PLEASE ANSWER ALL OF THE QUESTIONS IN THE PHOTO. I WILL GIVE A THUMBS UP THANKS

PLEASE ANSWER ALL OF THE QUESTIONS IN THE PHOTO. I WILL GIVE A THUMBS UP THANKS

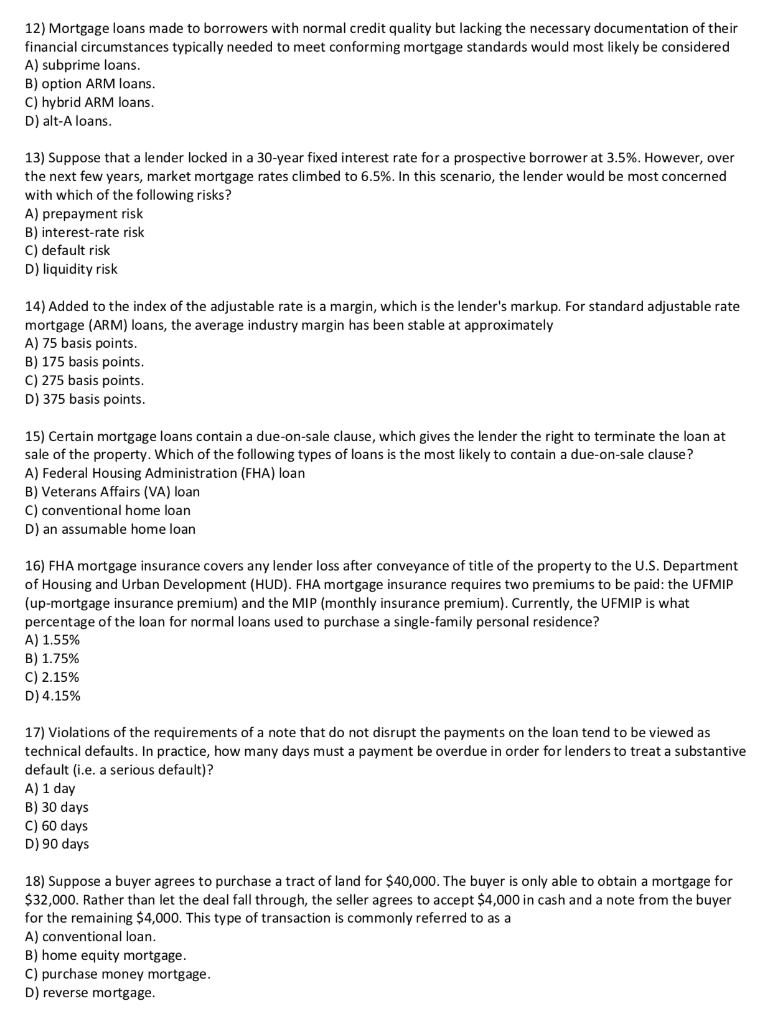

12) Mortgage loans made to borrowers with normal credit quality but lacking the necessary documentation of their financial circumstances typically needed to meet conforming mortgage standards would most likely be considered A) subprime loans. B) option ARM loans. C) hybrid ARM loans. D) alt-A loans. 13) Suppose that a lender locked in a 30-year fixed interest rate for a prospective borrower at 3.5%. However, over the next few years, market mortgage rates climbed to 6.5%. In this scenario, the lender would be most concerned with which of the following risks? A) prepayment risk B) interest-rate risk c) default risk D) liquidity risk 14) Added to the index of the adjustable rate is a margin, which is the lender's markup. For standard adjustable rate mortgage (ARM) loans, the average industry margin has been stable at approximately A) 75 basis points B) 175 basis points. C) 275 basis points. D) 375 basis points. 15) Certain mortgage loans contain a due-on-sale clause, which gives the lender the right to terminate the loan at sale of the property. Which of the following types of loans is the most likely to contain a due-on-sale clause? A) Federal Housing Administration (FHA) loan B) Veterans Affairs (VA) loan C) conventional home loan D) an assumable home loan 16) FHA mortgage insurance covers any lender loss after conveyance of title of the property to the U.S. Department of Housing and Urban Development (HUD). FHA mortgage insurance requires two premiums to be paid: the UFMIP (up-mortgage insurance premium) and the MIP (monthly insurance premium). Currently, the UFMIP is what percentage of the loan for normal loans used to purchase a single-family personal residence? A) 1.55% B) 1.75% C) 2.15% D) 4.15% 17) Violations of the requirements of a note that do not disrupt the payments on the loan tend to be viewed as technical defaults. In practice, how many days must a payment be overdue in order for lenders to treat a substantive default (i.e. a serious default)? A) 1 day B) 30 days C) 60 days D) 90 days 18) Suppose a buyer agrees to purchase a tract of land for $40,000. The buyer is only able to obtain a mortgage for $32,000. Rather than let the deal fall through, the seller agrees to accept $4,000 in cash and a note from the buyer for the remaining $4,000. This type of transaction is commonly referred to as a A) conventional loan. B) home equity mortgage. C) purchase money mortgage. D) reverse mortgage

PLEASE ANSWER ALL OF THE QUESTIONS IN THE PHOTO. I WILL GIVE A THUMBS UP THANKS

PLEASE ANSWER ALL OF THE QUESTIONS IN THE PHOTO. I WILL GIVE A THUMBS UP THANKS