Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer All. I will up-vote. NEED HELPPP. To complete this portion of the exam, you will need to produce financial statements for the firm

Please Answer All. I will up-vote. NEED HELPPP.

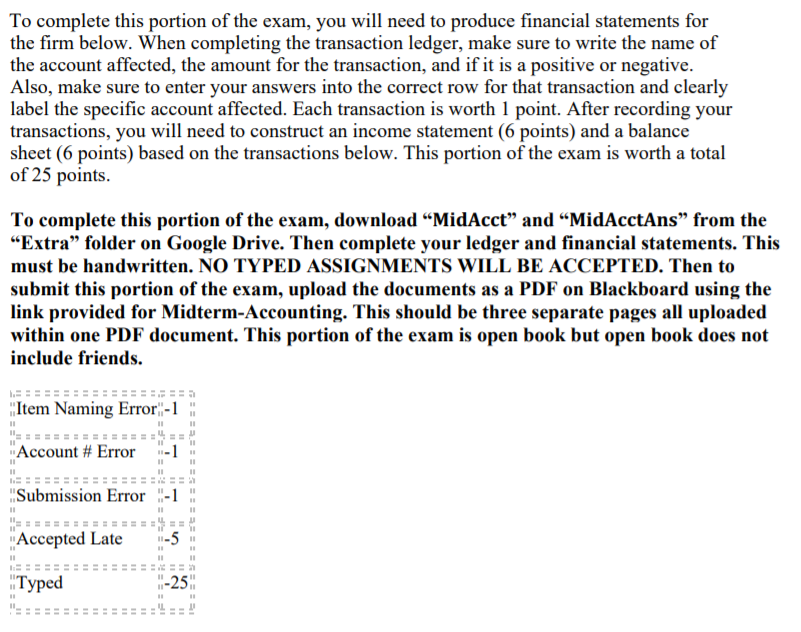

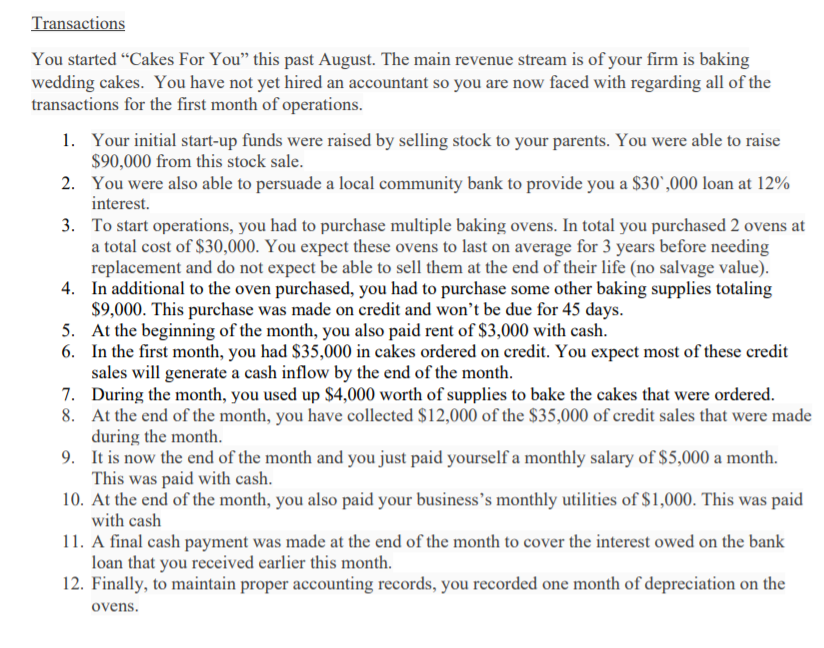

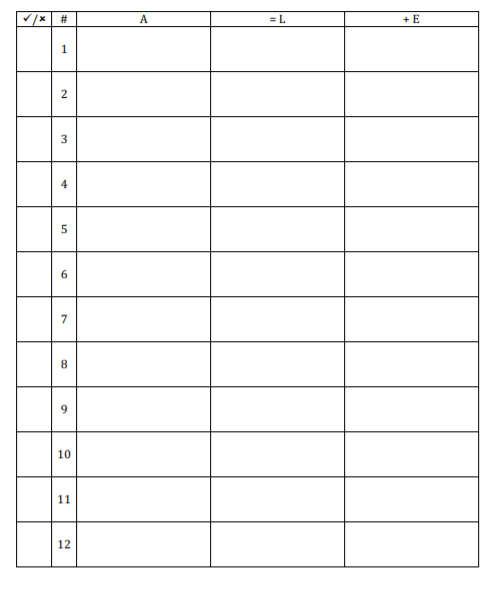

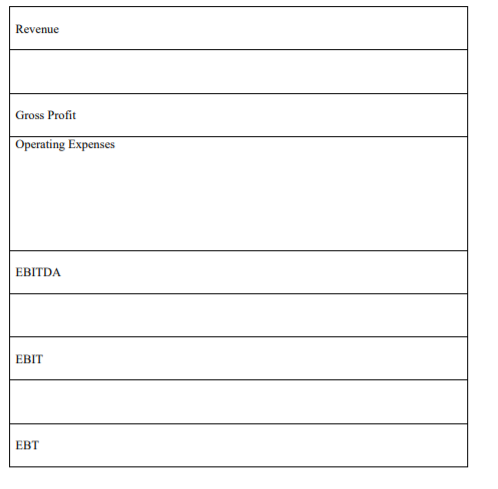

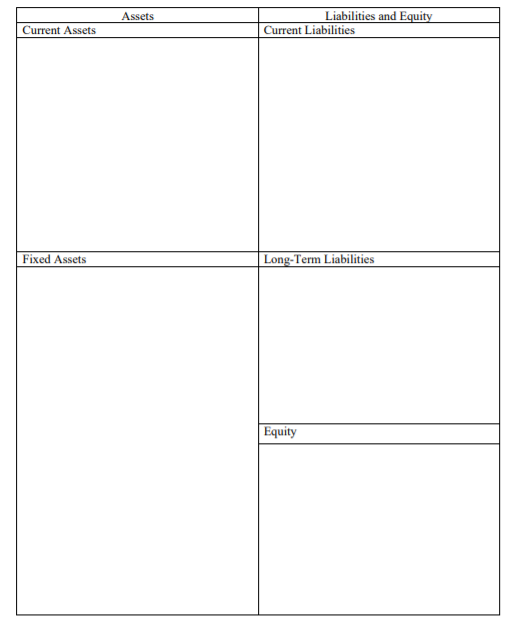

To complete this portion of the exam, you will need to produce financial statements for the firm below. When completing the transaction ledger, make sure to write the name of the account affected, the amount for the transaction, and if it is a positive or negative. Also, make sure to enter your answers into the correct row for that transaction and clearly label the specific account affected. Each transaction is worth 1 point. After recording your transactions, you will need to construct an income statement (6 points) and a balance sheet (6 points) based on the transactions below. This portion of the exam is worth a total of 25 points. To complete this portion of the exam, download "MidAcct and MidAcctAns from the "Extra folder on Google Drive. Then complete your ledger and financial statements. This must be handwritten. NO TYPED ASSIGNMENTS WILL BE ACCEPTED. Then to submit this portion of the exam, upload the documents as a PDF on Blackboard using the link provided for Midterm-Accounting. This should be three separate pages all uploaded within one PDF document. This portion of the exam is open book but open book does not include friends. Item Naming Error-1 | Account # Error 1 11 Submission Error 11 Accepted Late 11-5 Typed 1-25 Transactions You started Cakes For You this past August. The main revenue stream is of your firm is baking wedding cakes. You have not yet hired an accountant so you are now faced with regarding all of the transactions for the first month of operations. 