Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL OF THE FOLLOWING 9(a,b,c) & 10(a,b,c) AS SOON AS POSSIBLE thank you so so much!! 9 10. any info needed provided below

PLEASE ANSWER ALL OF THE FOLLOWING 9(a,b,c) & 10(a,b,c) AS SOON AS POSSIBLE thank you so so much!!

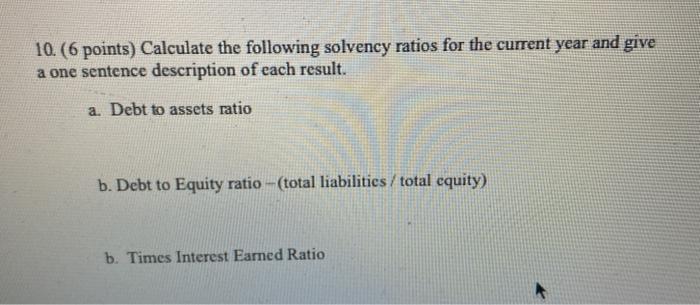

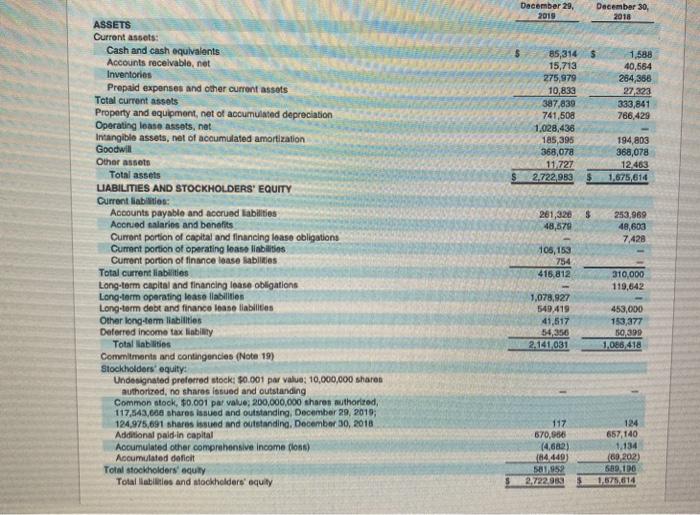

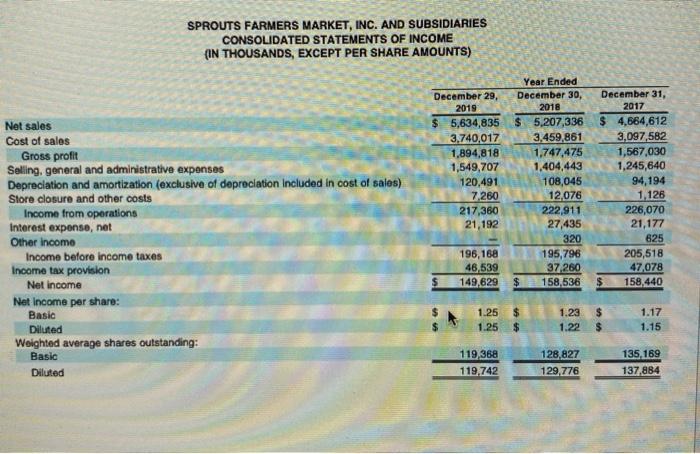

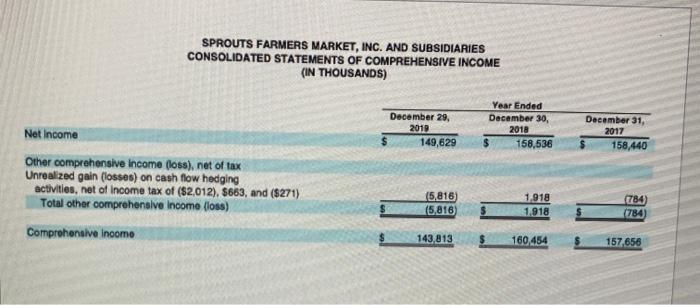

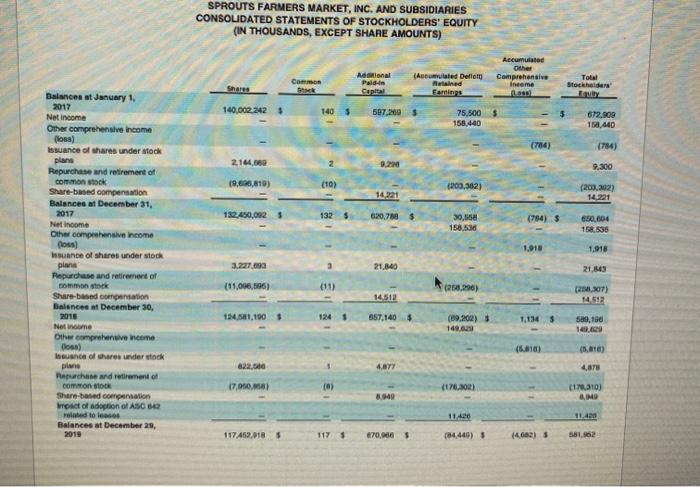

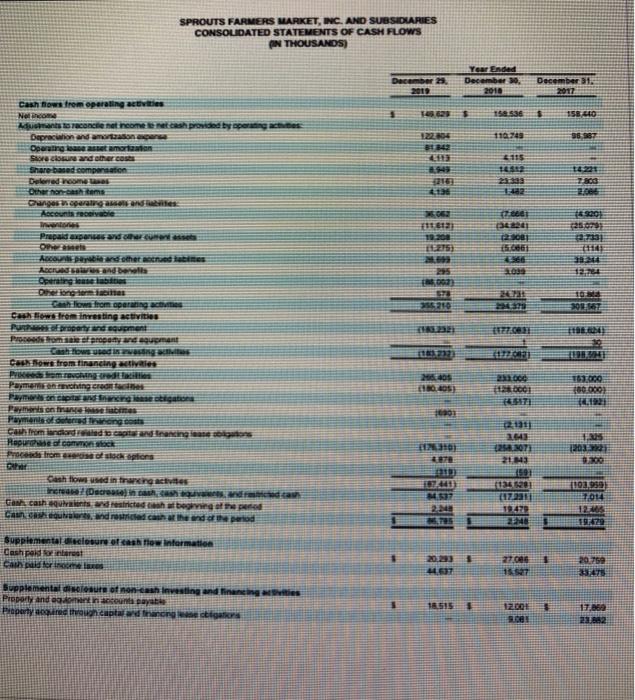

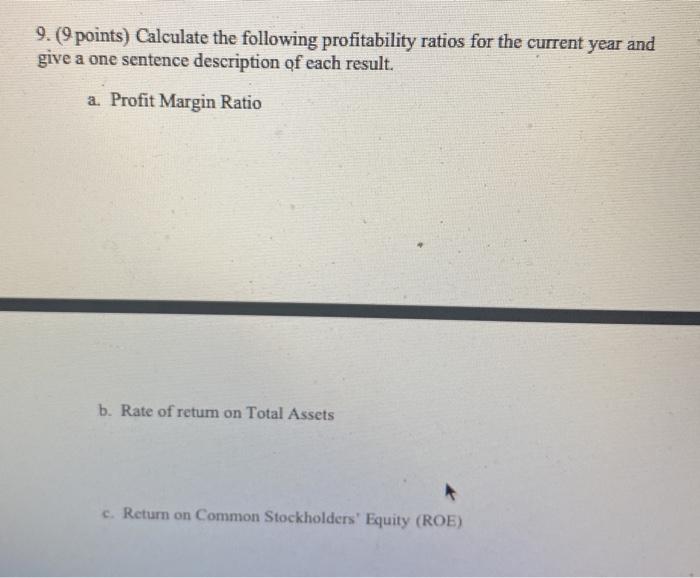

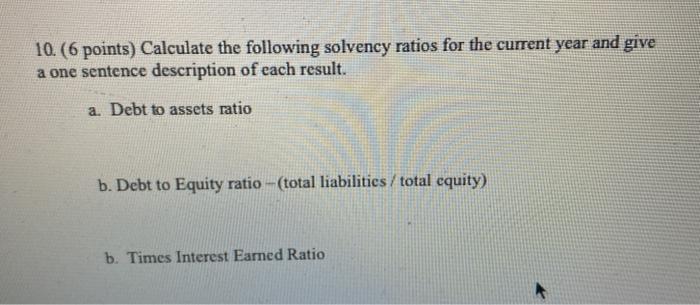

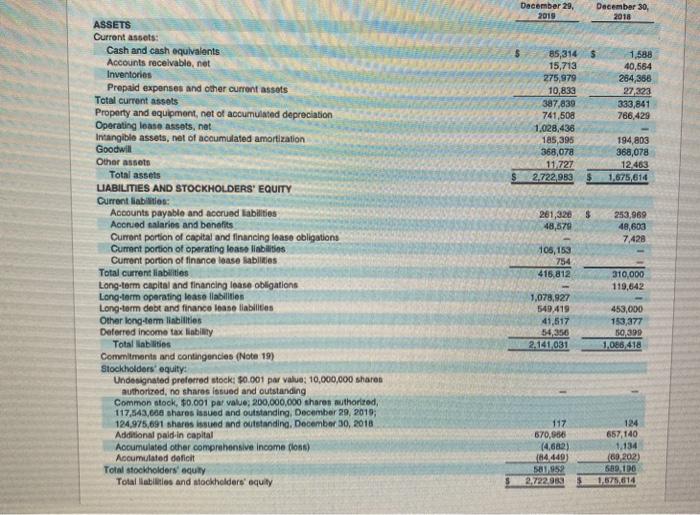

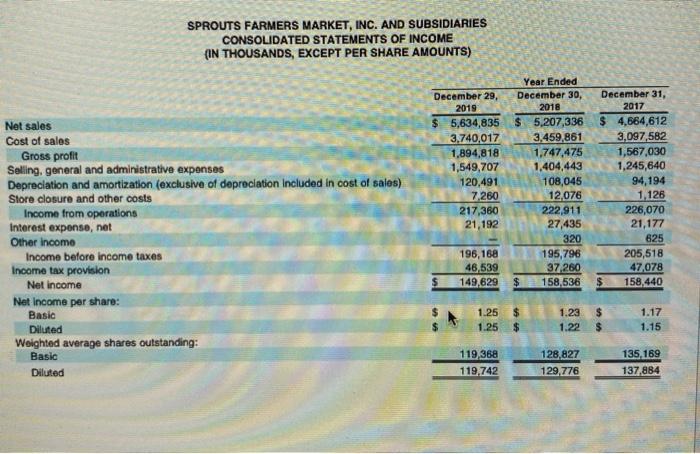

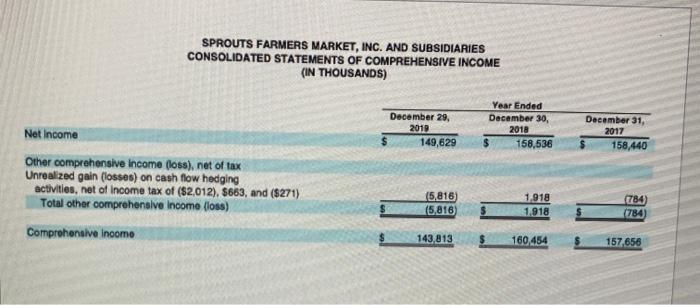

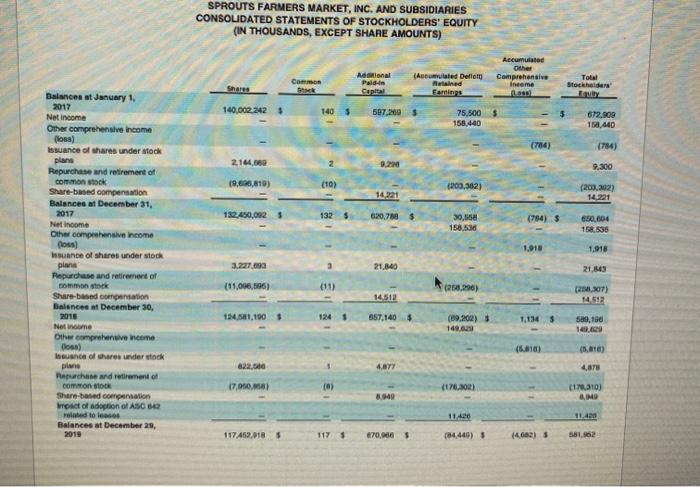

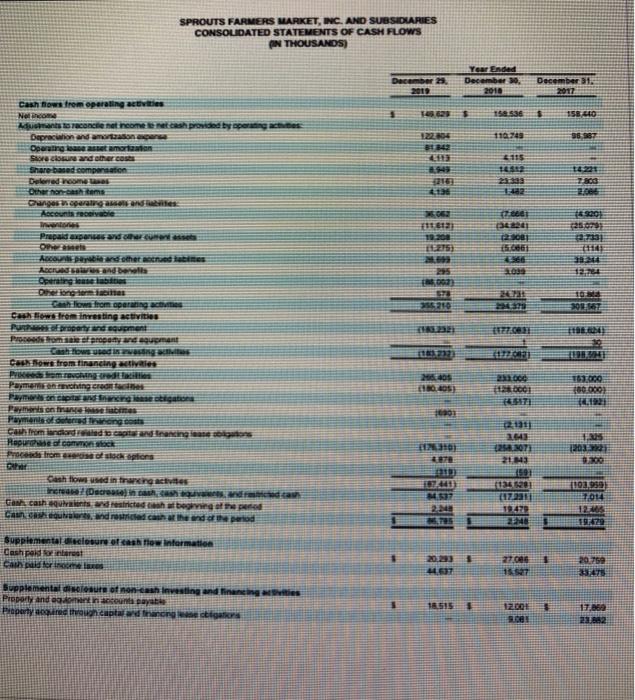

9. (9 points) Calculate the following profitability ratios for the current year and give a one sentence description of each result. a. Profit Margin Ratio b. Rate of return on Total Assets c. Return on Common Stockholders' Equity (ROE) 10. (6 points) Calculate the following solvency ratios for the current year and give a one sentence description of each result. a Debt to assets ratio b. Debt to Equity ratio -(total liabilities/total cquity) b. Times Interest Earned Ratio December 29, 2019 December 30, 2018 85,314 $ 15,713 275,979 10,833 387,839 