Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all of part one questions! Will leave thumbs up, positive comments, etc. Part One Instructions The financial information for the past two years

Please answer all of part one questions!

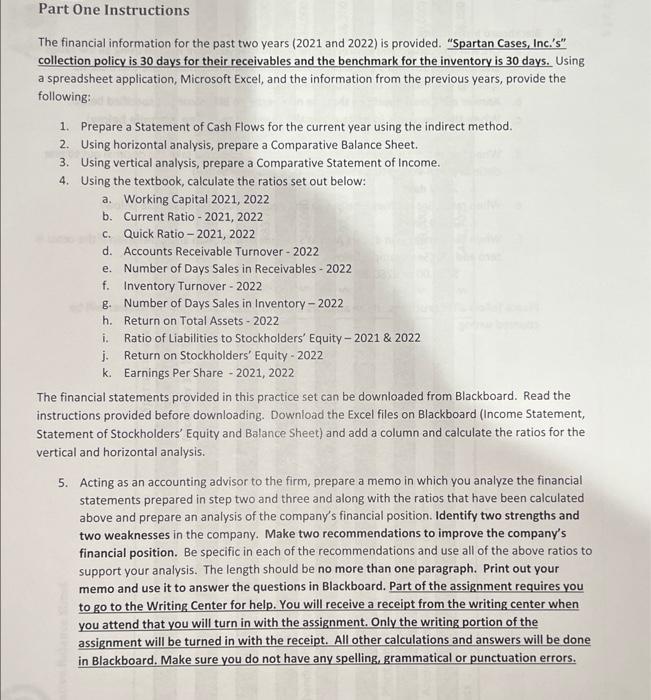

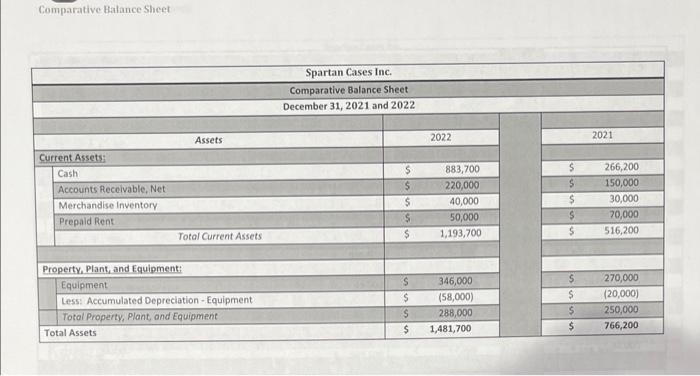

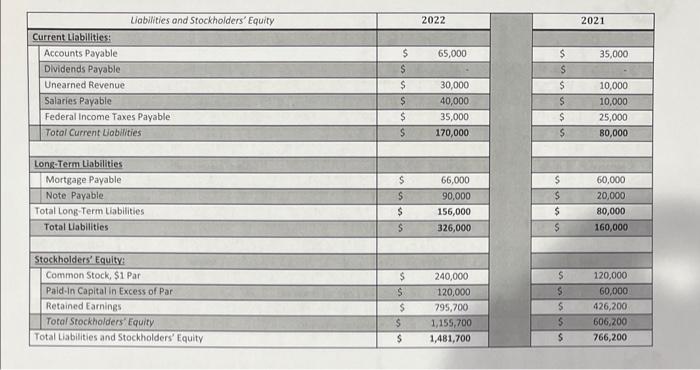

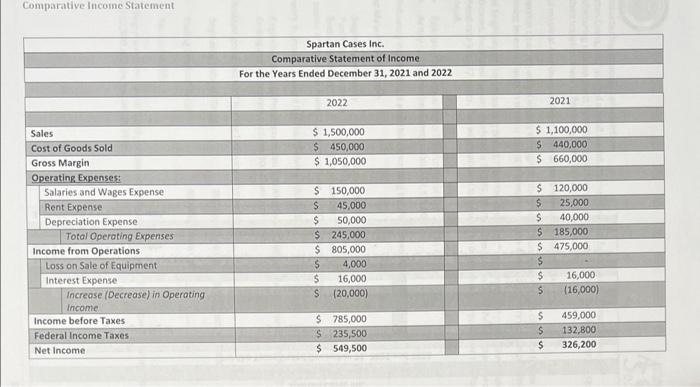

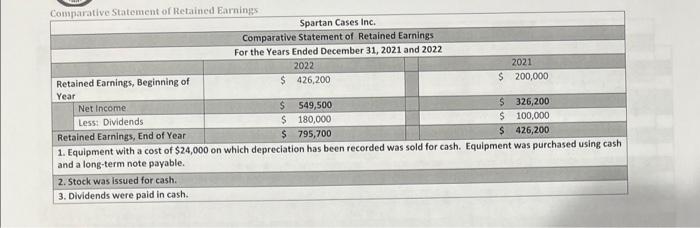

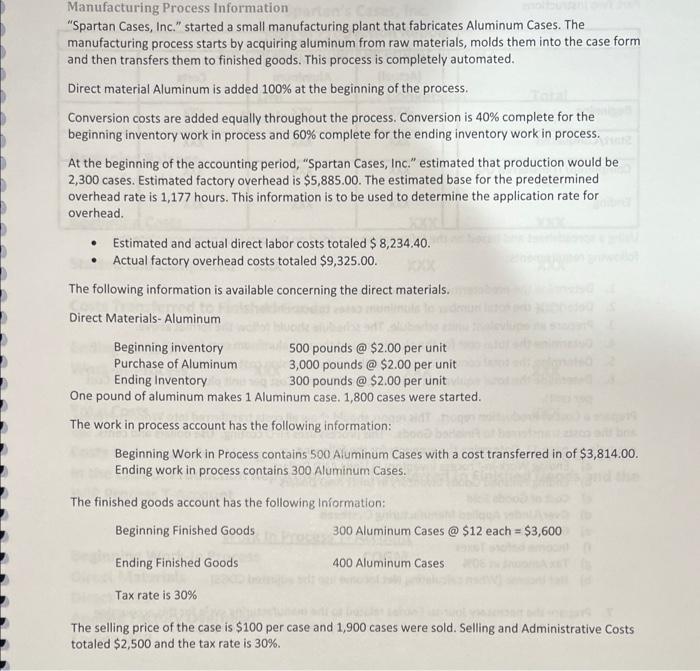

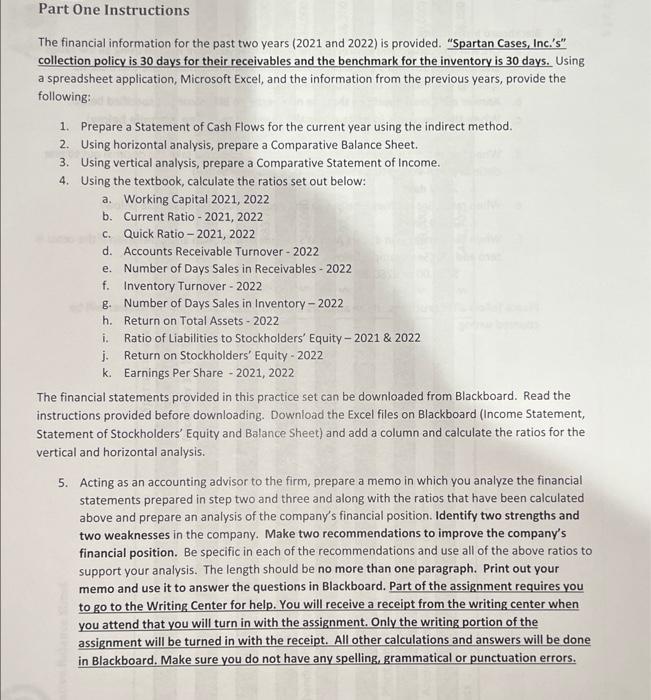

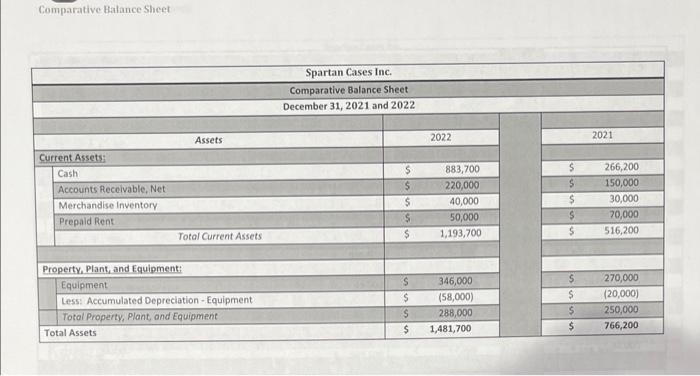

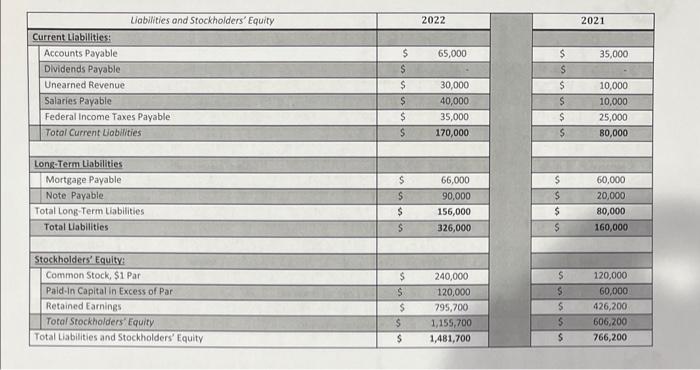

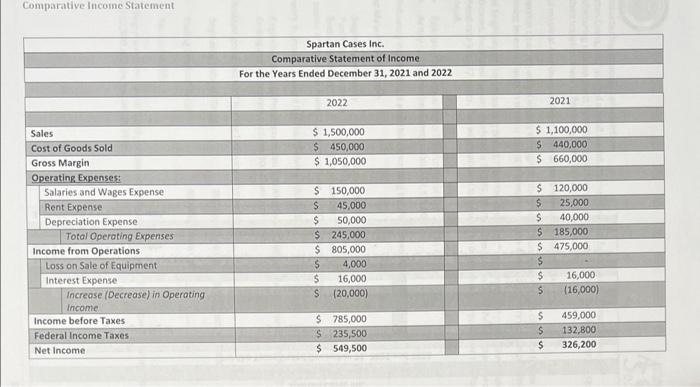

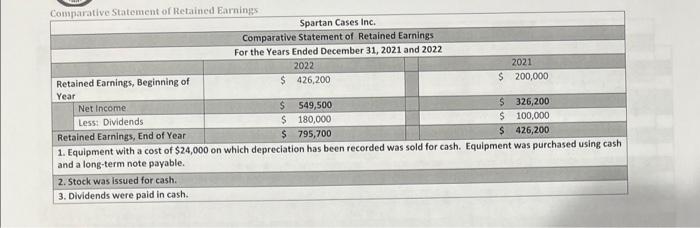

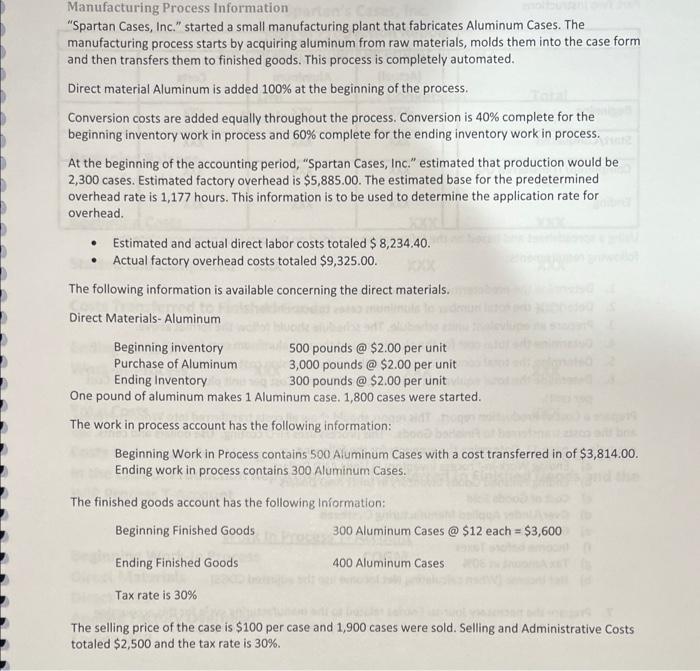

Part One Instructions The financial information for the past two years (2021 and 2022) is provided. "Spartan Cases, Inc.'s" collection policy is 30 days for their receivables and the benchmark for the inventory is 30 days. Using a spreadsheet application, Microsoft Excel, and the information from the previous years, provide the following: 1. Prepare a Statement of Cash Flows for the current year using the indirect method. 2. Using horizontal analysis, prepare a Comparative Balance Sheet. 