Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all. It will be highly appreciated. 6. A zero-coupon bond for Sun Inc with 10 years to maturity is trading for $512.35. What

Please answer all. It will be highly appreciated.

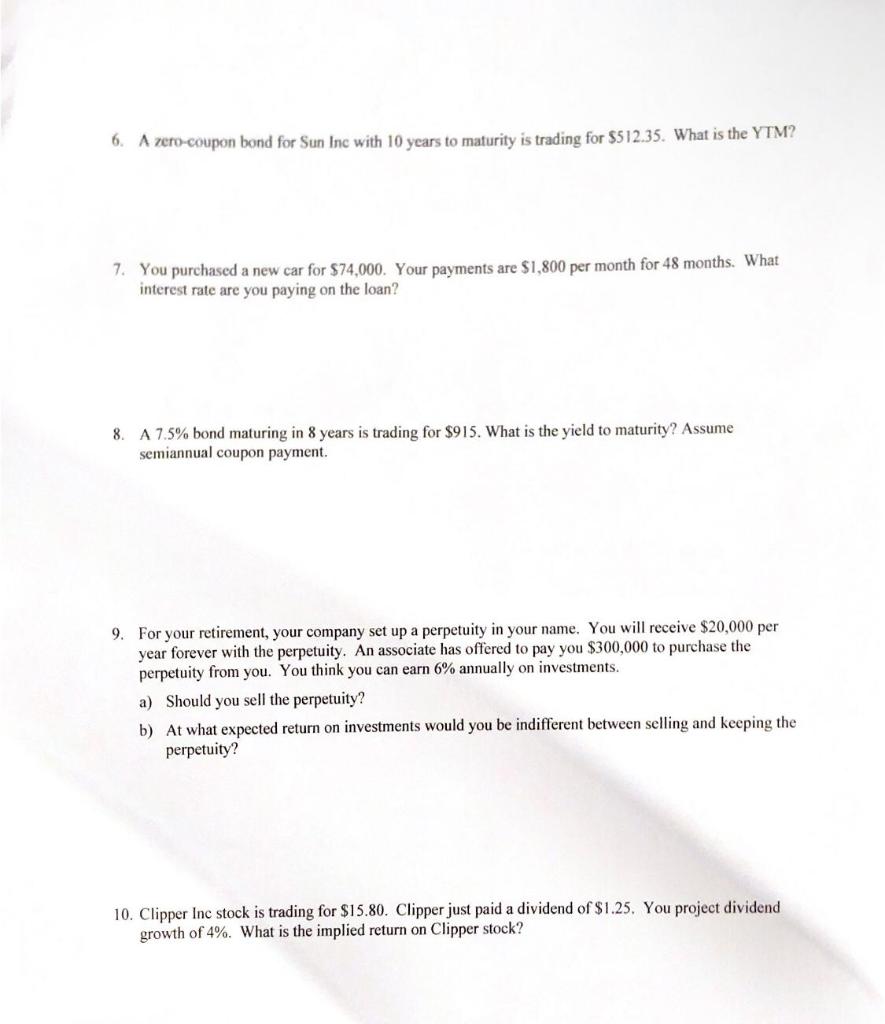

6. A zero-coupon bond for Sun Inc with 10 years to maturity is trading for $512.35. What is the YTM? 7. You purchased a new car for $74,000. Your payments are $1,800 per month for 48 months. What interest rate are you paying on the loan? 8. A 7.5% bond maturing in 8 years is trading for $915. What is the yield to maturity? Assume semiannual coupon payment. 9. For your retirement, your company set up a perpetuity in your name. You will receive $20,000 per year forever with the perpetuity. An associate has offered to pay you $300,000 to purchase the perpetuity from you. You think you can earn 6% annually on investments. a) Should you sell the perpetuity? b) At what expected return on investments would you be indifferent between selling and keeping the perpetuity? 10. Clipper Inc stock is trading for $15.80. Clipper just paid a dividend of $1.25. You project dividend growth of 4%. What is the implied return on Clipper stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started