Please answer all

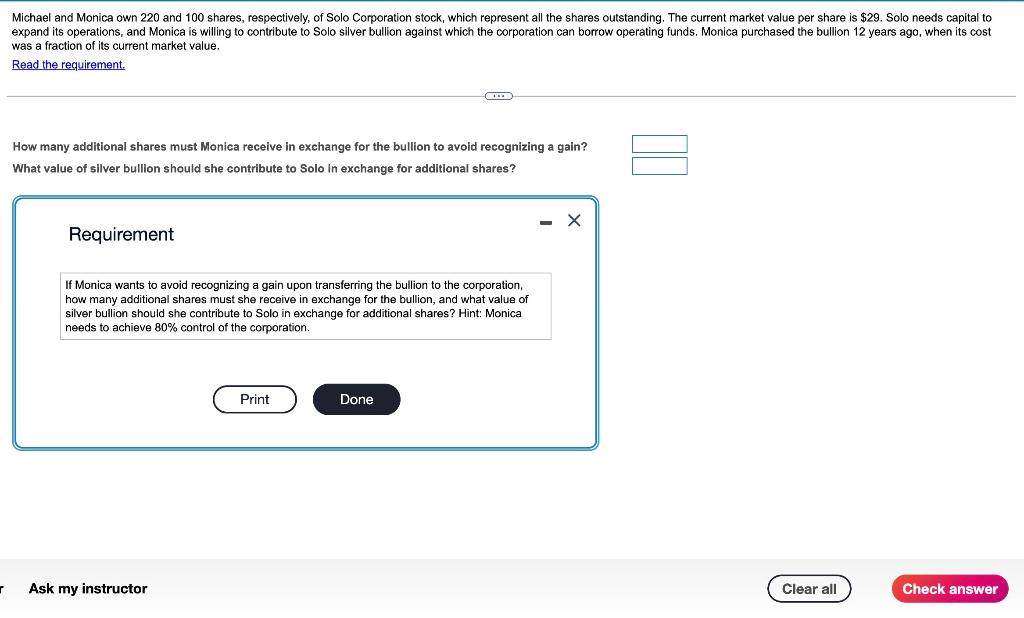

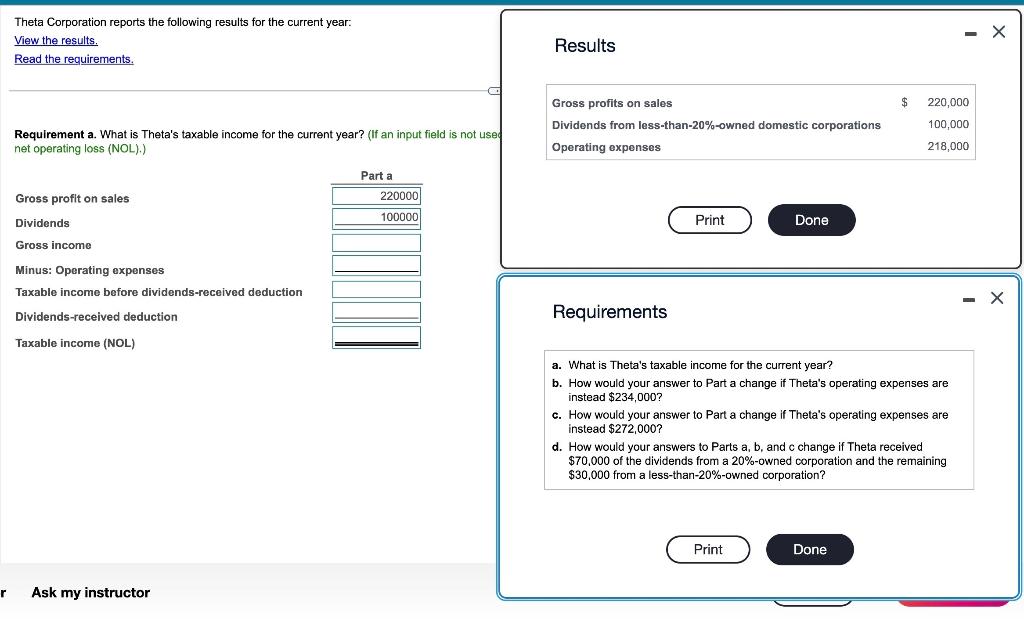

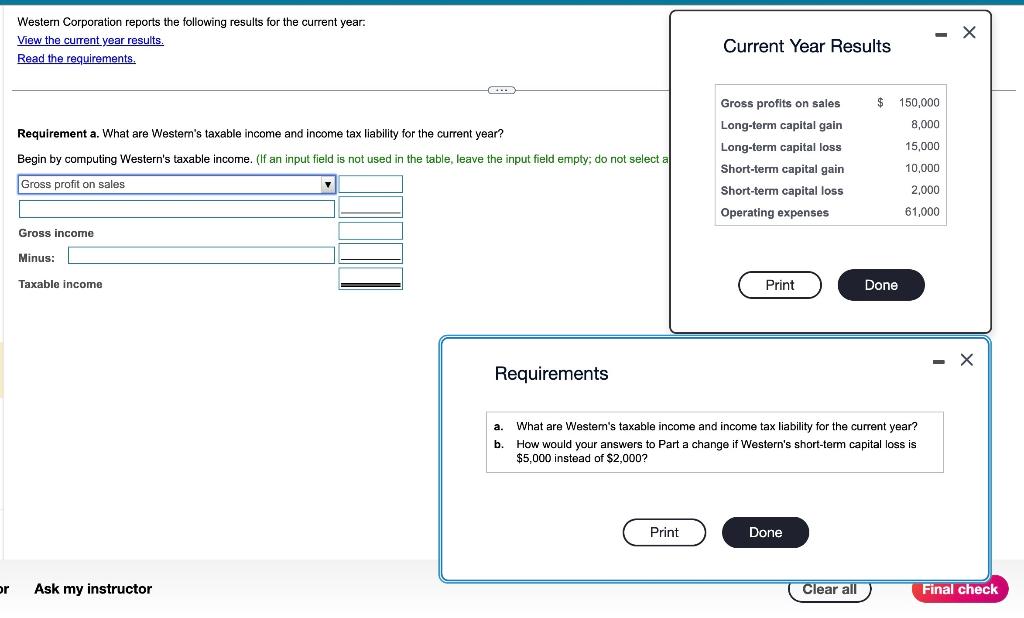

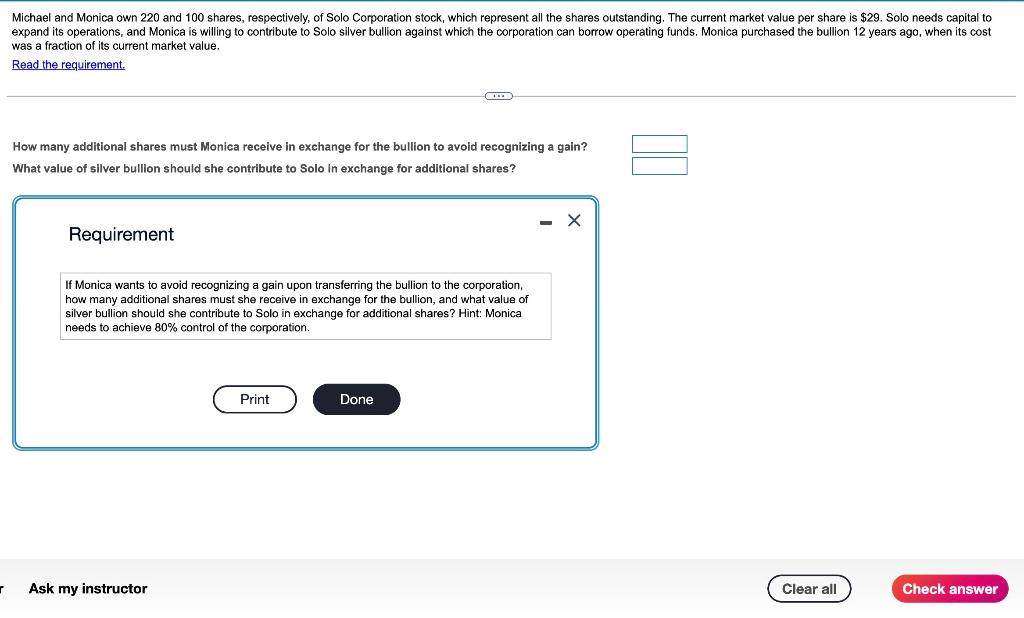

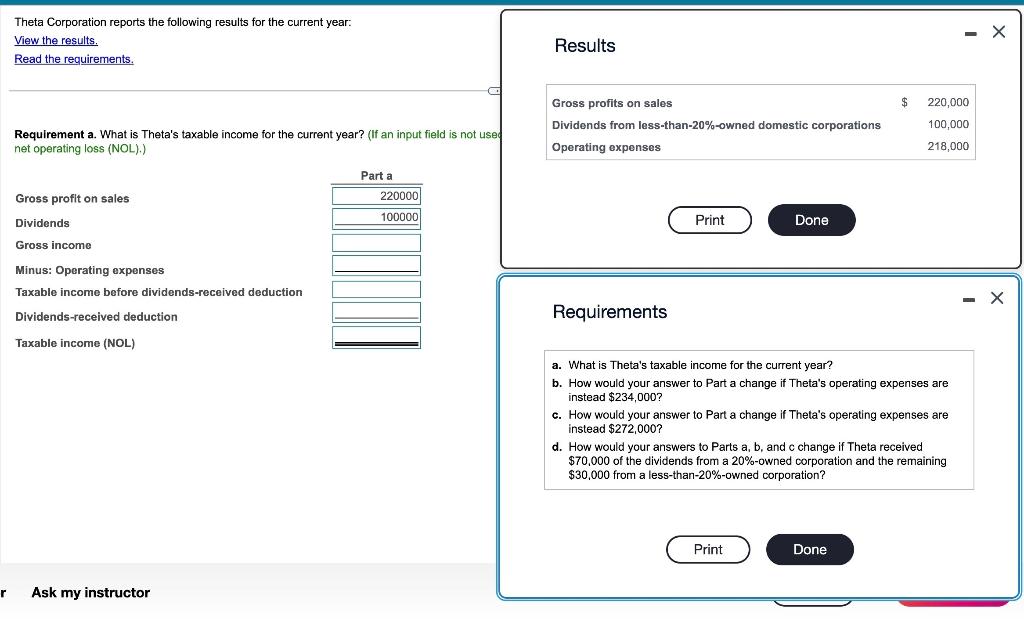

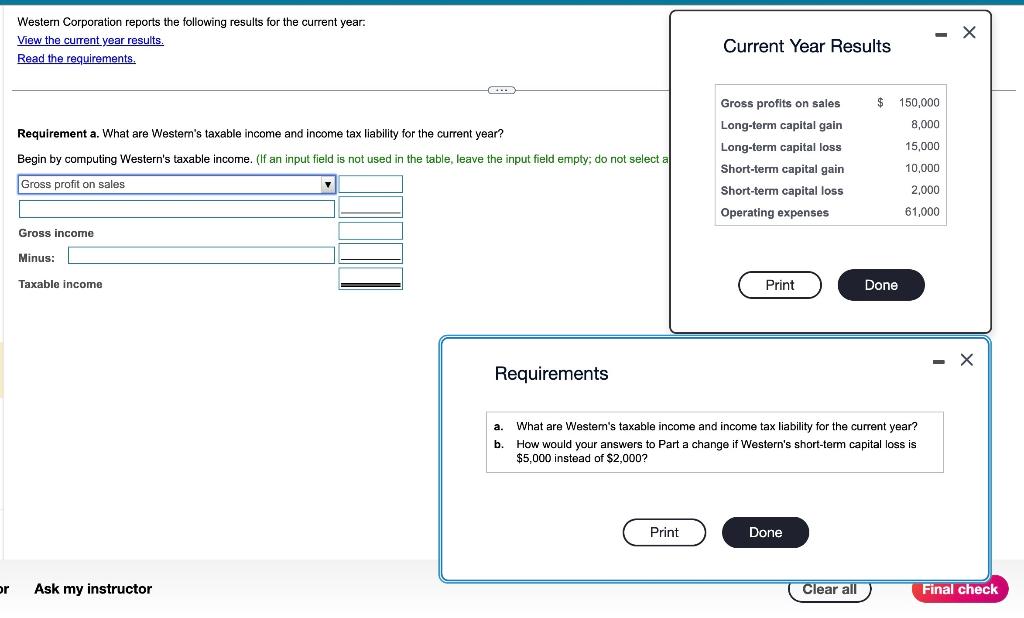

Michael and Monica own 220 and 100 shares, respectively, of Solo Corporation stock, which represent all the shares outstanding. The current market value per share is $29. Solo needs capital to expand its operations, and Monica is willing to contribute to Solo silver bullion against which the corporation can borrow operating funds. Monica purchased the bullion 12 years ago, when its cost was a fraction of its current market value. Read the requirement. How many additional shares must Monica receive in exchange for the bullion to avoid recognizing a gain? What value of silver bullion should she contribute to Solo in exchange for additional shares? Requirement If Monica wants to avoid recognizing a gain upon transferring the bullion to the corporation, how many additional shares must she receive in exchange for the bullion, and what value of silver bullion should she contribute to Solo in exchange for additional shares? Hint: Monica