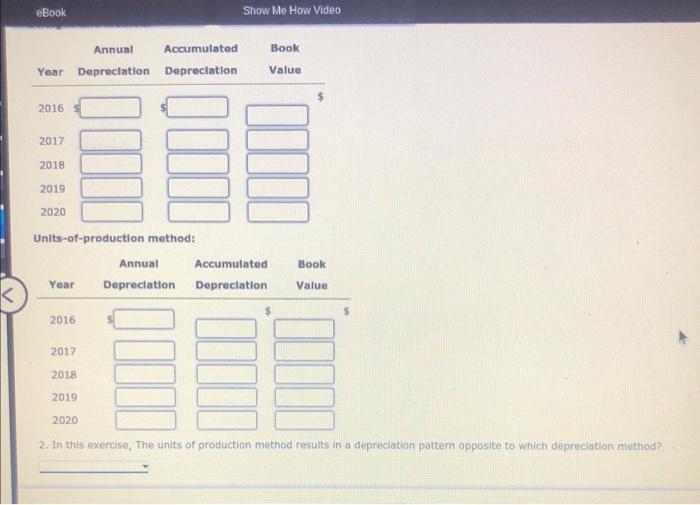

On Jaritary 1, 2016, Topaz Corp. purchased a plece of equipment with a llst price of $60,000. The foliowing amounts were reiated to the equipment purchase: - Terms of the purchase were 2/10, net 30. Topaz paid for the purchase on lanuary 8. - Freight costs of 51,000 were incurred. - A state egency required that a pollution control device be installed on the equipment at a cost of $7,500. - During instaliation, the equipment was demaged and repair costs of 54,000 were incurred. - Architect's foes of $8,600 were paid ta redesign the work spoce to accommodote the new equipment. - Topaz purchesed liability insurance to cover possible damage to the asset. The three-year pollcy cost 58,000. - Topaz financed the purchase with a bank loan. interest of $3,000 was pald on the loan during 2016. Required: Determine the acquisition cost of the equlpment. Amortization of Intangibles For each of the following intangible assets; indicate the amount of arnortizotion expense that fitiould be recorded for the year 2016 and the amount of accumulatod emortization on the balance sheet as of December 31,2016. * Represents the straight-ine method. If an ambunt is zero, enter " 0" Straight-Line and Units-ot-Production Methods Assume that Sample company purchased factory equipment on January 1,2016 , for $65,000. The equipment has an estimated life of five years and an estimated residual value of $6,500. Sample's accountant is considering whether to use the straight-ine or the units-of-production method to depreciate the esset. Because the campany is beginning a new production process, the equipment will be used to produce 10,000 units in 2016, but production subsequent to 2016 will increase by 10,000 units each year. Required: 1. Calculate the depreciation expense, occumulated depreciation, and book value of the equipment under both methods for each of the five years of its life. Enter all amounts as positive values:. Units-of-production method: 2. In this exercise, The units of production method results in a depreciation pattern opposite to which depreciation method question 1.

question 2.

question 3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started