Answered step by step

Verified Expert Solution

Question

1 Approved Answer

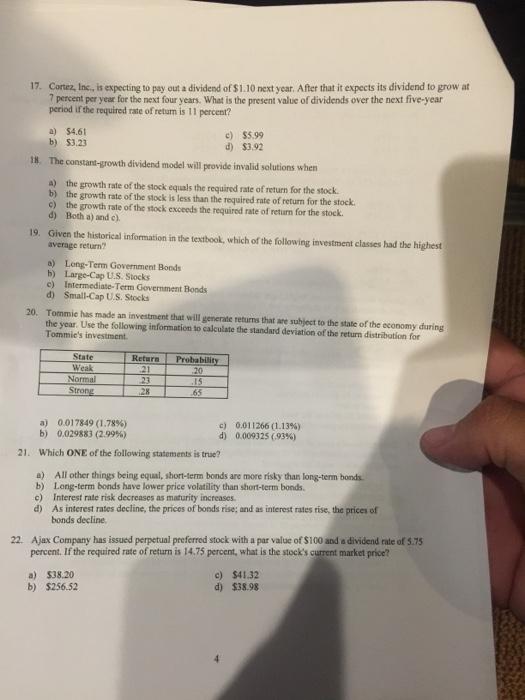

please answer all, help me !! 17. Cortez, Inc, is expecting to pay out a dividend of $1.10 next year. After that it expects its

please answer all, help me !!

17. Cortez, Inc, is expecting to pay out a dividend of $1.10 next year. After that it expects its dividend to grow at 7 percent per year for the next four years. What is the present value of dividends over the next five-year period if the required rate of return is 11 percent? a) $4.61 b) S3.23 c) $5.99 d) $3.92 18. The constant-growth dividend model will provide invalid solutions when a) the growth rate of the stock equals the required rate of return for the stock b) the growth rate of the stock is less than the required rate of return for the stock c) the growth rate of the stock exceeds the required rate of return for the stock d) Both a) and c). 19. Given the historical information in the textbook, which of the following investment classes had the highest average return? Long-Term Government Bonds b) a) Large-Cap U.S. Siocks Intermediate-Term Government Bonds c) d) Small-Cap U.S. Stocks Tommie has made an investment that will generate returns that are subject to the state of the economy during the year. Use the following information to calculate the standard deviation of the return distribution for 20. Tommie's investment State Weak Normal Return Probability 20 23 28 65 0017849 (1.78%) b) c) d) 0.01 1266 (1.13%) 0.0093 25(93%) a) 0029883 (2.99%) 21. Which ONE of the following statements is true? Long-term bonds have lower price volatility than short-term bonds. c) All other things being equal, short-term bonds are more risky than long-term bonds. a) b) Interest rate risk decreases as maturity increases. d) As interest rates decline, the prices of bonds rise; and as interest rates rise, the prices of bonds decline. Ajax Company has issued perpetual preferred stock with a par value of $100 and a dividend rate of 5.75 percent. If the required rate of return is 14.75 percent, what is the stock's current market price? 22. a) $38.20 b) $256.52 c) $41.32 d) $38.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started