Please answer all, not just one. All questions are answered just want to make sure they are not wrong. Thanks!

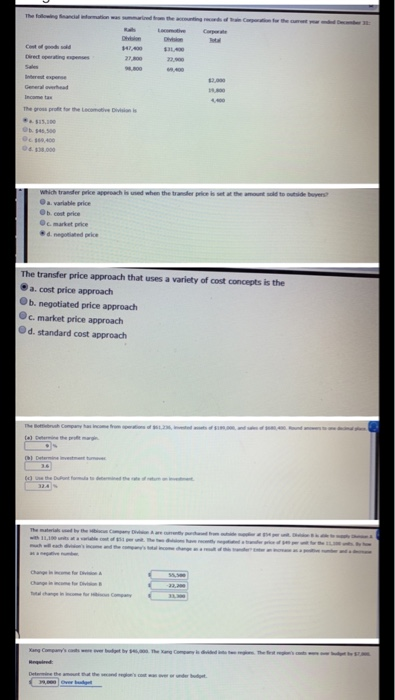

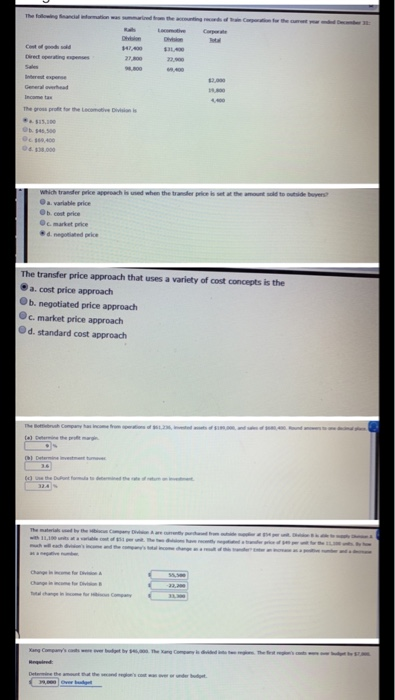

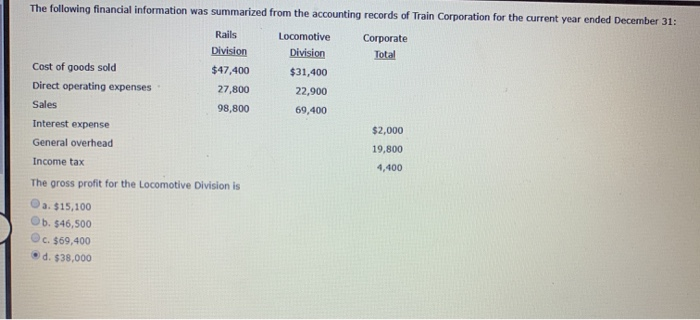

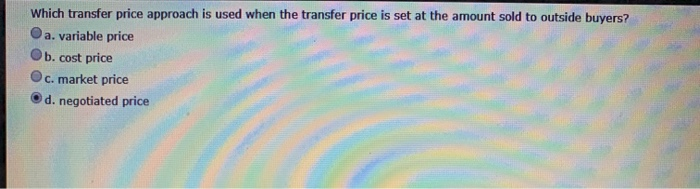

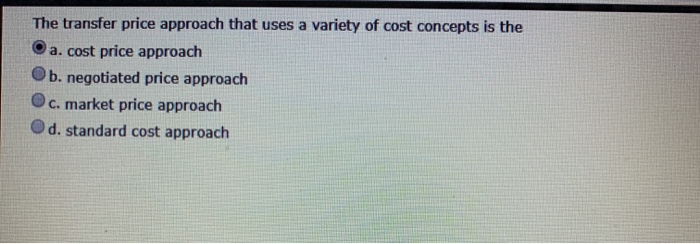

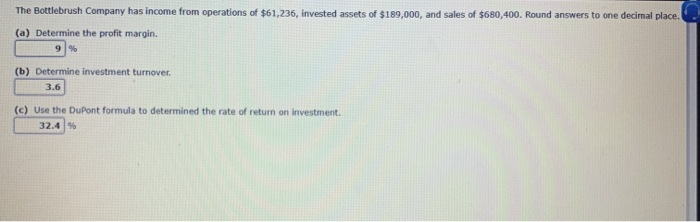

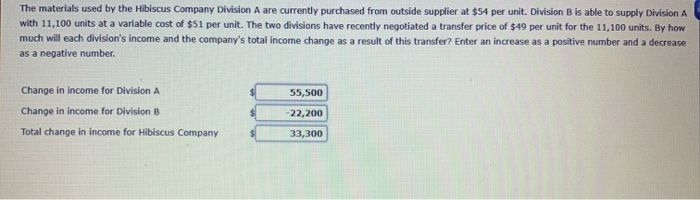

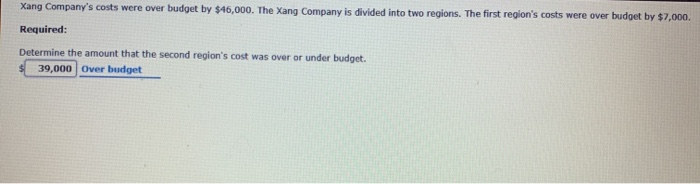

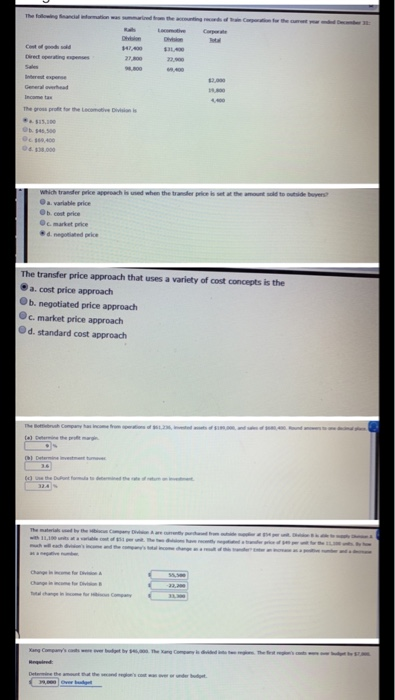

Income The gross profit for the Locomotive Divisia 546,500 63.000 price is the amount to ide buyers which trader price approach is used when the brand a variate price Ob cest price The transfer price approach that uses a variety of cost concepts is the a. cost price approach b. negotiated price approach c. market price approach d. standard cost approach There The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Corporate Total Cost of goods sold Direct operating expenses Sales Interest expense General overhead Income tax Rails Division $47,400 27,800 98,800 Locomotive Division $31,400 22,900 69,400 $2,000 19,800 4,400 The gross profit for the Locomotive Division is a $15,100 b. $46,500 c. $69,400 d. $38,000 Which transfer price approach is used when the transfer price is set at the amount sold to outside buyers? a. variable price b. cost price c. market price d. negotiated price The transfer price approach that uses a variety of cost concepts is the a. cost price approach b. negotiated price approach c. market price approach d. standard cost approach The Bottlebrush Company has income from operations of $61,236, invested assets of $189,000, and sales of $680,400. Round answers to one decimal place. (a) Determine the profit margin. 9 % (b) Determine investment turnover, 3.6 (c) Use the DuPont formula to determined the rate of return on investment. 32.4% The materials used by the Hibiscus Company Division A are currently purchased from outside supplier at $54 per unit. Division B is able to supply Division A with 11,100 units at a variable cost of $51 per unit. The two divisions have recently negotiated a transfer price of $49 per unit for the 11,100 units. By how much will each division's income and the company's total income change as a result of this transfer? Enter an increase as a positive number and a decrease as a negative number. 55,500 Change in income for Division A Change in income for Division B 22,200 Total change in income for Hibiscus Company 33,300 Xang Company's costs were over budget by $46,000. The Xang Company is divided into two regions. The first region's costs were over budget by $7,000 Required: Determine the amount that the second region's cost was over or under budget. $ 39,000 Over budget