Answered step by step

Verified Expert Solution

Question

1 Approved Answer

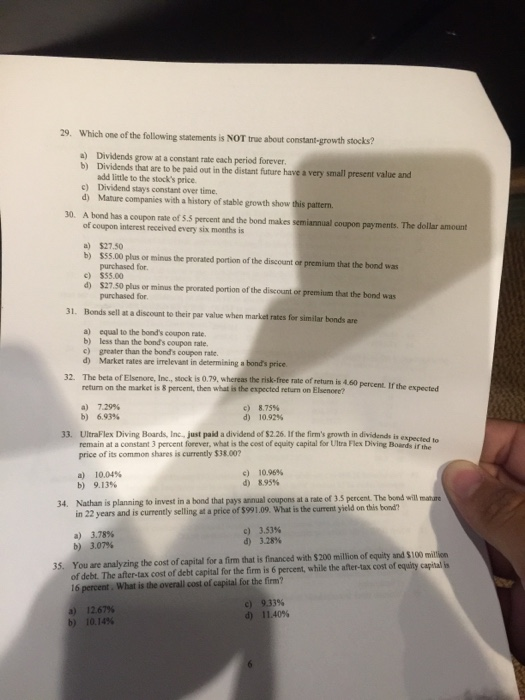

please answer all, much appriciated ! 29. Which one of the following statements is NOT true about constant-growth stocks? Dividends grow at a constant rate

please answer all, much appriciated !

29. Which one of the following statements is NOT true about constant-growth stocks? Dividends grow at a constant rate each period forever b) a) Dividends that are to be paid out in the distant future have a very small present value and add little to the stock's price c) Dividend stays constant over time d) Mature companies with a history of stable growth show this pattern 30. A bond has a coupon rate of 5.5 percent and the bond makes semianniual coupon payments. The dollar amount of coupon interest received every six months is $27.50 b) a) 555.00 plus of minus the prorated portion of the discount or premium that the bond was purchased for. c) $55.00 d) $27.50 plus or minus the prorated portion of the discount or premium that the bond was purchased for. Bonds sell at a discount to their par value when market rates for similar bonds are a) 31. equal to the bond's coupon rate b) less than the bonds coupon rate Market rates are irrelevant in determining a bond's price return on the market is 8 percent, then what is the expected return on Elsenore? a) d) 32. The beta of Elsenore, Inc., stock is 0.79, whereas the risk-free r rate of return is 4.60 percent. If the expected 7.29% c) 8.75% b) 693% d) 10.92% 33. UltraFlex Diving Boards, Inc just paid a dividend of $2.26. If the firm's growth in dividends is es remain at a constant 3 percent forever, what is the cost of equity capital for Ultra Flex Diving Boards if th price of its common shares is currently $38.00? expected to a) b) 10.04% 9,13% c) d) 10.96% 8.95% 34. Nathan is planning to invest in a bond that pays annual coupons at a rate of 3.5 percent. The bond will matre n 22 years and is currently selling at a price of $991.09. What is the curent yield on this bond c) d) 3.53% 3.28% a) 3.78% b) 3,07% of debt. The after-tax cost of debt capital for the firm is 6 percent, while the after-tax cost of equity capital is 16 percent. What is the overall cost of capital for the firm? 35. You are analyzing the cost of capital for a firm that is financed with $200 million of equity and S100 a) b) 12.67% 10.14% d) 11.40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started