Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all in 30 minute just need final answer only i will Upvote you Assume that the return of a risk-free asset is 2%,

Please answer all in 30 minute just need final answer only i will Upvote you

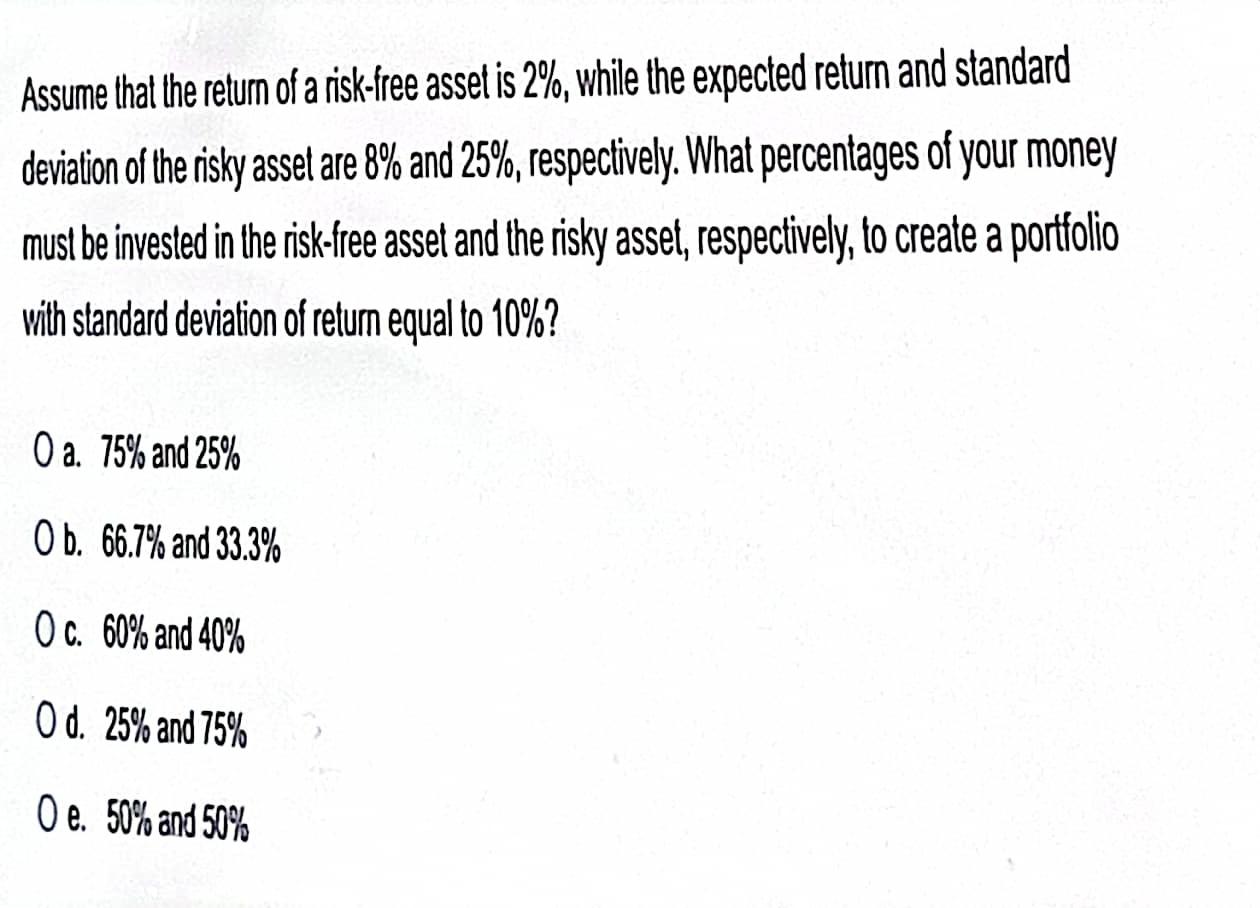

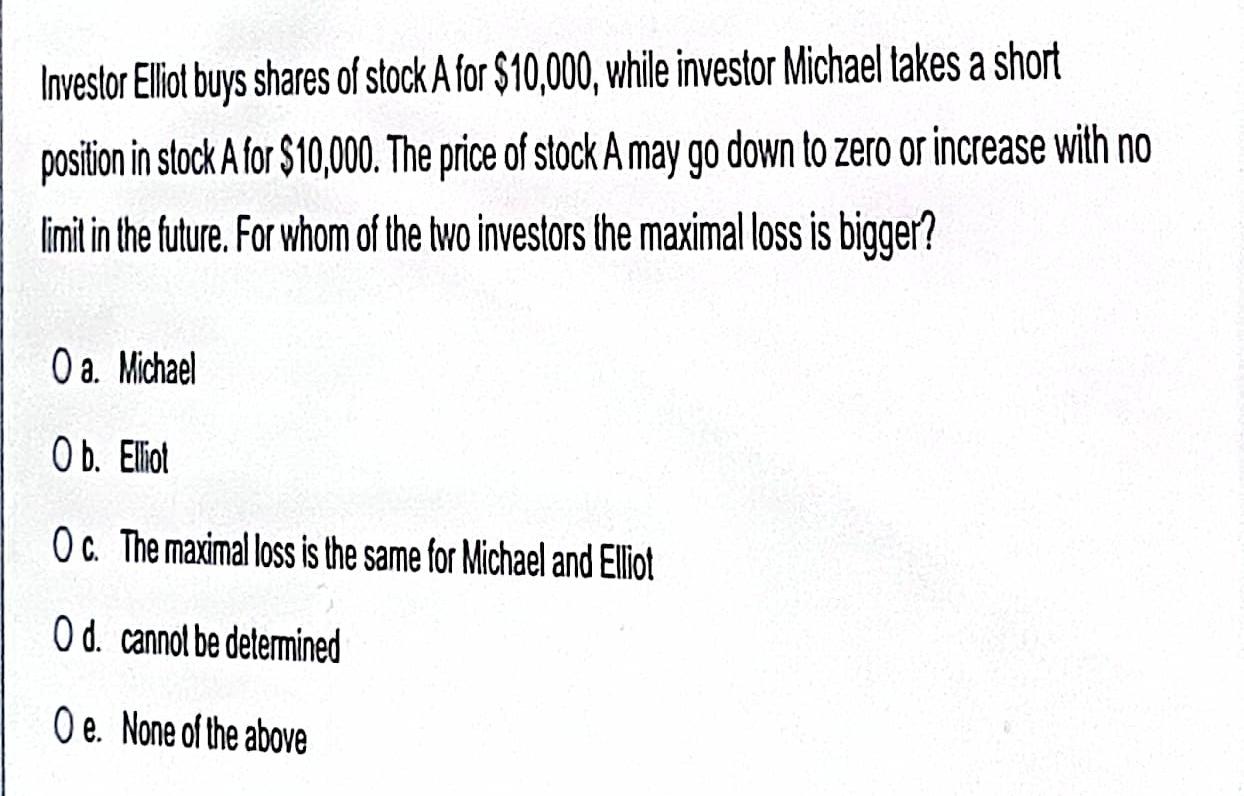

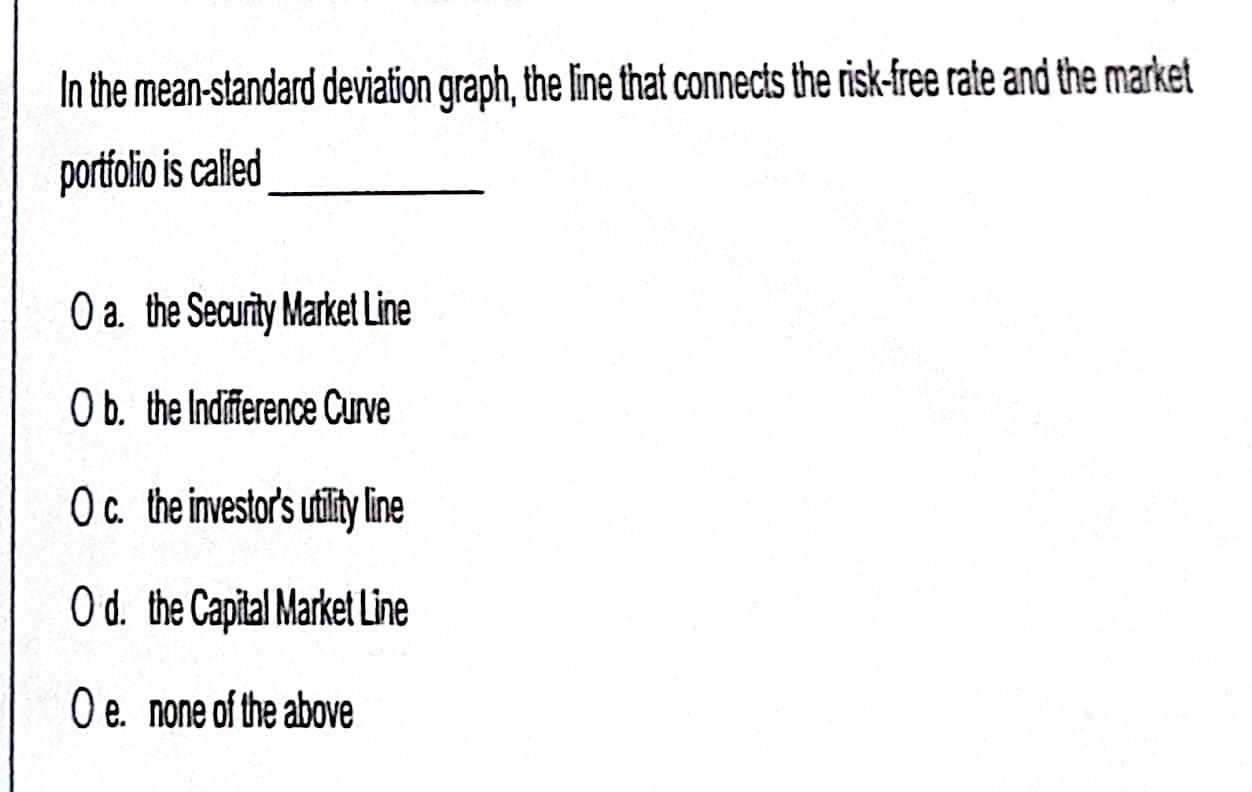

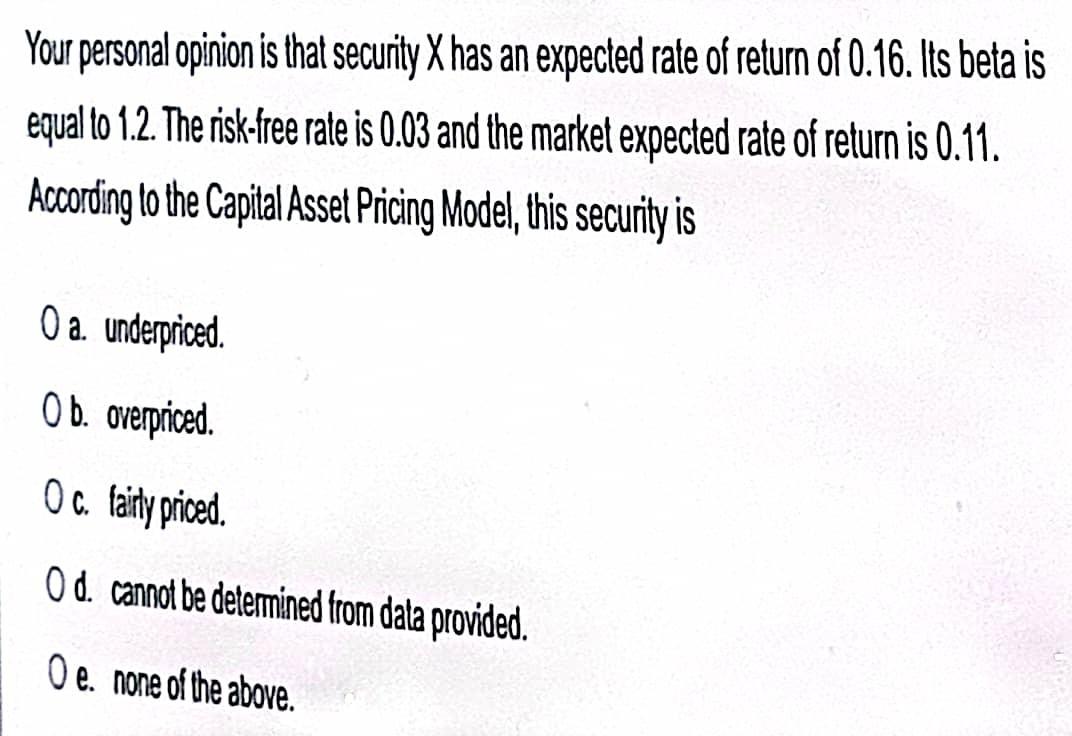

Assume that the return of a risk-free asset is 2%, while the expected return and standard deviation of the risky asset are 8% and 25%, respectively. What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to create a portfolio with standard deviation of retum equal to 10%? O a. 75% and 25% O b. 66.7% and 33.3% OC. 60% and 40% O d. 25% and 75% O e. 50% and 50% Investor Elliot buys shares of stock A for $10,000, while investor Michael takes a short position in stock A for $10,000. The price of stock A may go down to zero or increase with no limit in the future. For whom of the two investors the maximal loss is bigger? O a. Michael Ob. Elliot O c The maximal loss is the same for Michael and Elliot Od cannot be determined Oe. None of the above In the mean-standard deviation graph, the line that connects the risk-free rate and the market portfolio is called O a. the Security Market Line O b. the Indifference Curve O c. the investor's utility line Od. the Capital Market Line Oe. none of the above Your personal opinion is that security X has an expected rate of return of 0.16. Its beta is equal to 1.2. The risk-free rate is 0.03 and the market expected rate of return is 0.11. According to the Capital Asset Pricing Model, this security is Oa underpriced. O b. overpriced. Oc. fairly priced. Od cannot be determined from data provided. O e. none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started