Please answer ALL. I will thumbs you up, thank you!!!

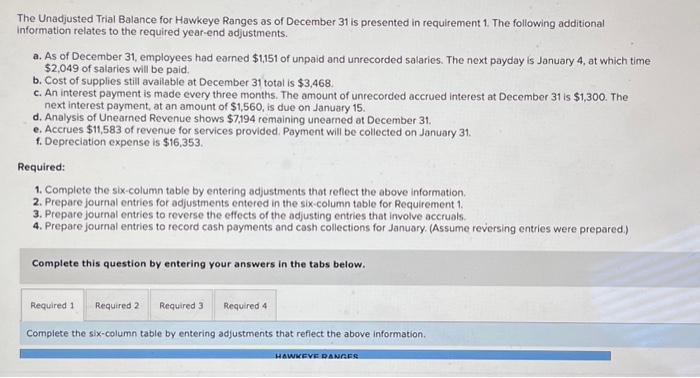

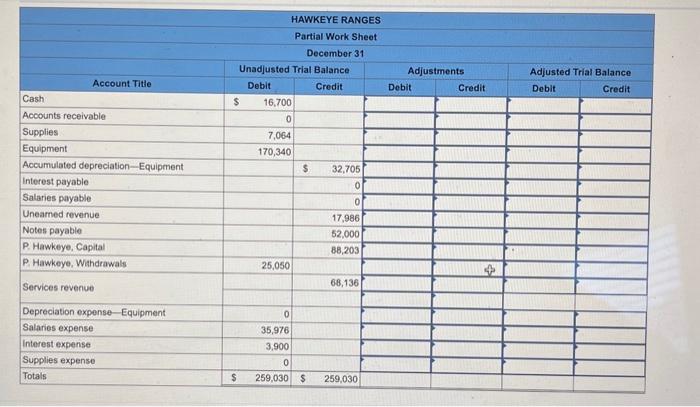

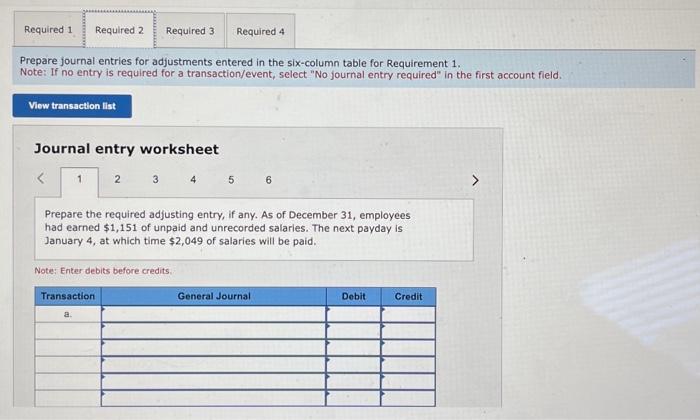

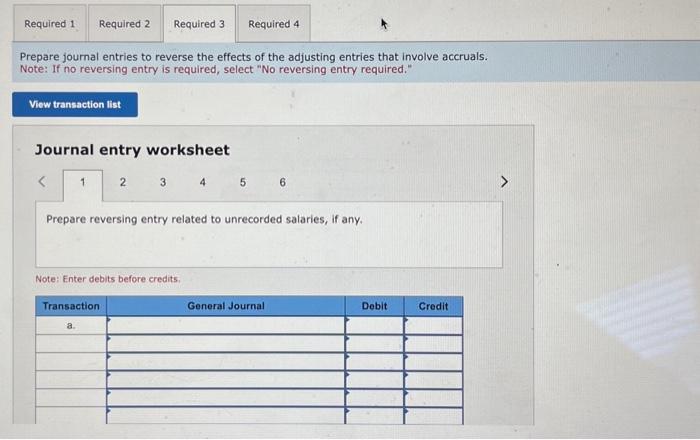

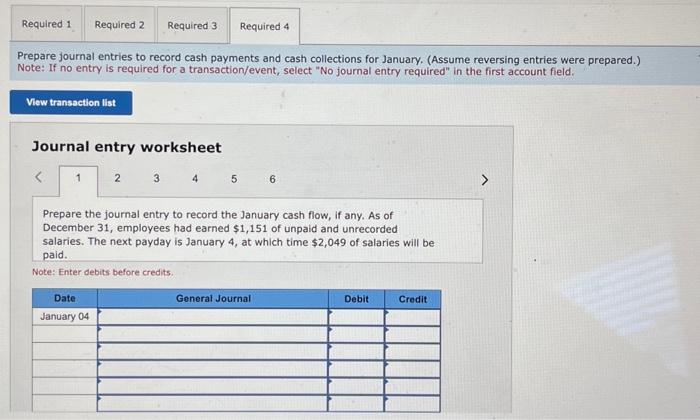

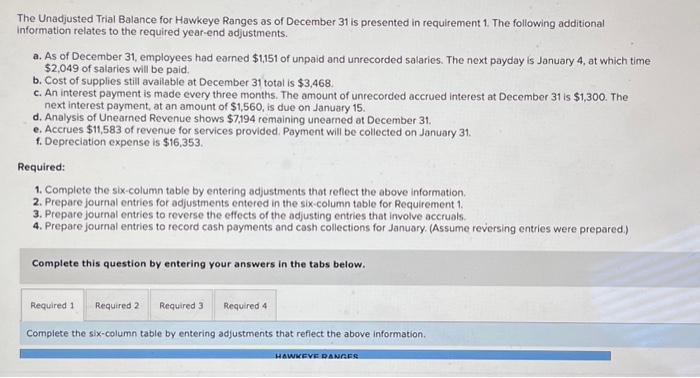

The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required year-end adjustments. a. As of December 31 , employees had earned $1,151 of unpaid and unrecorded salaries. The next payday is January 4 , at which time $2,049 of salaries will be paid. b. Cost of supplies still available at December 31 total is $3,468. c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,300. The next interest payment, at an amount of $1,560, is due on January 15. d. Analysis of Unearned Revenue shows $7,194 remaining unearned at December 31 . e. Accrues $11,583 of revenue for services provided. Payment will be collected on January 31. f. Depreciation expense is $16,353. Required: 1. Complete the six-column table by entering adjustments that reflect the above information. 2. Prepare journal entries for adjustments entered in the six-column table for Requirement 1. 3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals. 4. Prepare joumal entries to record cash payments and cosh collections for January. (Assume reversing entries were prepared.) Complete this question by entering your answers in the tabs below. Complete the six-column table by entering adjustments that reflect the above information. repare journal entries for adjustments entered in the six-column table for Requirement 1. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 5 Prepare the required adjusting entry, if any. As of December 31 , employees had earned $1,151 of unpaid and unrecorded salarles. The next payday is January 4 , at which time $2,049 of salaries will be paid. Note: Enter debits before credits. Prepare joumal entries to reverse the effects of the adjusting entries that involve accruals. Note: If no reversing entry is required, select "No reversing entry required." Journal entry worksheet 56 Prepare reversing entry related to unrecorded salaries, if any. Note: Enter debits before credits repare journal entries to record cash payments and cash collections for January. (Assume reversing entries were prepared.) lote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 56 Prepare the journal entry to record the January cash flow, if any. As of December 31 , employees had earned $1,151 of unpaid and unrecorded salaries. The next payday is January 4 , at which time $2,049 of salaries will be paid. Note: Einter debits before credits