Answered step by step

Verified Expert Solution

Question

1 Approved Answer

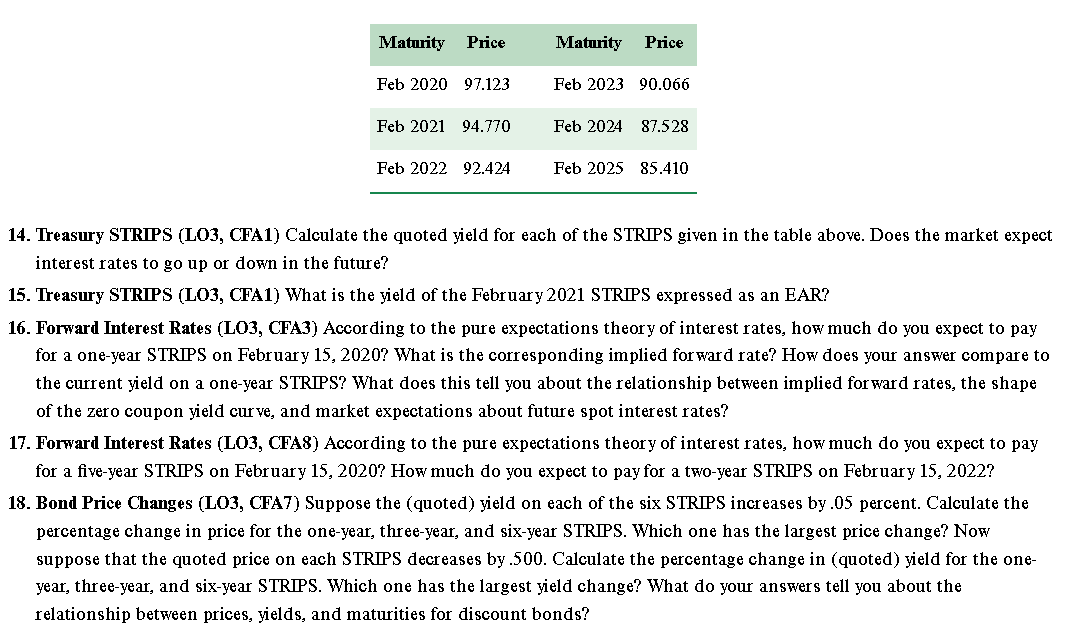

Please answer all for thumbs up Maturity Price Maturity Price Feb 2020 97.123 Feb 2023 90.066 Feb 2021 94.770 Feb 2024 87.528 Feb 2022 92.424

Please answer all for thumbs up

Maturity Price Maturity Price Feb 2020 97.123 Feb 2023 90.066 Feb 2021 94.770 Feb 2024 87.528 Feb 2022 92.424 Feb 2025 85.410 14. Treasury STRIPS (LO3, CFA1) Calculate the quoted yield for each of the STRIPS given in the table above. Does the market expect interest rates to go up or down in the future? 15. Treasury STRIPS (LO3, CFA1) What is the yield of the February 2021 STRIPS expressed as an EAR? 16. Forward Interest Rates (LO3, CFA3) According to the pure expectations theory of interest rates, how much do you expect to pay for a one-year STRIPS on February 15, 2020? What is the corresponding implied forward rate? How does your answer compare to the current yield on a one-year STRIPS? What does this tell you about the relationship between implied forward rates, the shape of the zero coupon yield curve, and market expectations about future spot interest rates? 17. Forward Interest Rates (LO3, CFA8) According to the pure expectations theory of interest rates, how much do you expect to pay for a five-year STRIPS on February 15, 2020? How much do you expect to pay for a two-year STRIPS on February 15, 2022? 18. Bond Price Changes (LO3, CFA7) Suppose the (quoted) yield on each of the six STRIPS increases by.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. Which one has the largest price change? Now suppose that the quoted price on each STRIPS decreases by.500. Calculate the percentage change in (quoted) yield for the one- year, three-year, and six-year STRIPS. Which one has the largest yield change? What do your answers tell you about the relationship between prices, yields, and maturities for discount bonds? Maturity Price Maturity Price Feb 2020 97.123 Feb 2023 90.066 Feb 2021 94.770 Feb 2024 87.528 Feb 2022 92.424 Feb 2025 85.410 14. Treasury STRIPS (LO3, CFA1) Calculate the quoted yield for each of the STRIPS given in the table above. Does the market expect interest rates to go up or down in the future? 15. Treasury STRIPS (LO3, CFA1) What is the yield of the February 2021 STRIPS expressed as an EAR? 16. Forward Interest Rates (LO3, CFA3) According to the pure expectations theory of interest rates, how much do you expect to pay for a one-year STRIPS on February 15, 2020? What is the corresponding implied forward rate? How does your answer compare to the current yield on a one-year STRIPS? What does this tell you about the relationship between implied forward rates, the shape of the zero coupon yield curve, and market expectations about future spot interest rates? 17. Forward Interest Rates (LO3, CFA8) According to the pure expectations theory of interest rates, how much do you expect to pay for a five-year STRIPS on February 15, 2020? How much do you expect to pay for a two-year STRIPS on February 15, 2022? 18. Bond Price Changes (LO3, CFA7) Suppose the (quoted) yield on each of the six STRIPS increases by.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. Which one has the largest price change? Now suppose that the quoted price on each STRIPS decreases by.500. Calculate the percentage change in (quoted) yield for the one- year, three-year, and six-year STRIPS. Which one has the largest yield change? What do your answers tell you about the relationship between prices, yields, and maturities for discount bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started