Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all. I will give an upvote. Thank you. Prepare balance sheet and income statement Prepare the reversing entries to be recorded in the

Please answer all. I will give an upvote. Thank you.

Prepare balance sheet and income statement

Prepare the reversing entries to be recorded in the next accounting period

Post the entries to the ledger using T-accounts

(Note: Do not submit pic/image so I can easily copy paste.)

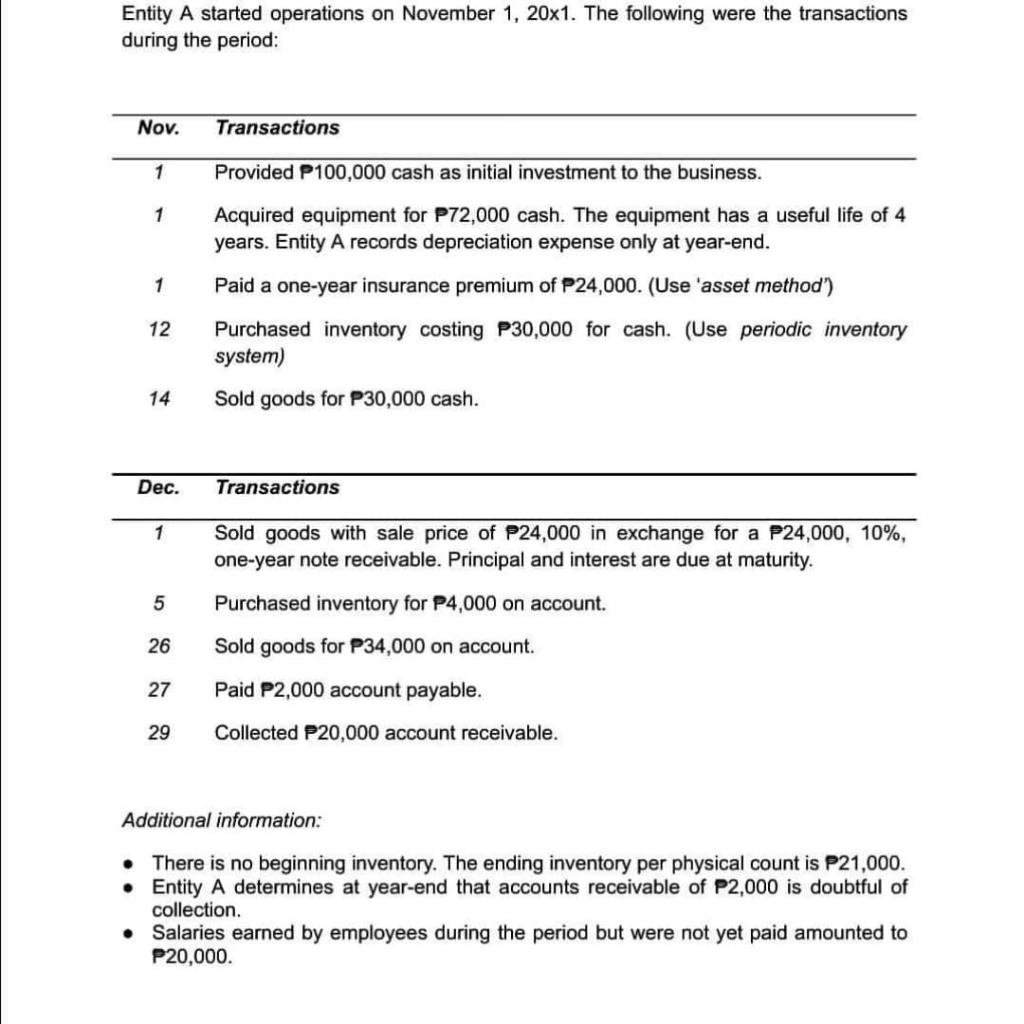

Entity A started operations on November 1, 20x1. The following were the transactions during the period: Nov. Transactions 1 Provided P100,000 cash as initial investment to the business. 1 1 Acquired equipment for P72,000 cash. The equipment has a useful life of 4 years. Entity A records depreciation expense only at year-end. Paid a one-year insurance premium of P24,000. (Use 'asset method') Purchased inventory costing P30,000 for cash. (Use periodic inventory system) 12 14 Sold goods for P30,000 cash. Dec. Transactions 1 Sold goods with sale price of P24,000 in exchange for a P24,000, 10%, one-year note receivable. Principal and interest are due at maturity. 5 Purchased inventory for P4,000 on account. 26 Sold goods for P34,000 on account. 27 Paid P2,000 account payable. 29 Collected P20,000 account receivable. Additional information: There is no beginning inventory. The ending inventory per physical count is P21,000. Entity A determines at year-end that accounts receivable of P2,000 is doubtful of collection. Salaries earned by employees during the period but were not yet paid amounted to P20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started