741,508 1,028,436 185,395 368,078 11727 2,722,983 $ 1.588 40,584 264,366 27,323 333,841 766,429 194.803 368,078 12,463 1.675,614 $ $ 261,320 48,579 253,969 48,603 7,428 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net of accumulated depreciation Operating lease assets, net Intangible assets, net of accumulated amortization Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and accrued abilities Aconued salaries and benefits Curront portion of capital and financing loase obligations Current portion of operating lease liabilities Current portion of finance lease sablities Total current liabilities Long-term capital and financing lease obligations Long-term operating lease liabilities Long-term debt and finance lease liabilities Other long-term linbilities Deferred income tax liability Total abilities Commitments and contingencies (Note 19) Stockholders' equity Undesignated preferred stock: 0.001 par value: 10,000,000 shares authorized, no shares issued and outstanding Common stock, $0.001 par value: 200,000,000 shares authorited, 117,543,600 shares issued and outstanding, December 29, 2019, 124,975,691 shares issued and outstanding, December 30, 2018 Additional paid in capital Accumulated other comprehensive Income dion) Accumulated deficit Total stockholders oqully Total abilities and stockholders' equity 105,153 754 416,812 310,000 119,642 1,078,927 549.419 41,517 54,356 2.141031 453,000 153,377 50,390 1,086,418 117 670.6856 (4.682) (84449) 1952 2.722983 124 657,140 1.134 (60202) 689,190 1,575,614 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) December 29, 2019 $ 5,634,835 3,740,017 1.894,818 1,549,707 120,491 7.260 217,360 21,192 Net sales Cost of sales Gross profit Seling, general and administrative expenses Depreciation and amortization (exclusive of depreciation Included in cost of sales) Store closure and other costs Income from operations Interest exponse, net Other income Income before income taxes Income tax provision Net income Net Income per share: Basic Diluted Weighted average shares outstanding: Basic Diluted Year Ended December 30, 2018 $ 5,207,336 3.459,861 1.747,475 1.404,443 108,045 12,076 222,911 27,435 320 195,796 37,260 $ 158,536 December 31, 2017 $ 4,664,612 3,097,582 1,567,030 1,245,640 94,194 1,126 226,070 21,177 625 205,518 47,078 $ 158,440 196,168 46,539 149,629 1.25 1.25 $ $ 1.23 1.22 $ $ 1.17 1.15 119,368 119,742 128,827 129,776 135,169 137,884 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN THOUSANDS) Year Ended December 30, 2018 $ 158,536 December 29, 2019 149,629 Net Income December 31, 2017 158.440 Other comprehensive Income (los), net of tax Unrealized gain (losses) on cash flow hedging activities, net of income tax of ($2,012). $663, and ($271) Total other comprehensive Income (loss) Comprehensive incomo 15,816 (5,816 1,918 1.918 784) (784) 143,813 160,454 157,656 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (IN THOUSANDS, EXCEPT SHARE AMOUNTS) Additional Paidin Capital Common Accumulated Other Comprehensive Income fo (Acumulated Detlom Retained Earnings Total Stockholders 140.0022425 1405 597,200 Balances at January 1, 2017 Net Income Other comprehensive Income osa) Issuance of shares understock 75,500 5 158.440 672.909 191.440 (784) (784) 2.144.00 9,300 19.626,819) (10) (203,362) 14,321 (203.202) 14.221 132.450,002 132 $ 620,788 $ 30.550 158.530 (754) S 650,004 168 536 1,918 1,918 3.227.000 21.840 21.143 (11.096,596) (11) (255,296) 14 512 Repurchase and retirement of common stock Share-based compensation Balances at December 31, 2017 Net income Other comprehensive Income loss) Issuance of shares understock plans Repurchase and retirement of ok Share-based compensation Baloncest December 30, 2015 Net Wome Other comprehensive income so) Inca of whares understock plane Repurchase and retirement of Common stock Share-based comparation Impact of adoption of ASC related to lose Balances at December 29, 2019 (2017) 14 512 124.581.100 657.140 $ 1,1345 (19,202) 140.6 59,150 140.00 (5.610) 822.00 4.877 4,878 17.000.000 (178.30 1940 IM310) 4,00 11.40 11.40 117452,9185 117 1 670,0065 (84440) 5 (4,082) 51.262 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS ON THOUSANDS) December Year Ended December 30, 2010 December 31 2017 T25 se 36 15840 110.248 96 67 8443 Cash flows from operating activities Nel com un sacencleneremeentera provided by peace Depreciation and amanecer Operating at amortation See and others Share based compensation Delented room was Other non-cash tems Gangeswaarae Accounts receivable + 115 2.800 2.08 18.2007 25.01 11 12 Prapatapansando 1 TETS 110 TO 25 007) ASCO other and ABC sonders Operating One og teras Chlow from operating at Casowarem investing activities Popropertrand squement Promes and aument 31.8T Trache HU ti 1 180.0001 19 Cash Row from financing activeles Paroching red Paymenting Credit Paymenciptakan stations monies Payment of dong costs Cash from landand to captanding innego Rape of cromo chegions 23 1643 2254.207 21843 120 134201 Sash towed in tracte Increase (Decreta Ganh cathos, destricted being of the per Cauna, android can then the period 1102959) 1014 12405 1979 Supplemental closure of the information Cash peld ut can al terte 20.2331 27.00 1 20.750 Supplemental dislosure of non cash investing and financing is Property and in conta ayat Property town cuptadinanggak 18.515 3 12.00 Set 17.00 1882 9

10.

any info needed provided below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started