Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all of them please. based on Canada. Mr Jacob Johnson has net employment income of ( $ 57100 ) (after the deduction of

please answer all of them please. based on Canada.

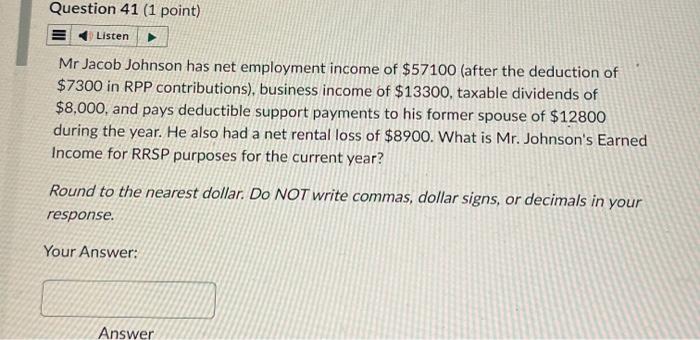

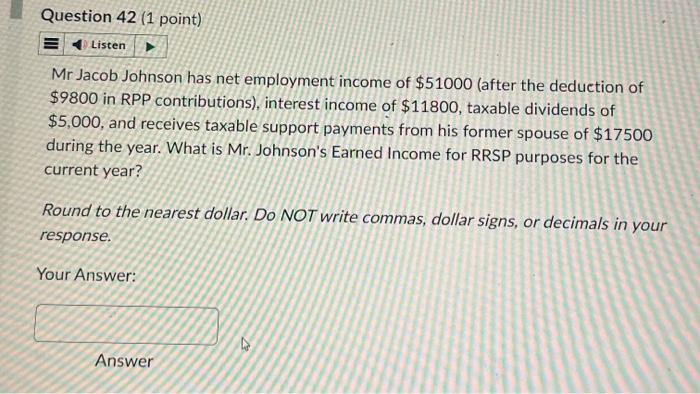

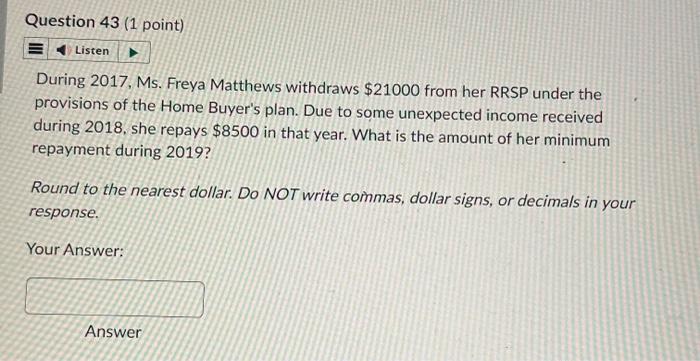

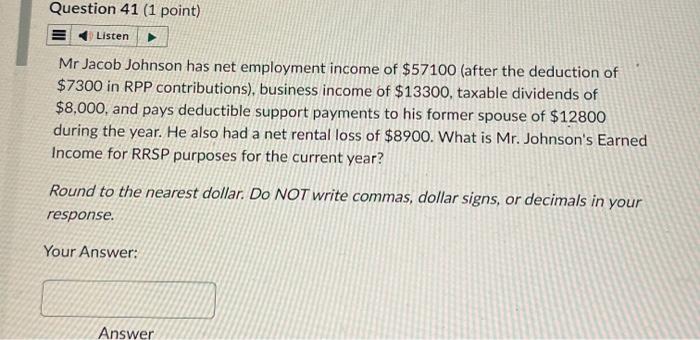

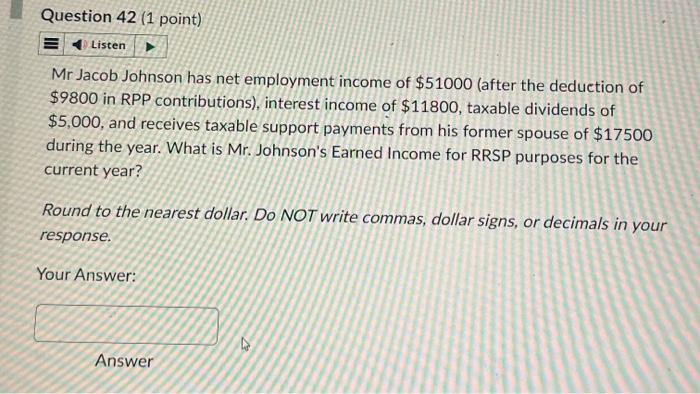

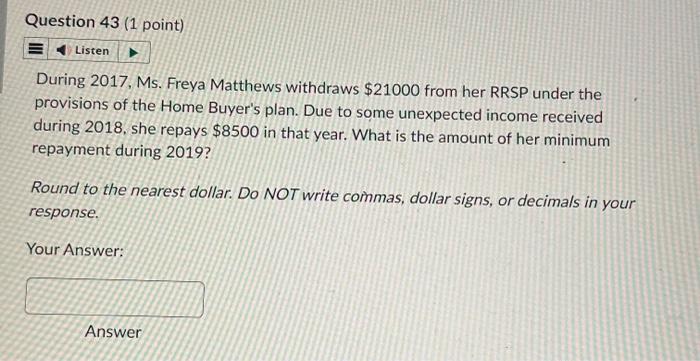

Mr Jacob Johnson has net employment income of \\( \\$ 57100 \\) (after the deduction of \\( \\$ 7300 \\) in RPP contributions), business income of \\( \\$ 13300 \\), taxable dividends of \\( \\$ 8,000 \\), and pays deductible support payments to his former spouse of \\( \\$ 12800 \\) during the year. He also had a net rental loss of \\( \\$ 8900 \\). What is Mr. Johnson's Earned Income for RRSP purposes for the current year? Round to the nearest dollar. DO NOT write commas, dollar signs, or decimals in your response. Your Answer: Mr Jacob Johnson has net employment income of \\( \\$ 51000 \\) (after the deduction of \\( \\$ 9800 \\) in RPP contributions), interest income of \\( \\$ 11800 \\), taxable dividends of \\( \\$ 5,000 \\), and receives taxable support payments from his former spouse of \\( \\$ 17500 \\) during the year. What is Mr. Johnson's Earned Income for RRSP purposes for the current year? Round to the nearest dollar. DO NOT write commas, dollar signs, or decimals in your response. Your Answer: Answer During 2017, Ms. Freya Matthews withdraws \\( \\$ 21000 \\) from her RRSP under the provisions of the Home Buyer's plan. Due to some unexpected income received during 2018 , she repays \\( \\$ 8500 \\) in that year. What is the amount of her minimum repayment during 2019 ? Round to the nearest dollar. Do NOT write commas, dollar signs, or decimals in your response. Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started