Please answer all of them I will appreciate it

Please answer all of them I will appreciate it

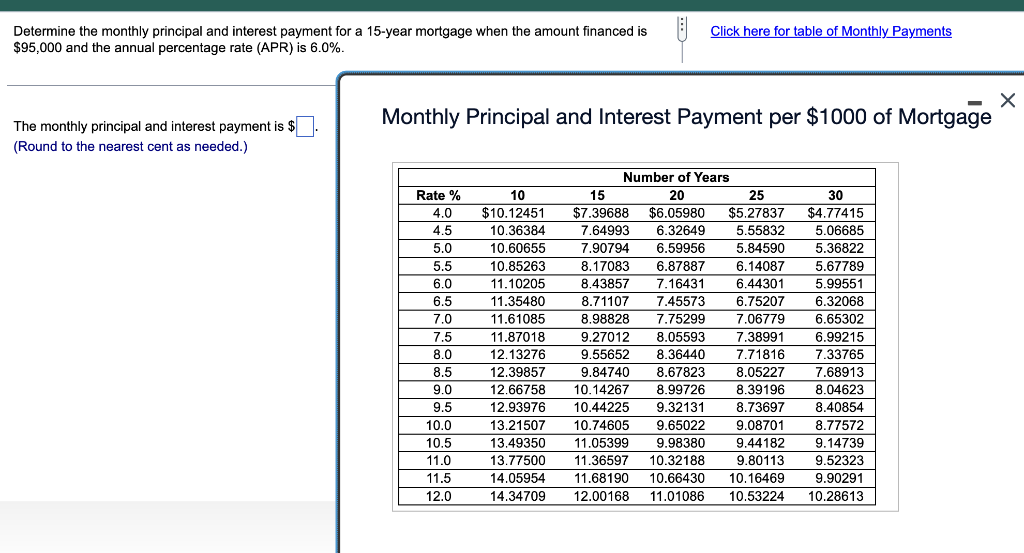

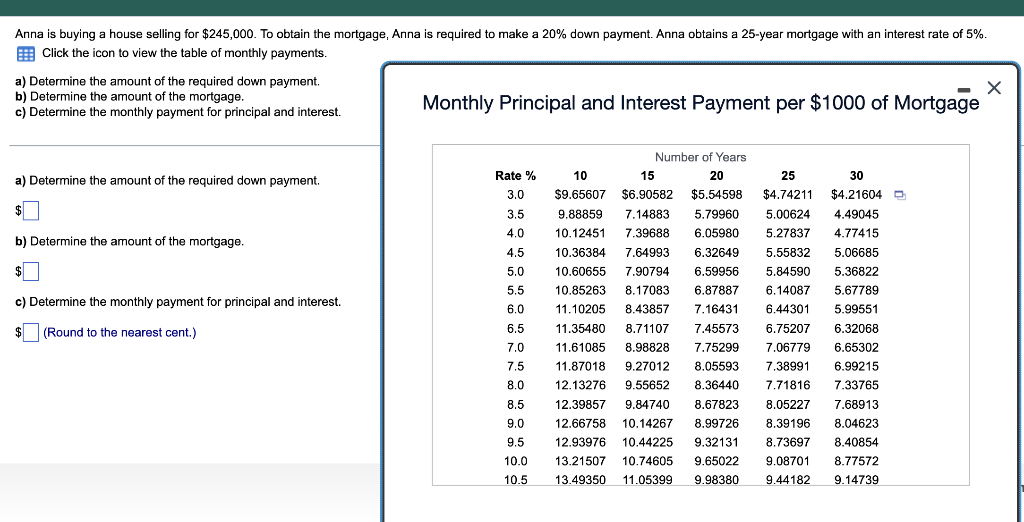

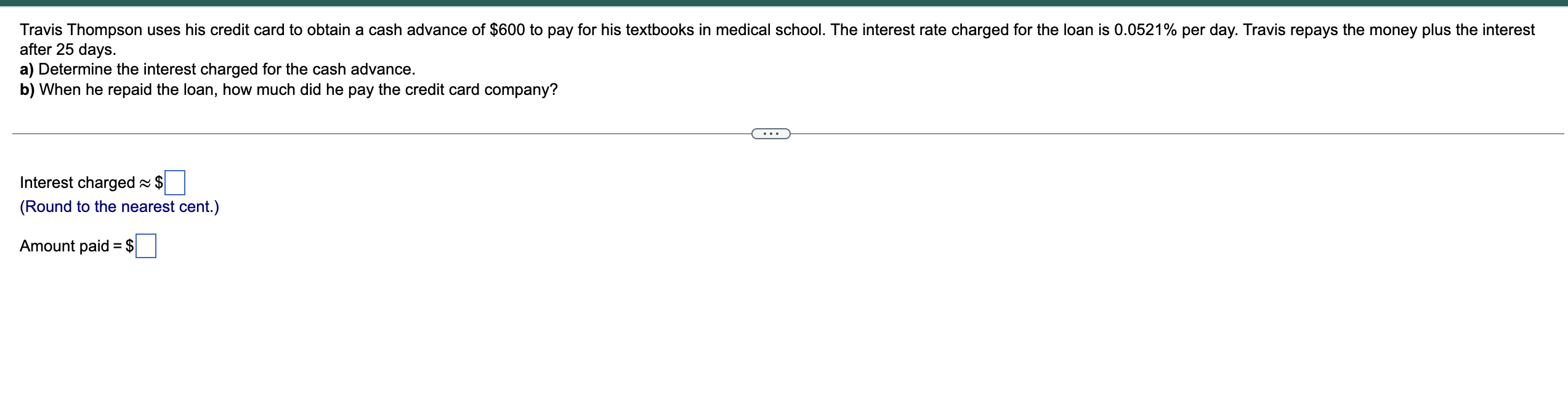

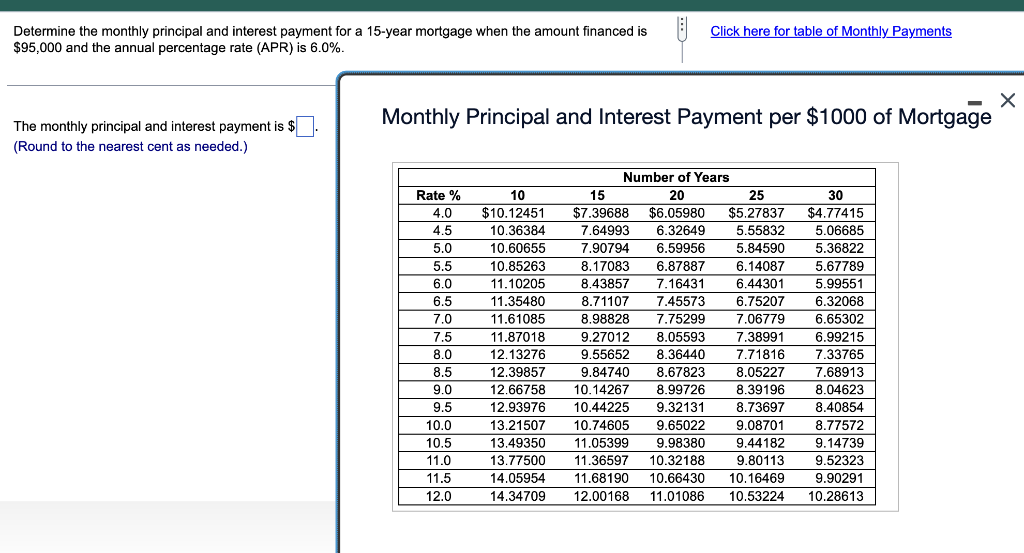

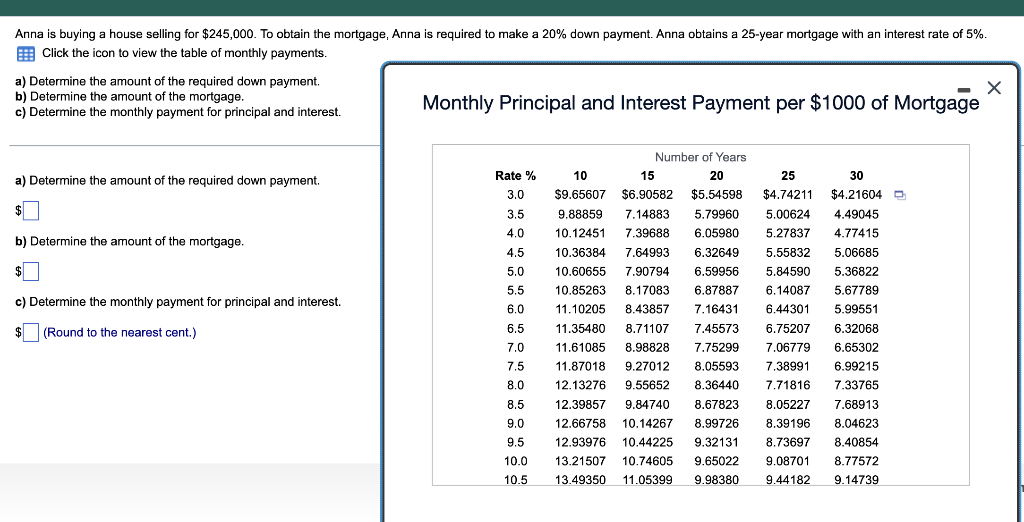

Click here for table of monthly Payments Determine the monthly principal and interest payment for a 15-year mortgage when the amount financed is $95,000 and the annual percentage rate (APR) is 6.0%. Monthly Principal and Interest Payment per $1000 of Mortgage The monthly principal and interest payment is $ (Round to the nearest cent as needed.) Rate % 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 11.0 11.5 12.0 10 $10.12451 10.36384 10.60655 10.85263 11.10205 11.35480 11.61085 11.87018 12.13276 12.39857 12.66758 12.93976 13.21507 13.49350 13.77500 14.05954 14.34709 Number of Years 15 20 25 $7.39688 $6.05980 $5.27837 7.64993 6.32649 5.55832 7.90794 6.59956 5.84590 8.17083 6.87887 6.14087 8.43857 7.16431 6.44301 8.71107 7.45573 6.75207 8.98828 7.75299 7.06779 9.27012 8.05593 7.38991 9.55652 8.36440 7.71816 