needs to achieve 80% control of the corporation. Ask my instructor Theta Corporation reports the following results for the current year: View the results. Results Read the requirements. Requirement a. What is Theta's taxable income for the current year? (If an input field is not used Gross profits on sales Dividends from less-than-20\%-owned domestic corporations Operating expenses net operating loss (NOL).) Requirements a. What is Theta's taxable income for the current year? b. How would your answer to Part a change if Theta's operating expenses are instead $234,000 ? c. How would your answer to Part a change if Theta's operating expenses are instead $272,000 ? d. How would your answers to Parts a,b, and c change if Theta received $70,000 of the dividends from a 20%-owned corporation and the remaining $30,000 from a less-than-20\%-owned corporation? Ask my instructor Western Corporation reports the following results for the current year: View the current year results. Current Year Results Read the requirements. Requirement a. What are Westem's taxable income and income tax liability for the current year? Begin by computing Western's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a Requirements a. What are Westem's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Western's short-term capital loss is $5,000 instead of $2,000 ? Michael and Monica own 220 and 100 shares, respectively, of Solo Corporation stock, which represent all the shares outstanding. The current market value per share is $29. Solo needs capital to expand its operations, and Monica is willing to contribute to Solo silver bullion against which the corporation can borrow operating funds. Monica purchased the bullion 12 years ago, when its cost was a fraction of its current market value. Read the requirement. How many additional shares must Monica receive in exchange for the bullion to avoid recognizing a gain? What value of silver bullion should she contribute to Solo in exchange for additional shares? Requirement If Monica wants to avoid recognizing a gain upon transferring the bullion to the corporation, how many additional shares must she receive in exchange for the bullion, and what value of silver bullion should she contribute to Solo in exchange for additional shares? Hint: Monica needs to achieve 80% control of the corporation. Ask my instructor Theta Corporation reports the following results for the current year: View the results. Results Read the requirements. Requirement a. What is Theta's taxable income for the current year? (If an input field is not used Gross profits on sales Dividends from less-than-20\%-owned domestic corporations Operating expenses net operating loss (NOL).) Requirements a. What is Theta's taxable income for the current year? b. How would your answer to Part a change if Theta's operating expenses are instead $234,000 ? c. How would your answer to Part a change if Theta's operating expenses are instead $272,000 ? d. How would your answers to Parts a,b, and c change if Theta received $70,000 of the dividends from a 20%-owned corporation and the remaining $30,000 from a less-than-20\%-owned corporation? Ask my instructor Western Corporation reports the following results for the current year: View the current year results. Current Year Results Read the requirements. Requirement a. What are Westem's taxable income and income tax liability for the current year? Begin by computing Western's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a Requirements a. What are Westem's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Western's short-term capital loss is $5,000 instead of $2,000