3. Using vertical analysis, prepare a Comparative Statement of Income. 4. Using the textbook, calculate the ratios set out below: a. Working Capital 2021, 2022 b. Current Ratio-2021, 2022 c. Quick Ratio - 2021, 2022 d. Accounts Receivable Turnover 2022 e. Number of Days Sales in Receivables - 2022 f. Inventory Turnover 2022 g. Number of Days Sales in Inventory 2022 h. Return on Total Assets - 2022 i. Ratio of Liabilities to Stockholders' Equity - 2021&2022 j. Return on Stockholders' Equity - 2022 k. Earnings Per Share - 2021, 2022 The financial statements provided in this practice set can be downloaded from Blackboard. Read the instructions provided before downloading. Download the Excel files on Blackboard (Income Statement, Statement of Stockholders' Equity and Balance Sheet) and add a column and calculate the ratios for the vertical and horizontal analysis. 5. Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements prepared in step two and three and along with the ratios that have been calculated above and prepare an analysis of the company's financial position. Identify two strengths and two weaknesses in the company. Make two recommendations to improve the company's financial position. Be specific in each of the recommendations and use all of the above ratios to support your analysis. The length should be no more than one paragraph. Print out your memo and use it to answer the questions in Blackboard. Part of the assignment requires you to go to the Writing Center for help. You will receive a receipt from the writing center when you attend that you will turn in with the assignment. Only the writing portion of the assignment will be turned in with the receipt. All other calculations and answers will be done in Blackboard. Make sure you do not have any spelling, grammatical or punctuation errors. Comparative Batance Sheet Comparative Incoine Statement Comparative Statement of Retained Earnings 1. Equipment with a cost of $24,000 on which depreciation has been recorded was sold for cash. Equipment was purchased using cash and a long-term note payable. 2. Stock was issued for cash. 3. Dividends were paid in cash. Manufacturing Process Information "Spartan Cases, Inc." started a small manufacturing plant that fabricates Aluminum Cases. The manufacturing process starts by acquiring aluminum from raw materials, molds them into the case form and then transfers them to finished goods. This process is completely automated. Direct material Aluminum is added 100% at the beginning of the process. Conversion costs are added equally throughout the process. Conversion is 40% complete for the beginning inventory work in process and 60% complete for the ending inventory work in process. At the beginning of the accounting period, "Spartan Cases, Inc." estimated that production would be 2,300 cases. Estimated factory overhead is $5,885.00. The estimated base for the predetermined overhead rate is 1,177 hours. This information is to be used to determine the application rate for overhead. - Estimated and actual direct labor costs totaled \$ 8,234.40. - Actual factory overhead costs totaled $9,325.00. The following information is available concerning the direct materials. Direct Materials- Aluminum The work in process account has the following information: Beginning Work in Process contains 500 . Aluminum Cases with a cost transferred in of $3,814.00. Ending work in process contains 300 Aluminum Cases. The finished goods account has the following information: The selling price of the case is $100 per case and 1,900 cases were sold. Selling and Administrative Costs totaled $2,500 and the tax rate is 30% Will leave thumbs up, positive comments, etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started