Please answer all. I will rate, thanks

Please answer correctly. I will rate, thanks

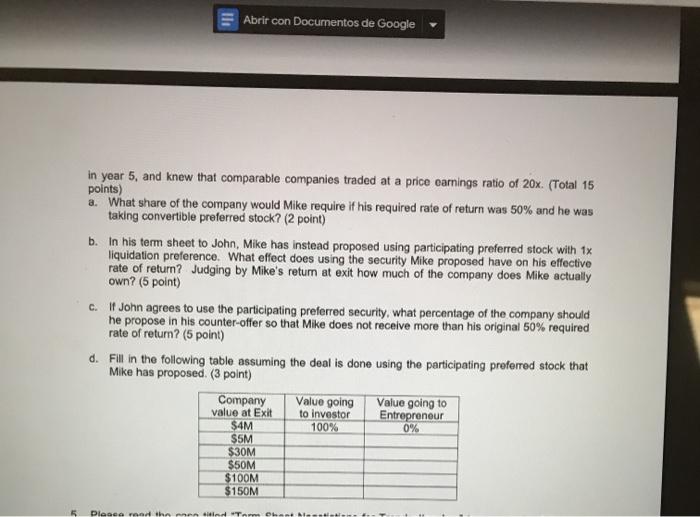

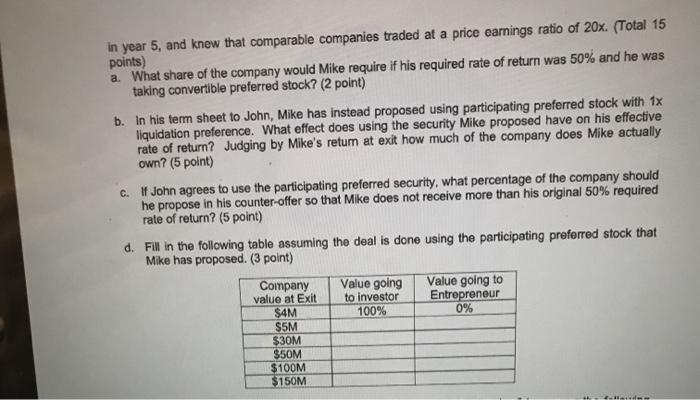

4 John Tambers, CEO of Bisco, Inc., sought to raise $5M in private placement of equity from VC Mike Marks in John's early stage networking company. John conservatively projected net income of $5M 1 In year 5, and knew that comparable companies traded at a price earnings ratio of 20%. (Total 15 points) a What share of the company would Mike require If his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's retum at exit how much of the company does Mike actually own? (5 point) c. John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed. (3 point) E Abrir con Documentos de Google in year 5, and knew that comparable companies traded at a price carnings ratio of 20x (Total 15 points) a What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) C. John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed (3 point) Company Value going Value going to to investor Entrepreneur 100% 0% value at Exit $4M SSM $30M $50M $100M $150M Diesea and the end Tom Chant 4 John Tambers, CEO of Bisco, Inc., sought to raise $5M in private placement of equity from VC Mike Marks in John's early stage networking company. John conservatively projected net income of $5M 1 in year 5, and know that comparable companios traded at a price camings ratio of 20x (Total 15 points) a. What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) c. If John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating proferred stock that Mike has proposed. (3 point) in year 5, and knew that comparable companies traded at a price earnings ratio of 20x. (Total 15 points) a. What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) C. If John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed. (3 point) Value going to investor 100% Value going to Entrepreneur 0% Company value at Exit $4M $5M $30M $50M $100M $150M 4 John Tambers, CEO of Bisco, Inc., sought to raise $5M in private placement of equity from VC Mike Marks in John's early stage networking company. John conservatively projected net income of $5M 1 In year 5, and knew that comparable companies traded at a price earnings ratio of 20%. (Total 15 points) a What share of the company would Mike require If his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's retum at exit how much of the company does Mike actually own? (5 point) c. John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed. (3 point) E Abrir con Documentos de Google in year 5, and knew that comparable companies traded at a price carnings ratio of 20x (Total 15 points) a What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) C. John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed (3 point) Company Value going Value going to to investor Entrepreneur 100% 0% value at Exit $4M SSM $30M $50M $100M $150M Diesea and the end Tom Chant 4 John Tambers, CEO of Bisco, Inc., sought to raise $5M in private placement of equity from VC Mike Marks in John's early stage networking company. John conservatively projected net income of $5M 1 in year 5, and know that comparable companios traded at a price camings ratio of 20x (Total 15 points) a. What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) c. If John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating proferred stock that Mike has proposed. (3 point) in year 5, and knew that comparable companies traded at a price earnings ratio of 20x. (Total 15 points) a. What share of the company would Mike require if his required rate of return was 50% and he was taking convertible preferred stock? (2 point) b. In his term sheet to John, Mike has instead proposed using participating preferred stock with 1x liquidation preference. What effect does using the security Mike proposed have on his effective rate of return? Judging by Mike's return at exit how much of the company does Mike actually own? (5 point) C. If John agrees to use the participating preferred security, what percentage of the company should he propose in his counter-offer so that Mike does not receive more than his original 50% required rate of return? (5 point) d. Fill in the following table assuming the deal is done using the participating preferred stock that Mike has proposed. (3 point) Value going to investor 100% Value going to Entrepreneur 0% Company value at Exit $4M $5M $30M $50M $100M $150M