Answered step by step

Verified Expert Solution

Question

1 Approved Answer

************ PLEASE ANSWER ALL, IF UNABLE TO PLEASE SKIP THANK YOU ***************************** Problem 24-03A a-b, c, d (Part Level Submission) (Video) Hill Industries had sales

************ PLEASE ANSWER ALL, IF UNABLE TO PLEASE SKIP THANK YOU *****************************

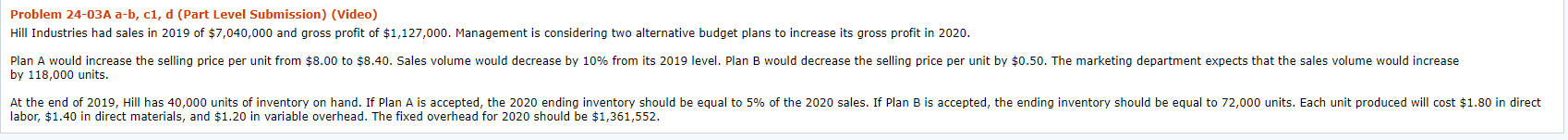

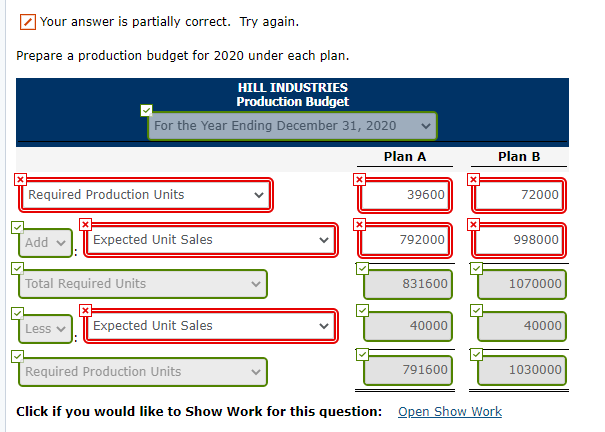

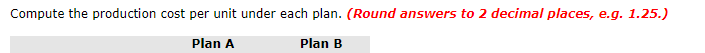

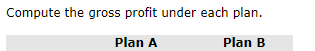

Problem 24-03A a-b, c, d (Part Level Submission) (Video) Hill Industries had sales in 2019 of $7,040,000 and gross profit of $1,127,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 118,000 units. At the end of 2019, Hill has 40,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 72,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,361,552. Your answer is partially correct. Try again. Prepare a production budget for 2020 under each plan. HILL INDUSTRIES Production Budget For the Year Ending December 31, 2020 Plan A Plan B Required Production Units 39600 72000 X Add Expected Unit Sales 792000 998000 Total Required Units 831600 1070000 Less Expected Unit Sales 40000 40000 Required Production Units 791600 1030000 Click if you would like to Show Work for this question: Open Show Work Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) Plan A Plan B Compute the gross profit under each plan. Plan A Plan B Which plan should be acceptedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started