9.84740 8.67823 8.05227 10.14267 8.99726 8.39196 10.44225 9.32131 8.73697 10.74605 9.65022 9.08701 11.05399 9.98380 9.44182 11.36597 10.32188 9.80113 11.68190 10.66430 10.16469 12.00168 11.01086 10.53224 30 $4.77415 5.06685 5.36822 5.67789 5.99551 6.32068 6.65302 6.99215 7.33765 7.68913 8.04623 8.40854 8.77572 9.14739 9.52323 9.90291 10.28613 Anna is buying a house selling for $245,000. To obtain the mortgage, Anna is required to make a 20% down payment. Anna obtains a 25-year mortgage with an interest rate of 5%. B Click the icon to view the table of monthly payments. a) Determine the amount of the required down payment, b) Determine the amount of the mortgage. Monthly Principal and Interest Payment per $1000 of Mortgage c) Determine the monthly payment for principal and interest. a) Determine the amount of the required down payment. 25 Rate % 3.0 $4.74211 $ 3.5 4.0 30 $4.21604 D 4.49045 4.77415 5.06685 b) Determine the amount of the mortgage. 4.5 5.36822 c) Determine the monthly payment for principal and interest. 5.0 5.5 6.0 6.5 7.0 Number of Years 10 15 20 $9.65607 $6.90582 $ $5.54598 9.88859 7.14883 5.79960 10.12451 7.39688 6.05980 10.36384 7.64993 6.32649 10.60655 7.90794 6.59956 10.85263 8.17083 6.87887 11.10205 8.43857 7.16431 11.35480 8.71107 7.45573 11.61085 8.98828 7.75299 11.87018 9.27012 8.05593 12.13276 9.55652 8.36440 12.39857 9.84740 8.67823 12.66758 10.14267 8.99726 12.93976 10.44225 9.32131 13.21507 10.74605 9.65022 13.49350 11.05399 9.98380 $ (Round to the nearest cent.) 5.00624 5.27837 5.55832 5.84590 6.14087 6.44301 6.75207 7.06779 7.38991 7.71816 8.05227 8.39196 8.73697 9.08701 9.44182 7.5 8.0 5.67789 5.99551 6.32068 6.65302 6.99215 7.33765 7.68913 8.04623 8.40854 8.77572 9.14739 8.5 9.0 9.5 10.0 10.5 Travis Thompson uses his credit card to obtain a cash advance of $600 to pay for his textbooks in medical school. The interest rate charged for the loan is 0.0521% per day. Travis repays the money plus the interest after 25 days. a) Determine the interest charged for the cash advance. b) When he repaid the loan, how much did he pay the credit card company? Interest charged ~$ (Round to the nearest cent.) Amount paid = $

Please answer all of them I will appreciate it

Please answer all of them I will appreciate it