1. Your initial start-up funds were raised by selling stock to your parents. You were able to raise $90,000 from this stock sale. 2. You were also able to persuade a local community bank to provide you a $30",000 loan at 12% interest 3. To start operations, you had to purchase multiple baking ovens. In total you purchased 2 ovens at a total cost of $30,000. You expect these ovens to last on average for 3 years before needing replacement and do not expect be able to sell them at the end of their life (no salvage value). 4. In additional to the oven purchased, you had to purchase some other baking supplies totaling $9,000. This purchase was made on credit and won't be due for 45 days. 5. At the beginning of the month, you also paid rent of $3,000 with cash. 6. In the first month, you had $35,000 in cakes ordered on credit. You expect most of these credit sales will generate a cash inflow by the end of the month. 7. During the month, you used up $4,000 worth of supplies to bake the cakes that were ordered. 8. At the end of the month, you have collected $12,000 of the $35,000 of credit sales that were made during the month. 9. It is now the end of the month and you just paid yourself a monthly salary of $5,000 a month. This was paid with cash. 10. At the end of the month, you also paid your business's monthly utilities of $1,000. This was paid with cash 11. A final cash payment was made at the end of the month to cover the interest owed on the bank loan that you received earlier this month. 12. Finally, to maintain proper accounting records, you recorded one month of depreciation on the ovens. # A =L + E 1 2 3 4 5 7 8 9 10 11 12 Revenue Gross Profit Operating Expenses EBITDA EBIT Assets Liabilities and Equity Current Liabilities Current Assets Fixed Assets Long-Term Liabilities EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started